DE-FI protocol has changed quite a lot of perspectives of users in crypto world! Which gave crypto hodlers/investors see things a lot differently than they used to. Significance of money and the use case has changed over the time. Now, not only trading but there are other ways where a user can get benefitted with their assets. Defi exchanges has made that possible.

One of the most interesting and exciting way of getting some revenue is via giving liquidity to different LP pools of different coins. This usually happens in DEX's. For starters, all of this started with UNI-SWAP. Thus the revolution began. Now we have plenty of exchnages which are performing these activities and at the same time helping the eco system of crypto space. But the one thing which demolished the success of these phases is the GAS fees of ETH. It literally broke the speed of the development, which ruined almost everything. But still there are ways to make things stable once again. Which is brought by BSC (Binance Smart Chain).

If you are aware BSC network has been developing in a phenomenon way. Which made user experience little better compared to ETH DEX's. Keeping that in mind, providing liquidity in a LP pool, I myself consider it a loss project. Especially if you have a low budget effort. As there might be significant ups and downs with your assets due to the price impact and also the imparmanent loss which will get to you at every stage. Unless you are providing liquidity on a stable pool. I am not sure if there is anything stable in crypto (Besides stable coins) lol.

Staking can a wise way to make some easy money, if you are thinking long term. I have been staking my crypto assets in different ways. I made a post about one of the ways here. Now lately, I have been trying to get in on BSC network. Also participated on an IDO on bakery swap (but missed it). But still it is a progress, regardless of anything! I got into Pancake Swap and bought some Cake. Which I am thinking of keeping it for long term. Since Binance has their way out for making some hype in the market, they know how to create HYPE for a coin and increase its value within a short period of time (History says it all).

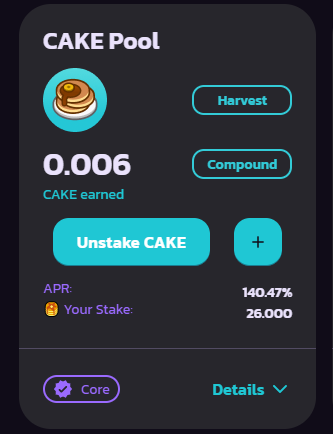

I have accumulated some CAKE token, which is available in Binance, Pancakeswap and in some other exchanges. Upon claiming them, I have staked them on Pancakeswap and at a decent APR, I am accumulating some cake coins. Now I am aware these are probably nothing. But since I will be holding them for some time, I am thinking of making some right usage of the coins at hand. Currently, I am holding 26 Cakes and I just started the procedure. So far I have managed to get around 0.006 Cake coin. Lets see how much I will be able to accumulate in the long run. And since Pancakeswap has been getting some limelight, the governance token is suppose to hit some massive gains. Just like it happened with the UNI token of Uniswap.

Although these are just speculations of mine and not any kind of financial advices. I am just doing what I am thinking is best for my assets.

Images used from Pancakeswap

Best regards

Rehan

Posted Using LeoFinance Beta

Hi You should checkout MOCHISWAP, its not even 4 days old and they could be bigger then pancake, less then half the supply and the pools just started

https://pool.mochiswap.io

Have not heard about it but thanks, I will check it out ASAP!

Posted Using LeoFinance Beta

I think it is a promising project

I have to invest a little in

Posted Using LeoFinance Beta

So far it is showing promising aspects. DYOR before getting into it ;)

Posted Using LeoFinance Beta

I love Pancake swap and CAKE!!! I am actually utilizing AutoFarm to earn CAKE on my CAKE while also earning AUTO you should check them out!

Posted Using LeoFinance Beta

That sounds pretty damn cool. Do share some info when you have time ;)

Posted Using LeoFinance Beta

Been eyeing Cake from afar. This pulls me in. And I must appreciate how it has been delivered in such an awesome write up. Must indulge in some Cake now :)

Posted Using LeoFinance Beta

hhahaha thanks. But DYOR before making a move ;)

Posted Using LeoFinance Beta

Always ;)

Posted Using LeoFinance Beta

I thought Pancake Swap recently came under fire as being a scam? I haven't read enough into it as of yet though.

Posted Using LeoFinance Beta

Not sure about it but yeah precautions are better before investing even a single penny. I got satisfied by doing my own research. Thanks for the heads up though.

Posted Using LeoFinance Beta

I had given up on DEFI due to the insane gas fees on ethereum, but I have come back to it on pancake swap. :)

Posted Using LeoFinance Beta

Hopefully you make some gains on P.Swap ;)

Posted Using LeoFinance Beta

I'm skeptical about all these food and fruit tokens but hey, like you said binance has a way of hyping their projects so it is worth the try. Hopefully you make some gains

Posted Using LeoFinance Beta

Yup, if I am being honest I was skeptical about these tokens but things changes I suppose lol.

Thanks. I hope I do.

Posted Using LeoFinance Beta

came to the same conclusion yesterday! ETHs gas fees could be its demise... well I guess that is a bit harshly spoken, but it's a huge problem. I invested into cake so let's see how it goes!

Posted Using LeoFinance Beta

I just hodled my Pancake and sold them at $5. But I am planning to buy one.

Posted Using LeoFinance Beta

that is a big number of cake stake you have. I have only a piece of cake. when i bought it at $2. and that i can only afford that time

Posted Using LeoFinance Beta

Nice post. I agree that low fees and forked uniswap Dapps is a winning combination for Binance Smart Chain, forked code is battle tested, so except for rug pulls it should be safe. And Binance has the self-interest in their success, so rug pull seems unlikely. Do you know anything about code audits there?

Thanks

Posted Using LeoFinance Beta

@rehan12 this js an awesome writeup from you....the CAKE token is a good thing too...

Yup, so far it is looking good! Hope it keeps this trend in long term as well.

Posted Using LeoFinance Beta