Today, everyone who is interested in cryptocurrencies has to buy some stable crypto money at the beginning in order to enter a cryptocurrency exchange. Although it is challenging from time to time to choose among dozens of stable cryptocurrencies for those who have just started, users generally buy Tether because Tether (usdt) occupies a large part of the market volume in terms of dominance and exchanges recommend it at first. In this article, I will talk about how wrong these and similar choices are and that the only real stable cryptocurrency is actually Dai.

- Centralization problem

Let's start with the principle of decentralization, which is the origin of cryptocurrencies. Today, the goal of decentralization has already come to the point of extinction with the identity verification systems brought by the exchanges, and stable cryptocurrencies, which have a large part of the volume in the market, also support this centralization. With centralization, companies that manage stable cryptocurrencies such as Tether and USDC have gained dominance over user funds and we have the right to freeze users' funds at any time, just like central banks.

7 million dollar of tether stolen by hackers through Yearn.finance was frozen in the past months. While it sounds good that hackers won't be able to use these funds, there's no guarantee that the same won't happen to your funds in the future.

That's why you should host your funds in decentralized projects like Dai Fei and Ampleforth, not companies managed by centralized companies like Bitfinex(USDT) Circle(USDC) and Pax.

- Centralized ones are not holding 1:1 Usd for your stablecoins!

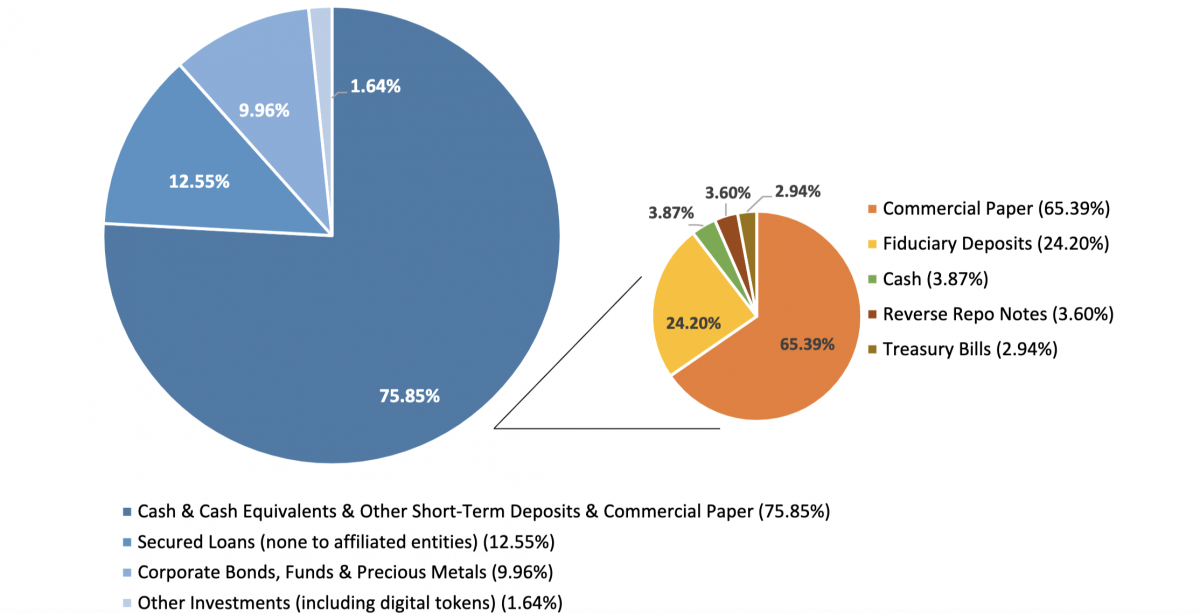

Yes you heard it right, centralized stable cryptocurrency providers do not hold as much dollars as the stable cryptocurrency they release. In other words, many of those assets that you keep as stable crypto in your wallet are actually fictitious.

The pie chart you see above belongs to the most commonly used stable cryptocurrency Tether. Tether holds less than 3% of the circulating amount of cash in its bank accounts.

But don't worry. Dai has this great solution. In dai, you need to lock 150% worth of Ethereum for each Dai produced, and these ethereums are unlocked thanks to the algorithm in serious price drops. Thus, each DAI in the market has a counterpart and its stability can be ensured.

3- It has a parity on all cryptocurrency exchanges.

Compared to its centralized rivals such as True Usd and Gemini Usd, and decentralized competitors such as Ample and Fei, Dai is listed on almost all exchanges, and all cryptocurrency payment providers accept payments with Dai.

4- It doesn't need regulations!

Yes, we've read hundreds of times on news portals like Coindesk that Tether is on trial in New York. Many stable cryptocurrencies such as True Usd and Ust cannot trade on any cryptocurrency exchange within the borders of the USA today. In fact, until a few months ago, exchanges operated in the USA were forbidden to allow users to trade with USDT (Tether). Fortunately, Dai does not have a problem with complying with such regulations because, by its nature, there is no company that the states can find a counterparty to. Dai is a stable cryptocurrency managed entirely by the people who are part of it, and it doesn't need anyone's permission for any transaction.

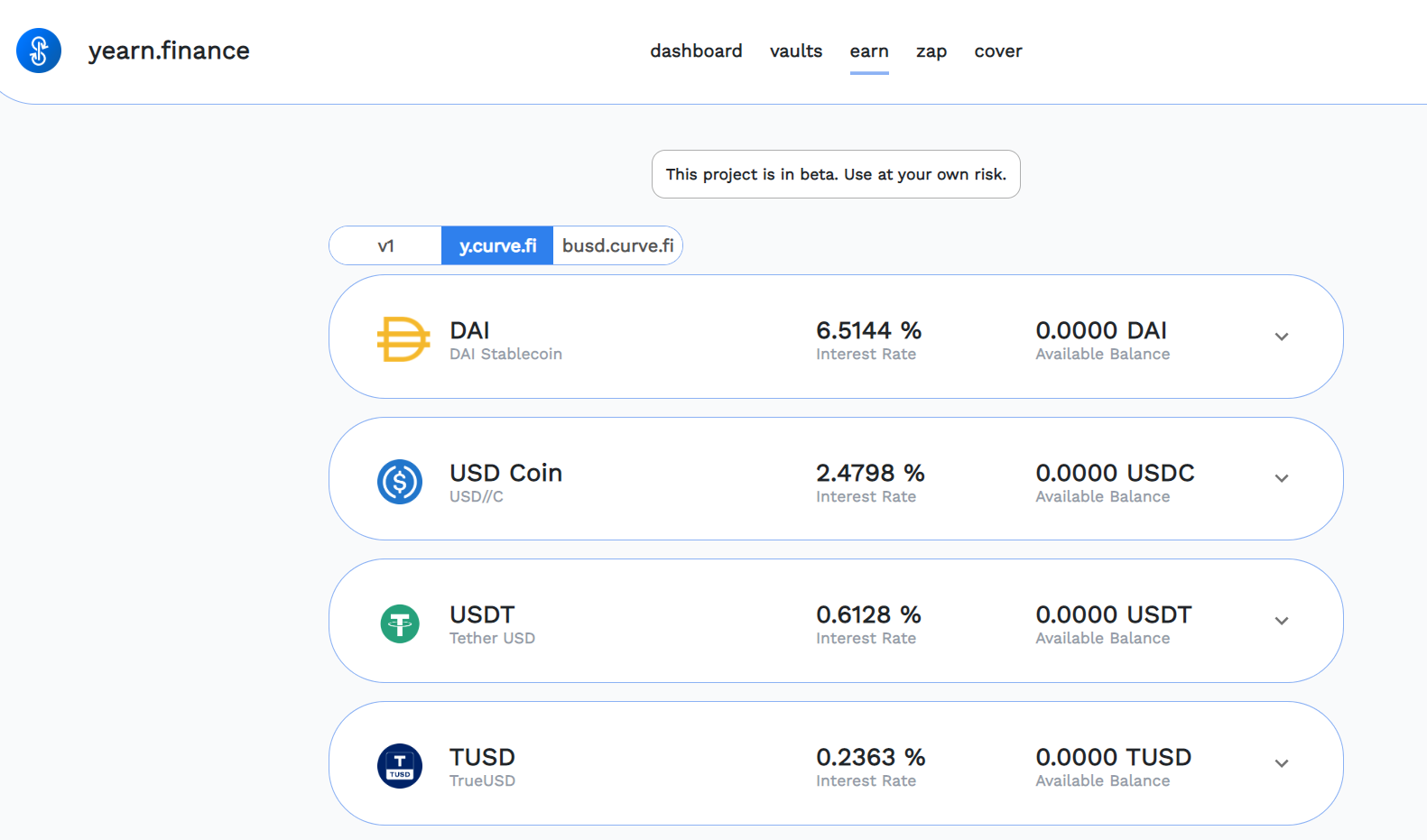

5- High interest income opportunity

Many central banks charge between 1% and 2% on the USD these days, but at Dai it's about 8%! So for every Dai you keep in your wallet, you earn 8% interest per annum, without any risk of price drop.

Competitors such as Tether and Usdc can receive a maximum of 4% interest within the borders of the USA.

Posted Using LeoFinance Beta

This is my very first post on hive, i hope all of you guys like it.

Posted Using LeoFinance Beta

Congratulations @relium! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 50 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz: