Glassnode, a blockchain-focused data provider, announced that miners are accumulating Bitcoin like never before, and that the supply of Bitcoin has become more constrained than the supply of gold, albeit for a short time, as a result of developments in recent weeks.

Bitcoin's hash rate, which was 180 EH/s until a few months ago, dropped to 65 EH/s on June 28, and then increased to 88-110 EH/s.

The average time between two Bitcoin blocks jumped to 32.6 minutes on June 28, 226% higher than the average 10-minute time. The increase in the hash rate has brought this time to the range of 13.3-15 minutes.

BTC supply more constrained than gold

- Bitcoin miners can mine an average of 144 blocks per day.

- According to Glassnode data, 58 blocks could be produced per day instead of 144 due to the drop in the hash rate at the end of June.

- The production of 40% less Bitcoin than normally produced that day resulted in a 60% cut in the miners' total daily earnings.

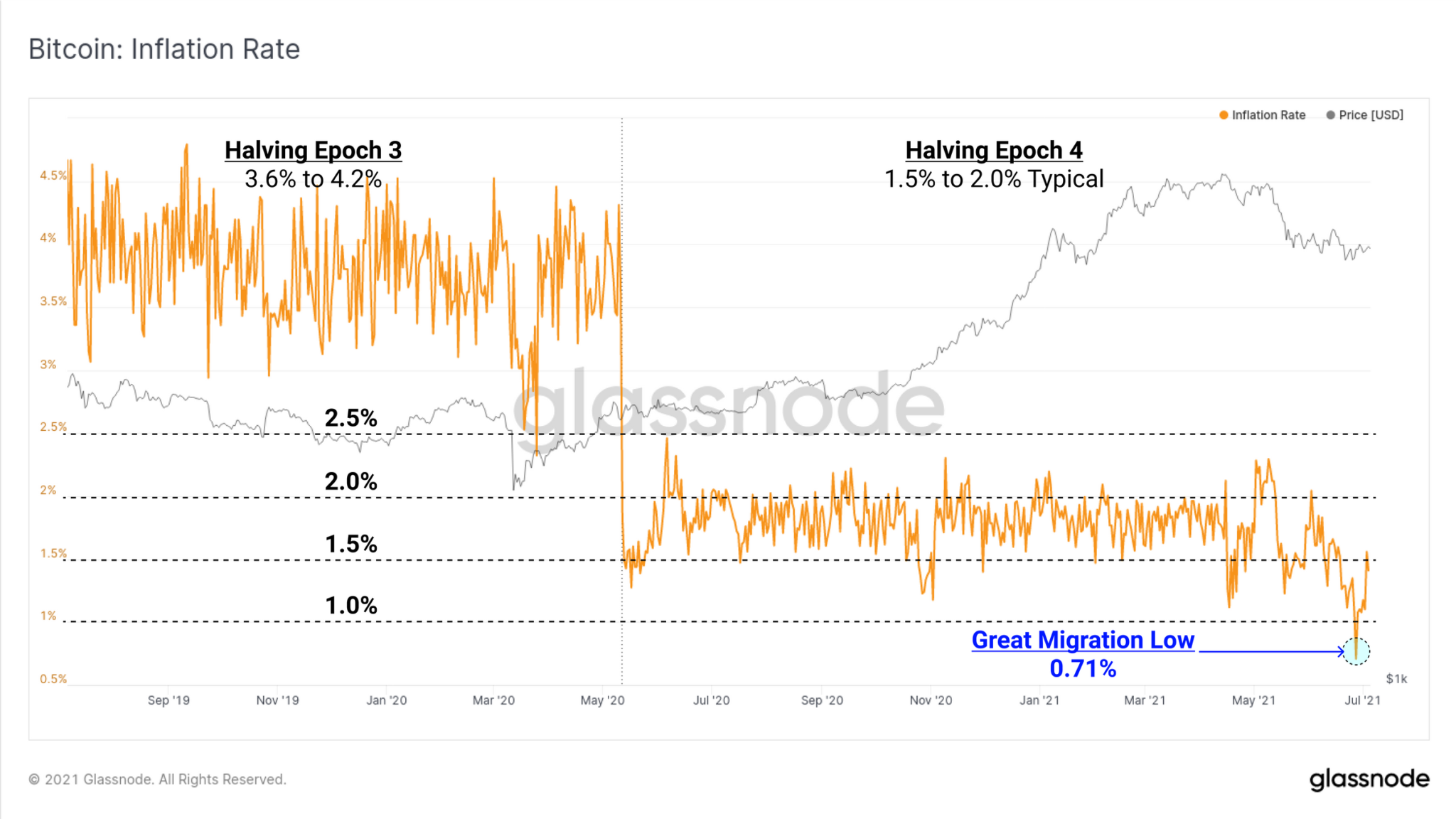

- Bitcoin's inflation rate fell to 0.71% on June 27, hitting an all-time low.

- According to Glassnode's report, Bitcoin's stock-to-flow (S2F) ratio was measured at 140 due to this drop, making Bitcoin 2.37 times more restricted than gold, albeit for a day.

Profitability doubled for remaining miners

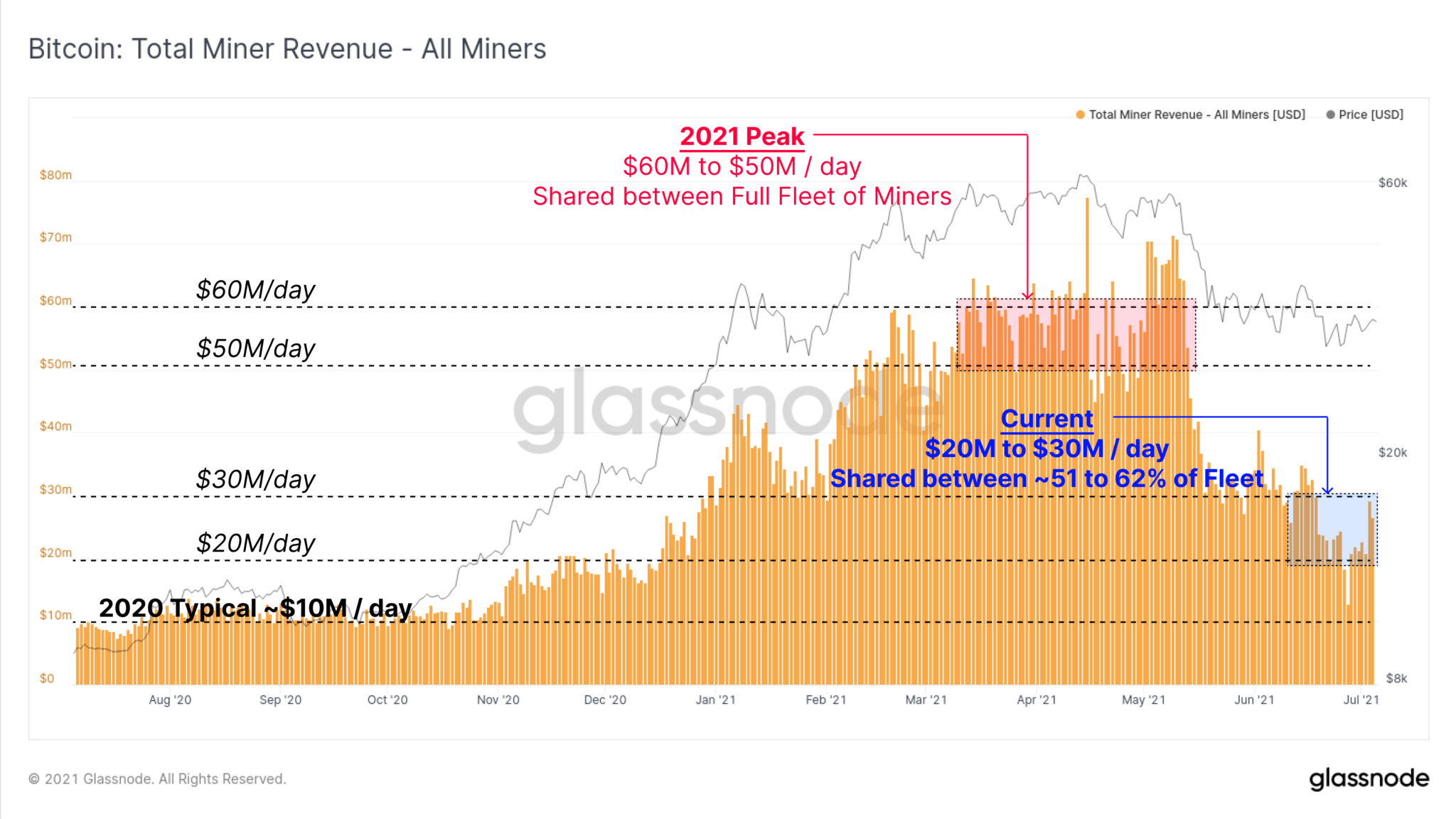

The hash rate has been cut by almost half, resulting in a decrease in miners' total daily income. In addition, miners, who made a total of $ 50 to $ 60 million per day in April, when the Bitcoin price was in the range of $ 50,000 to $ 60,000, saw the BTC price halve.

Still, the fact that miners, who represent almost half of the Bitcoin network in terms of hash rate, shut down devices due to restrictions in China, increased the share of the remaining and actively working miners.

The miners' total daily revenue has fallen to the range of $25 to $30 million, but this revenue is now shared among a much smaller group. The profitability rate of miners, which were not affected by the bans in China, increased to almost April levels.

Unprecedented accumulation from miners

Some of the miners working in China started to migrate to different countries such as the USA and Kazakhstan due to the bans. Although miner-induced selling pressure is expected to increase due to the costs it will entail, miners still do not sell large amounts of Bitcoin.

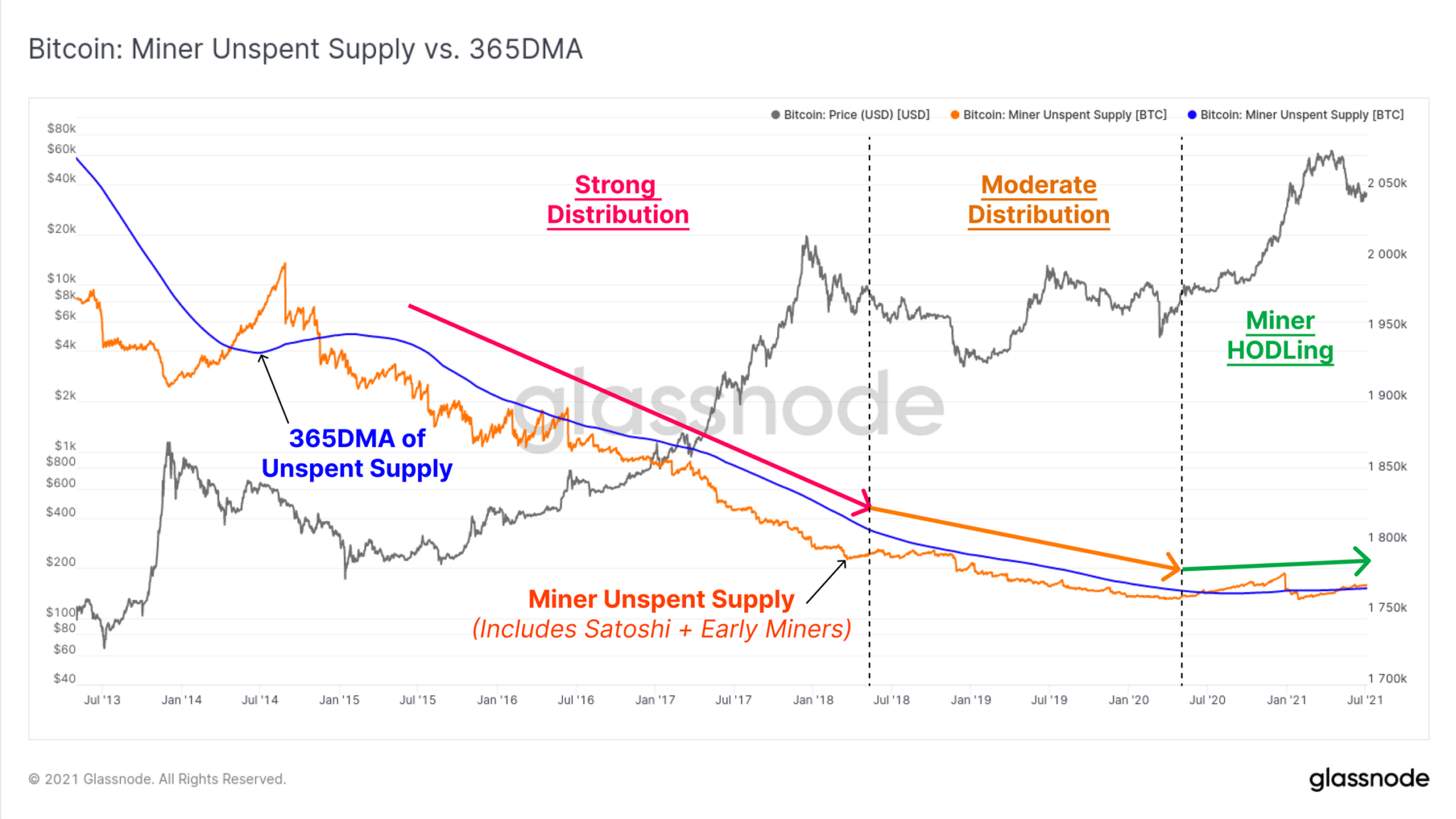

- Bitcoin miners have historically tended to sell more than they have accumulated.

- The total supply of Bitcoin that miners do not spend, compared to its 365-day moving average, shows that the picture began to change direction in mid-2020.

- Noting that the unspent Bitcoin supply is above the annual average, the Glassnode team stated that “miners are starting to accumulate in a way this market has never seen before.”

- This may be because miners now have many more options to finance their operations (collateralize cryptocurrencies and get loans, etc.).

Warning: The written and visual data in this article were obtained from the glassnode website.

Posted Using LeoFinance Beta