What is EIP-1559 developed specifically for Ethereum? Will EIP-1559 have an impact on the Ether price and will it affect Ethereum's monetary policy? Will or how will it reduce transaction fees on the Ethereum network? Can EIP-1559 make Ethereum deflationary? Before answering all the questions in this article, first of all, it is necessary to talk about what EIP means.

What is EIP and for what purpose is it prepared?

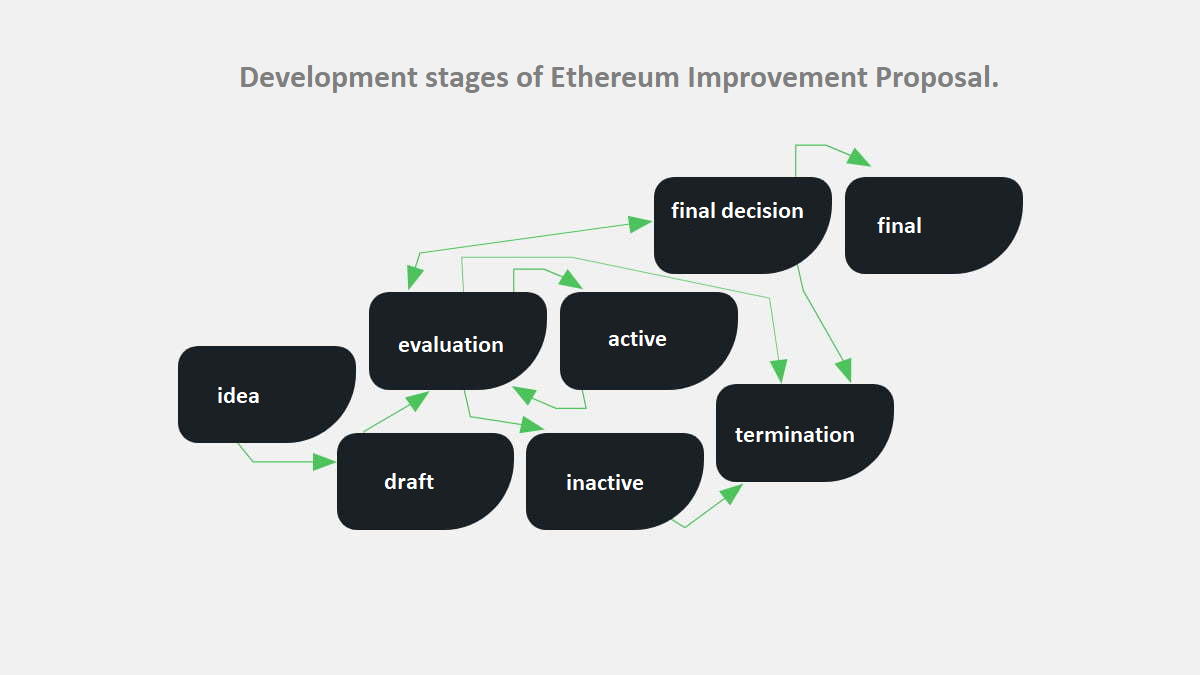

EIP stands for Ethereum Improvement Proposal. EIPs are the basic name given to the proposed enhancements for Ethereum. These improvements are recommended by Ethereum developers and implemented on the Ethereum network if deemed appropriate by the majority. This type of development model is also available in Bitcoin and they are called BIP (Bitcoin Improvement Proposal). Decentralized networks are developed with such propositions.

There are four different EIPs in total

EIPs are divided into 4 as Core, Networking, Interface and ERC. For example, the update designated as ERC-20, which causes new tokens to be created on Ethereum, is an EIP. Non-Fungible Tokens known as NFTs were added to Ethereum with ERC-721. EIP-1559 is also referred to as the "fee-burn proposal" proposed for Ethereum, just like these.

What is the transaction fee, what kind of mechanism does it have?

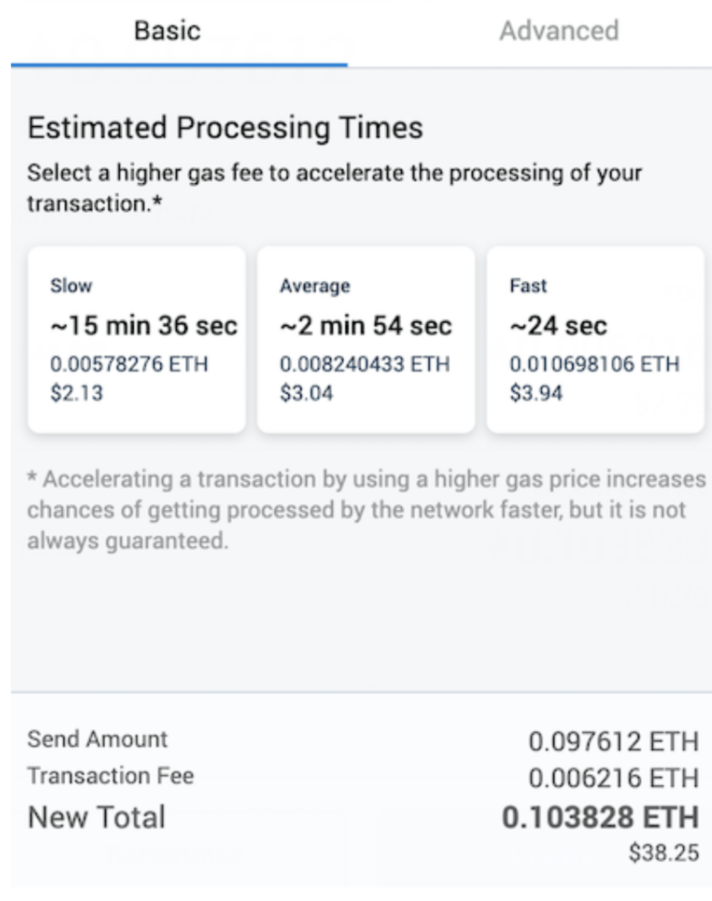

Before moving on to EIP-1559, it is first necessary to know the mechanism of transfer fees in the Ethereum network. On the Ethereum network, just like Bitcoin, miners are charged a certain amount to confirm transfers. This fee mechanism is similar to an auction. This auction is with the “Gas” required to confirm transactions on the Ethereum network.

Suppose that 10 transfers fit in a block. All 10 transfers have paid 50 Gwei Gas and are waiting for the block to be approved. While waiting like this, the 11th transfer shows up and says his job is in a hurry, giving 51 Gwei for his transaction to be confirmed in the first block. In this case, one of the 10 pending transactions is removed from that block and waits to be confirmed in the next block.

Wallets like Metamask also give you a Fee estimate based on this model. If you choose Fast, it will calculate and give you the amount of Gas Fee that can enter the first block to be confirmed. If you choose Slow, your transfer will be confirmed not in the first blocks, but in the very later blocks.

Whoever gives the money is the winner.

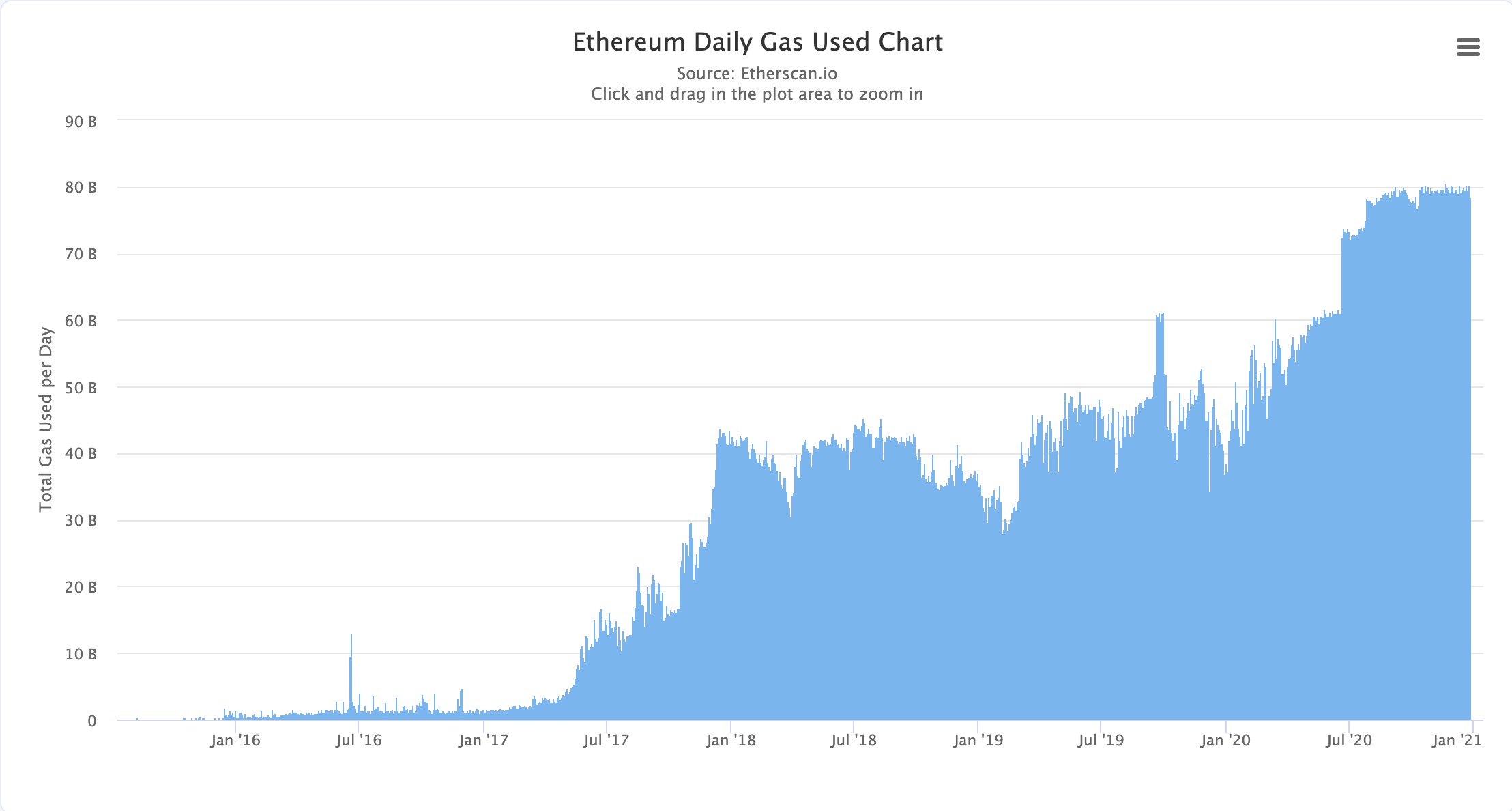

This mechanism in the Ethereum network brings with it many problems. Chief among these are the exorbitant Fee fees. Especially those who want to buy/sell fast with DeFi pay a high amount of Fee to confirm their transactions in the fastest way. This causes a serious amount of Fee to be paid and Fee explosions on the Ethereum network from time to time.

Those who do not want to give too much Fee to the Ethereum network due to the increased Fee fees, trade with low Gas fees. This delays the confirmation of transactions considerably and makes the Ethereum network not user-friendly.

EIP-1559 was proposed by Vitalik Buterin in 2019 to solve these problems. There are 4 items among the objectives of EIP-1559.

- To enable wallets to calculate transfer fees more reasonably.

- To prevent transfer confirmation delays to be made in the network.

- Making the Ethereum network more user-friendly.

- Adjusting the supply based on increased activity on the Ethereum network.

How will these problems be resolved?

Gas capacity increase per block

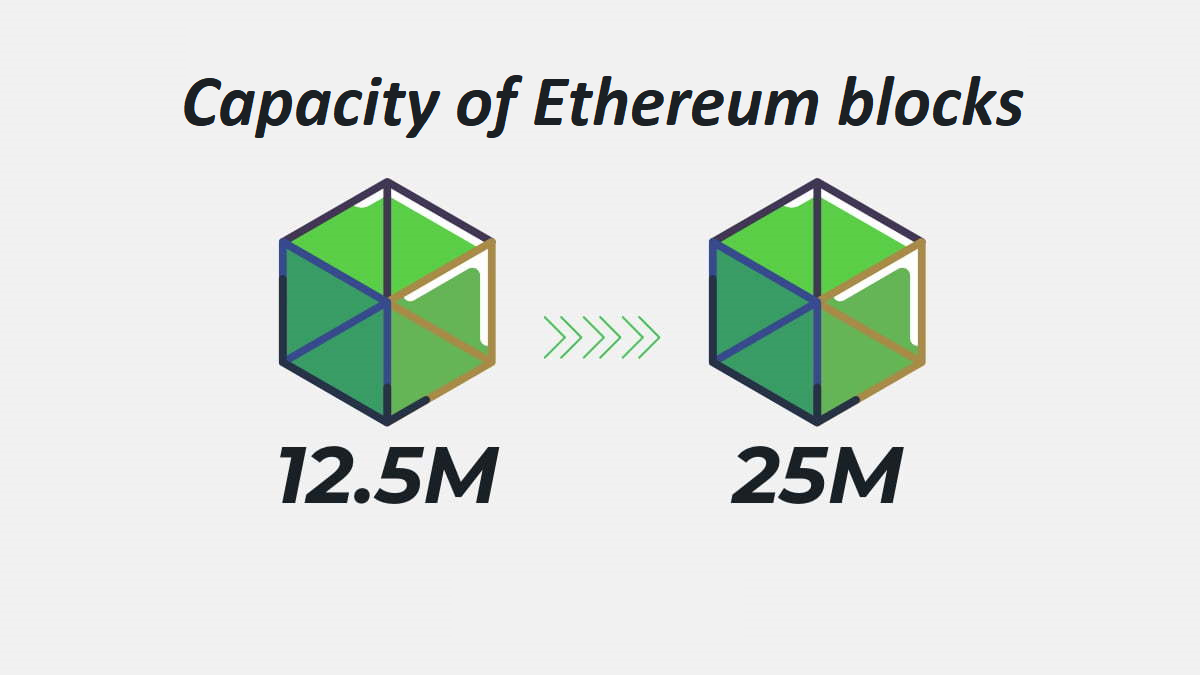

In Ethereum, each block has a capacity of 12.5 Million Gas. In the current system, as I mentioned above, each block has a certain capacity and it causes those who give low Gas to wait for the next blocks by giving more Gas, who want to have their transaction confirmed quickly.

EIP-1559 will cause each block to be increased to 25 million Gas capacity instead of 12.5 Million Gas when the Ethereum network is busy. Thus, each block can contain many more transfers. When the network usage decreases, each block will return to 12.5 million gas capacity again, preventing the Ethereum network size from increasing excessively.

Base-Fee Concept

The EIP-1559 will also bring a brand new Fee concept, "BASE FEE". Base fee is the minimum fee required for a transfer to be approved on the block. This minimum fee is the fee that is calculated separately in EACH BLOCK and will increase or decrease according to the usage intensity of the Ethereum network and will be BURNED after the block is approved. You did not hear wrong. This fee will not go to the miners and will be burned.

MinerTip

EIP-1559 will also introduce a new system, "Miner Tip", as miners cannot get BASE FEE. Miner Tip is the tip that will be paid separately from Base Fee by the person requesting immediate approval of the transfer to the miners. Thus, the transactions that want to be done quickly will be dug into the blocks with tips to be given directly to the miners instead of competing with other payments.

Thus, with EIP-1559, wallets will also charge fees according to the "Base Fee" calculated separately for each block, and the minimum fee required for the block will be the most appropriate amount for the transfer. Therefore, transaction fees on the Ethereum network will be more user-friendly and Fee explosions that will occur when the network is busy will be prevented.

Will Ethereum's price and monetary policy be affected by this?

According to the current model in Ethereum, miners receive both the block rewards they mine and the transfer fees they approve. With EIP-1559, miners will only receive the block rewards they mined and the “Miner Tips” paid for the emergency transfers I mentioned above. This will make it much more difficult to mine Ethereum.

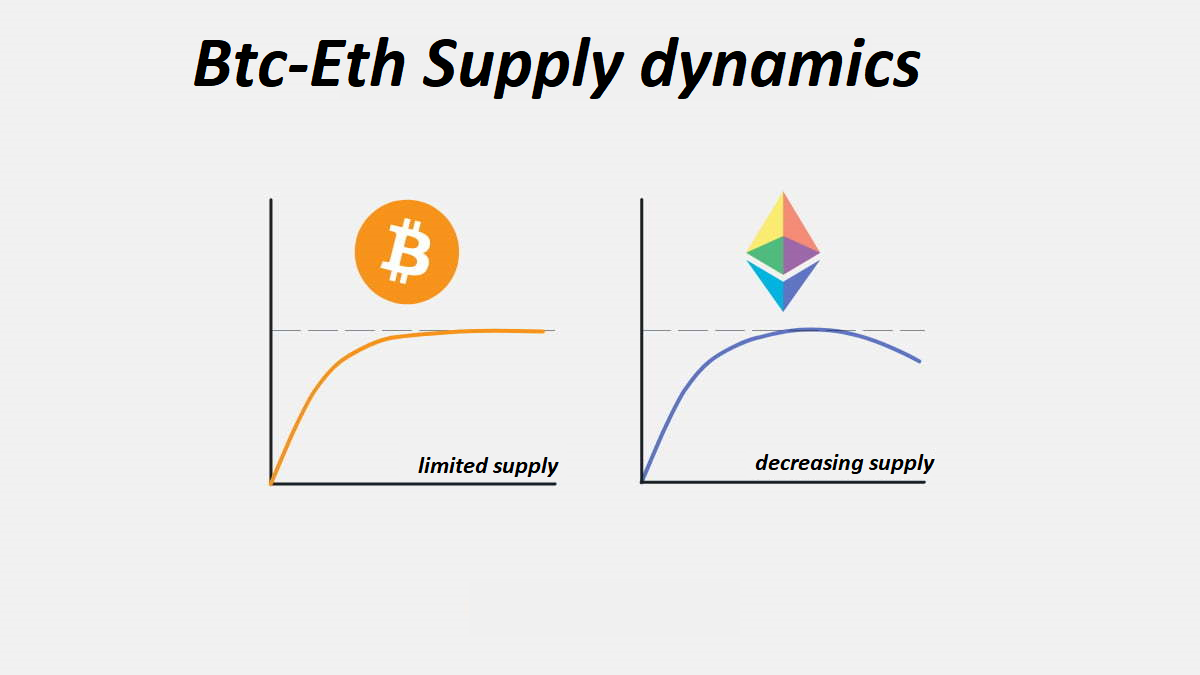

The “Base Fee” set for each block will be burned under any circumstances. Thus, if the amount of Base Fee, which increases during heavy use of the Ethereum network, exceeds the block reward, the supply in the Ethereum network will decrease.

With the EIP-1559, it will become much more difficult to mine Ethereum within the above developments, and the supply of Ethereum will decrease. Thus, together with Ethereum EIP-1559, it will be more scalable, enabling cheaper transfers, more user-friendly and most importantly, deflationary.

As Ethereum becomes more difficult to mine and BaseFee's are burned, the Ethereum price may climb much higher. Perhaps deflation will replace the declining inflation with the full transition to ETH 2.0.

When will EIP-1559 arrive?

Although EIP-1559 is actually completed on paper, miners are reluctant to release EIP-1559. Because miners earn serious amounts for transaction fees on the Ethereum network.

EIP-1559 can be applied to Ethereum 2.0 in the same way. The only difference is that staked Ethereums will be rewarded instead of miners.

The arrival date of EIP-1559 will likely be at the time of the "Berlin Hard Fork", when ETH 1.0 will be the Shard to ETH 2.0. While the exact date of the Berlin Hard Fork is unknown, 2021 will likely be the year for this crucial update.

Posted Using LeoFinance Beta

Congratulations @relium! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 100 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP