I was browsing on the bounty board on Bitcointalk looking for writing gigs, and came to the realization that there is a crap ton of new coins being launched. I think they are literally running out of words to put front of finance, you got Noob.Finance, Pulltherug.Finance, Tadpole Finance, Tardigrades Finance (Tardigrades, really?), Knit.Finance, and more than 100 others just with ".finance" in the name. Coinmarketcap currently has more than 9,000 different coins listed. I learned how to tell a shitcoin from a potential gem in the last bull market, so I decided to help my fellow crypto investors out a bit and do a deep dive into two different projects every month. One will be a total shitcoin that you should probably avoid, and the other will be a potential gem that I might consider adding to my portfolio. In a year or so, I will look back and see how well my list of gems did compared to the shitcoins. This is just for kicks, it's not financial advice, as always do your own research! This time I picked a shitcoin project called Knit.Finance, I hope you enjoy my article.

Copy and Paste

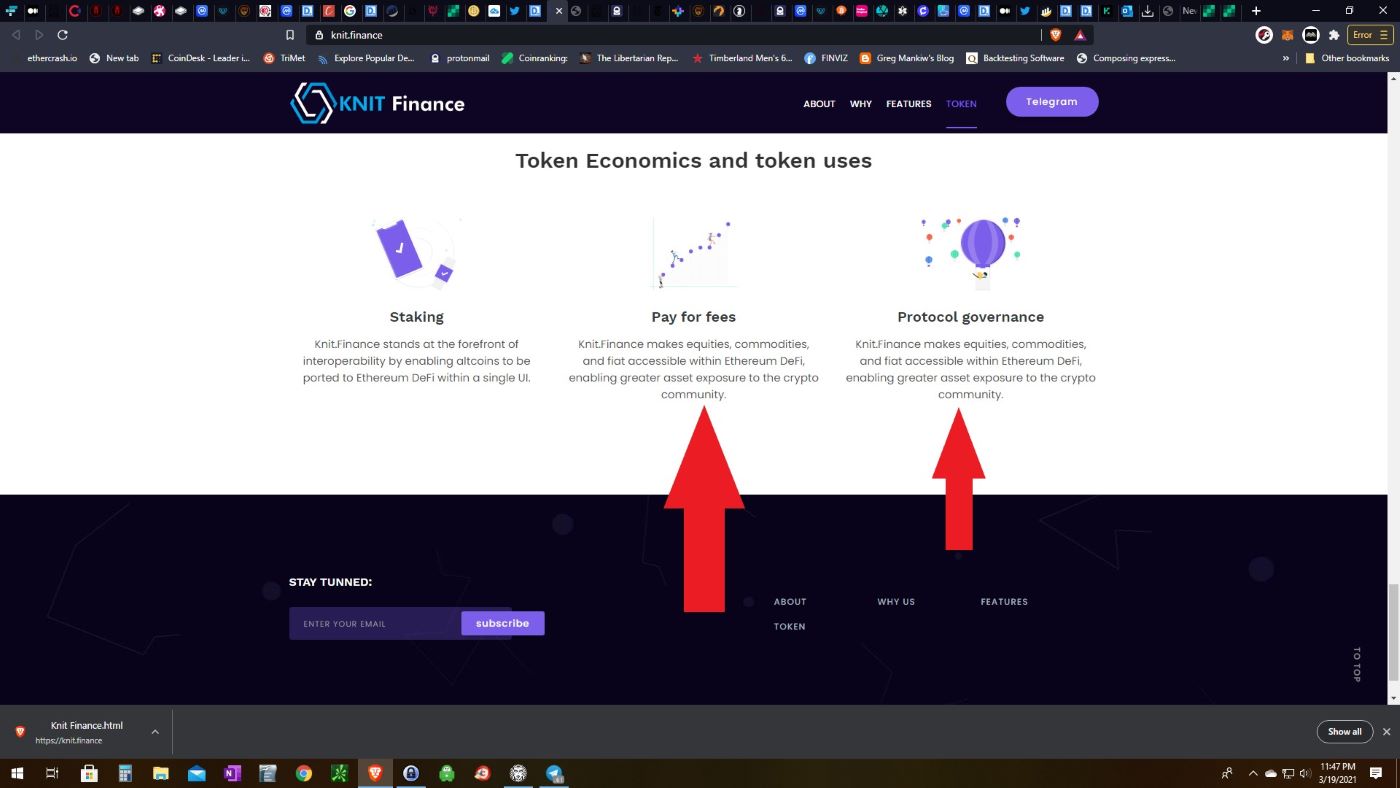

Recently, I stumbled upon this stinky shitcoin on BitcoinTalk's "Altcoin Bounty" forum page. It's called Knit.Finance and according to their website they are a "unique decentralized protocol that combines synthetics across multiple chains, bridges, and real world markets with yield, lend, trade, and margin services through smart contracts." How do they do this exactly? Well it's hard to say because there is literally zero actual information on their website, no white paper, no nothing. They didn't even bother to write different generic bullshit(no pun intended) for each section on their main page(when I say main page I mean only page, their website is literally one page). I guess they decided not to waste time by writing something different for each section, and instead decided to just copy and paste what they had already written! They use the same wording on their website's "Cross-Chain" section and the "Staking" section. What a way to be absolutely brilliant and efficient, because nobody reads these things anyways and DYOR(Do Your Own Research) is so 2019. This is 2021 and now people just click "Buy" as fast as possible. In fact, these time-saving tactics worked so well that they did the same thing again in the "Pay for fees" and "Protocol Governance" sections of their website. These copy and pasted words have nothing to actually do with fees or governance.

Since the official website didn't have much to offer, I went over to their Medium page next. All of the posts except for one, the first one, are just partnership announcements. The one with actual information told me that Knit.Finance will be able to convert any token on any blockchain into an ERC-20 token on a 1:1 basis using "cross-chain synthetics and bridges." I guess this wouldn't be too hard for some other blockchains, as many of them are designed to be compatible with Etheruem already, but there are several that are not compatible. So they are claiming to be able to swap assets from literally every single blockchain into Ethereum. This is of course possible, especially if they are going to be using synthetics, but I wondered is anyone else doing this already? Is there anything unique about this concept? How far along is Knit.Finance in accomplishing what they claim to be working on? It was time for some investigative googling, or well, some "presearching" ($PRE is a good example of a non-shitcoin, in my opinion). So I went down the Knit.Finance rabbit hole to do some digging.

Bounty Program

Next I visited Knit.Finance's official Telegram chat group, which currently has 8,442 members and is full of insightful discussion about the project such as;

"I really like this project. I hope one day this project Very rich and successful. Best platform in 2021. So everyone support the project."

"I can say this is a very cool and innovative project. This project in the future will be very helpful in the world of crypto. The project is very promising for investors. You have to join now, or else you’ll regret it later. I hope everyone can have profit with our project."

"Strong team with a great project. Love to be a part of this movement and wishing a successful to all team members and developers. The most interesting project to date",

"Strong Project headed by a strong and well experienced smart team who are devoted to make a very good future for the company possible!"

"A wonderful project, with a promising future. Responsible and effective team."

"A wonderful project, with a promising future. Responsible and effective team."

Oops, that's the same message from two different people....

Oh wait maybe all this lively discussion is because these people are getting paid to shill in the Telegram group. According to Knit.Finance's post in the "Bounties" section of the BitcoinTalk forum, you can get paid in "stakes" for Telegram posting. Notice the group's #3 rule: "Don't talk about getting paid to post." (First rule of Knit.Finance club, don't talk about Knit.Finance club) This is pretty disingenuous, don't you think? Some n00b investor who wanders into this Telegram chat group might think all these people are actually promoting the project because they believe in it or something, when in fact probably 99% of them are just posting to get paid. I am not opposed to marketing a project and paying people to blog about it, for example, but I think they should be open and transparent about such marketing tactics. They shouldn't try to hide the fact that they are paying people to promote the project, which is exactly what they are doing according to their #3 rule.

According to their BitcoinTalk Bounty post;

"Stakes will be paid depending on posts (at the start of the campaign).

5 posts per week: 1 stake

10 posts per week: 2 stake

15 posts per week: 3 stake

20 posts per week: 4 stake

25+ posts per week: 5 stake

Rules:

- You must join the Telegram chat: https://t.me/knitfinance

- You must write at least 5 messages a week about the project and conduct a dialogue with the participants in the project Telegram chat.

- You are not allowed to write a message about the bounty campaign in the chat.

- You should not have the name of another project in your profile name.

- Participants are prohibited from using any hashtags in the telegram chat!

- Words of greeting "hi, hello, etc." and words of goodbye "bye, goodbye" are not counted

- Once a week, you must send a report in the form."

You can also earn stakes for posting about the project on Twitter, Reddit, Facebook, YouTube, your personal blog, etc. What this does is make fake "social engagement" to put the project on the map for traders and investors who look at that metric when deciding whether to invest money into a project. This is not the only project to do this, so I wouldn't take anything you see on social media about a crypto project at face value. There is a very good chance that whoever is posting is getting paid to do so.

The Telegram chat group also had some people asking when the public token sale was going to be, and they were being told details would be released soon. I think it's important to note that this project hasn't even had a public sale yet, so it is still early and that needs to be considered when evaluating it. Other than the paid shills and the time of the token launch questions, only a few people were asking actual questions about the protocol and they usually got yelled at for spreading FUD in response. I also found out from the Telegram chat group that the project intends to start by launching on the Ethereum blockchain but also wants to launch on other chains as well, such as Binance Smart Chain.

The Knit.Finance Team

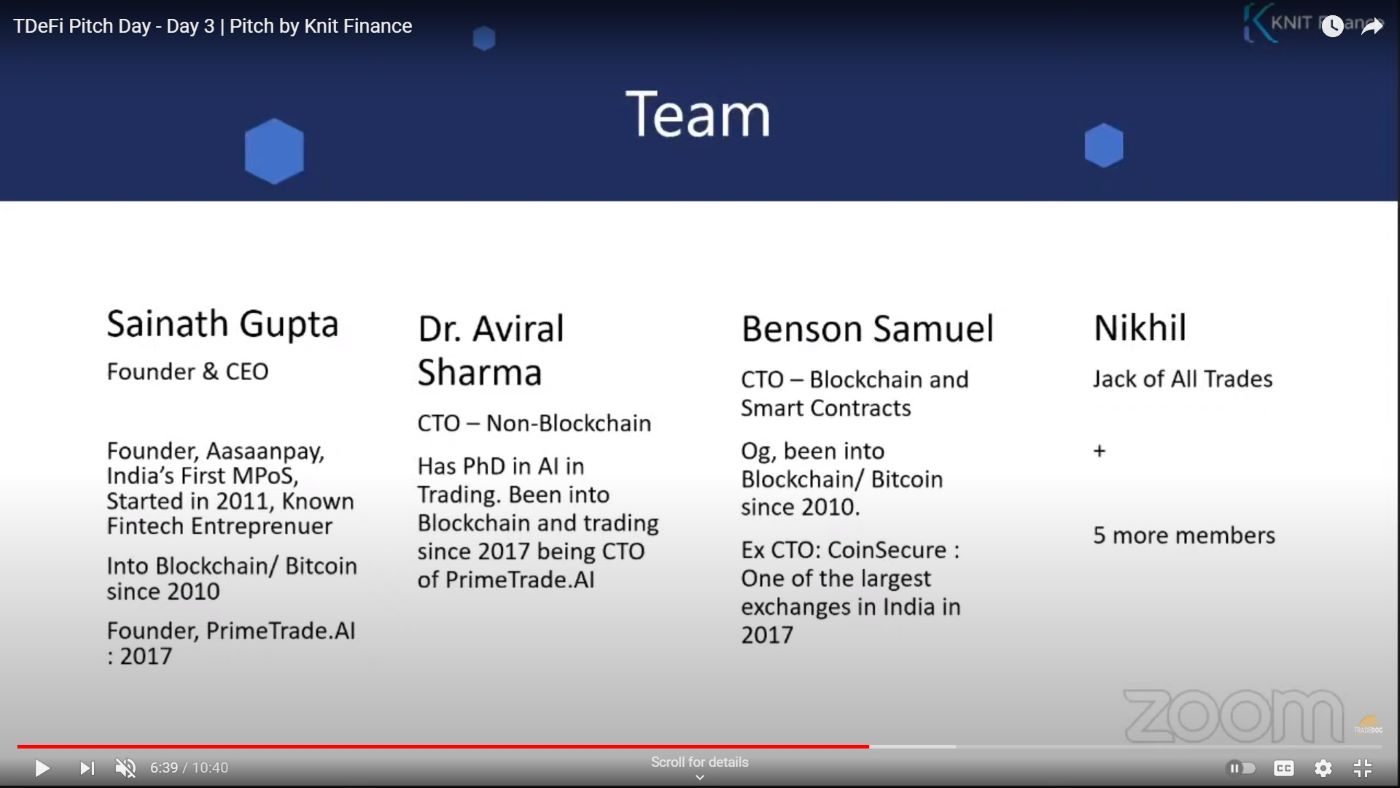

I found a pretty boring and unprofessional presentation they did on TDefi Pitch Day which told me that the Knit.Finance team consists of Sainath Gupta, Dr. Aviral Sharma, Benson Samuel, and Nikhil. Sainath Gupta is the founder and CEO, and he founded Aasaanpay in 2011 and PrimeTrade.Ai in 2017. I hadn't heard of either of these so I did a quick check into them. Aasaanpay is a Indian clone of Square's phone-based credit card reading system. No originality there, but why come up with an original idea when you can just copy something else and launch it in a different market with a different name? When I tried to visit the official Primetrade.AI website, it just took me directly back to the crappy Knit.Finance website, so I guess whatever that project was, it must have failed. This isn't necessarily a sign of a bad CEO, because failures are how you learn in the start-up space, but it is something to consider. Primetrade.AI's Twitter account is still around, and one of the last Tweets they made was about how bullish 2018 was going to be for ICOs, which was quite a bad call. They were supposed to launch a token, $TAI, but I guess the bear market interrupted their plans. Dr. Aviral Sharma seems to be very well educated, he has degrees in computer science and artificial intelligence and has written a few academic papers about finance. He was the CTO of Primetrade.AI and the CTO of an unnamed "non-blockchain" company according to their presentation. The presentation also said that Benson Samuel was the CTO of "Blockchain and Smart Contracts"(is that a company name?), a "BTC Og" since 2010, and the ex-CTO of Coinsecure. What I found interesting was on the Knit.Finance presentation Benson Samuel is listed only as the ex-CTO of Coinsecure, but according to his Crunchbase profile, he was also the founder. Maybe they don't want people to know he was the founder of a failed exchange? Coinsecure was an Indian cryptocurrency exchange that ran into some trouble in 2018 when $3 million in $BTC(now worth more than $25 million) was stolen. They said at the time that it was an inside job perpetrated by their Chief Scientific Officer and stated that they would refund customers if they submitted a claim form, KYC information, and absolved the exchange of responsibility for any future "inabilities"(What does that mean? Does it mean you got your money back only if you absolved them of responsibility if they couldn't pay back your money?). These customers were only given five days to complete and submit all of the forms or they wouldn't get a refund. Hopefully all of the affected users got the information in time and were able to quickly mail-in the forms. Yes, even though it was 2018, it was required that you physically submit the forms to the exchange's office. I am not sure how many customers, if any, were able to get refunds. I don't think the exchange exists anymore. Once again, this information doesn't say anything about Benson Samuel other than he was the founder of an exchange that got hacked and didn't give his customers much time to get refunds, but this is still information worth remembering when evaluating Knit.Finance. Nikhil is just listed online as a "Jack of All Trades," which might be code for no qualifications whatsoever. There are five more members of the team, at least at the time of TDefi Pitch Day, and I'm wondering how only nine people are going to deliver on all of these promises of cross chain bridges for every single cryptocurrency asset in existence? They will need to hire more people, which they will probably be able to do because investors will throw money at any kind of project these days.

So is there anything unique about Knit.Finance?

According to their pitch, they seem to be focused on moving non-ERC-20 assets from their chain onto Ethereum for use in DeFi, or making synthetic ERC-20 assets based on tokens or even real world assets such as gold or stocks. Real world assets are already being turned into synthetics by other projects, so that's not anything new. They also say in their presentation (Dated December 4, 2020) that there is currently no way to bring non-ERC-20 tokens to DeFi, such as $XMR, $LTC and $BCH. Is this true? Actually there are already several projects that can do this or are currently working on this capability. Some of these projects were around back in December of 2020, which means that Knit.Finance's claim that there is no way to bring non-ERC-20 assets to DeFi was false back then and is still false now. Renproject.io already provides a way to bring Bitcoin, Bitcoin Cash, Z-Cash, and even Dogecoin onto the Ethereum blockchain, and they are supposed to be adding this capability for more tokens as well. Polkadot has also funded the development of a number of cross chain bridges. Apparently something called BTSE has already started wrapping $XMR to bring it onto Ethereum. There are still some assets, like Litecoin, that currently have no bridges to Ethereum, as far as I could tell. So there is still some need there, but much of what Knit.Finance is offering is already up and running in other projects. So just like with Aasaanpay back in 2011, it seems to me like Sainath Gupta is just copying someone else's idea again. There are enough copies already in the blockchain space, so either do something different, do something better, or don't do anything at all. Knit.Finance at this point in time, has nothing new to offer, from what I can see. But who knows, they might work hard and bust out some well built cross asset bridges for all the non-Ethereum assets that nobody else has bridged yet, and if they do then they will have something to offer that nobody else does. However, the complete lack of any details as to how they are actually going to do this according to their website or in their presentation, is what is making me label this project a total shit coin, at least for the time being. Yes, it is still early in the project, but you should at least write your white paper before you start hosting Telegram sticker competitions and announcing partnerships. If you think otherwise, please change my mind in the comment section!

Governance?

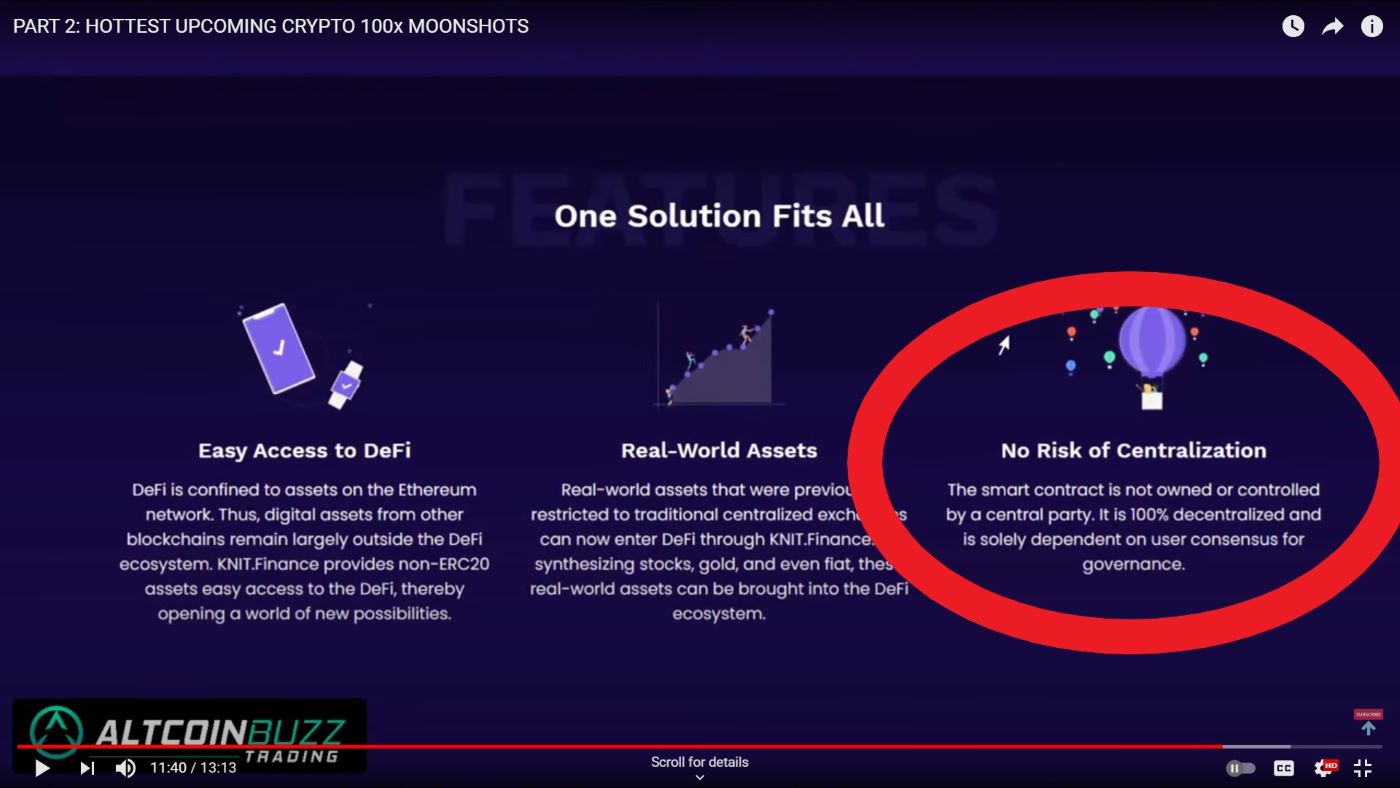

According to a brief segment about the project in an "Altcoin Buzz" video, they also claim to be a community led project, with no centralization. Except, there is currently no mechanism for any community to actual make any decisions about the project, or contribute to the code, so I don't believe that claim. There is no Github for Knit.Finance, so there is no way to tell if anyone is actually coding anything, let alone for a community to contribute to the project. Interestingly, the screenshots from the website in the Altcoin Buzz video show the mention of a community led project, but that wording has been removed from the website since that video was made. I think this also means that apparently Altcoin Buzz didn't research it's "Hottest Upcoming Crypto 100x Moonshots" very much if they picked Knit.Finance as one of them.

Partnerships

Not everything about Knit.Finance is bad, there is some evidence that they are working on something(italics). For example, they have announced partnerships with API3, PlotX, Unos.finance, Oropocket, and Elrond. The only one of these projects that I've heard of before is Elrond, and unfortunately partnerships are a dime a dozen right now. However, assuming at least one of these projects did any due diligence before announcing a partnership with Knit.Finance, then maybe there is some value in the project. Unfortunately, all the partnership announcements are almost completely devoid of any actual details about how the partnership will work. For example, the Nuls partnership announcement was a short Medium post that only said that "Knit.Finance gives $NULS holders the ability to use the token as a payment instrument in their marketplace." and that "Nuls will use KnitFinance’s multi-chain solution for getting $NULS tokens on multiple chains." No actual information on how this is accomplished, what Knit.Finance's infrastructure consists of or how it is used. Feels like a "fake it 'til you make it" approach to me, however only time will tell if anything will come of Knit.Finance. Maybe the crappy website and generic pitches are just growing pains for a new project. Maybe they can be forgiven for the paid shills on social media because it's hard to stand out in such a crowded industry without some help. However, even with the help they still aren't standing out to me at all. I think I'll save my $BTC for a project with better fundamentals and a lot more transparency.

Pinching It Off

In summary, Knit.Finance claims that it will be able to bring a whole slew of non-ERC-20 assets to DeFi, as well as bring ERC-20 assets to other chains. This is obviously something that is needed in the cryptocurrency space, but other projects are already working hard at this, or are already doing it in some capacity. As far as their team goes, nobody really stands out to me and there are a million other projects that have much more qualified teams. Their transparency is nonexistent at the moment and we only have a vague idea of anything the project is working on, if they are even working on anything at all. I've seen projects with completely anonymous teams with more transparency than this project has. The only thing I see that they have going for them so far is a concept, a team of paid shills on social media, some partnerships, and a raging bull market. That might be all they need to give investors a 20X return on their investment, or they could crash and burn like so many other projects have. I'll check back on them in a few months and see if they have improved, but right now a preponderance of the evidence is telling me to flush this one down the toilet. I rate it a 3 out of 10 on my shit scale, a pile of rat shit.

Overall Rating Is Rat Shit

Shitcoin rating scale from worse to best

- dog shit full of parasites

- bloody diarrhea

- rat shit

- regular diarrhea

- cat shit

- average shit

- rabbit shit

- healthy stool

- shit that smells like roses

- golden shit

Check back in a couple weeks for my best shit coin of the month article as I look for gold among the feces and separate the good healthy shit coins from the diarrhea coins!

Follow me on Twitter @bitcoinrenegade

Check out my Leo Finance Blog

Or my Den.Social Blog

Send me some BTC if you like my articles

1LcGsgR3Mgi5HJAEFk9Xg1Kezo4a74xAUj

Or Some ETH

0x02DAE7659a066842d2b75e84cf631AA99987Fc0e

Or use one of my referral codes:

A decent place to earn free BTC at Cointiply by watching videos, doing surveys, playing games etc. http://www.cointiply.com/r/Kna

LBRY Screw Youtube, Check out LBRY https://lbry.tv/$/invite/@renegadetrader:e

Presearch, Earn Crypto just for searching the web https://presearch.org/signup?rid=2049241

Sandbox https://www.sandbox.game/login/?r=BE6MUs4_M7GlNjR_~grULp

Trade on Phemex and earn up to a $80 welcome bonus https://phemex.com/bonus?group=235&referralCode=BW77L

Resources

https://www.ccn.com/india-coinsecure-finally-reveals-compensation-process-for-3-million-bitcoin-theft/

https://www.ccn.com/indian-exchange-coinsecure-insider-job-in-3-million-bitcoin-theft/

https://knitfinance.medium.com/knit-finance-partners-with-69d75c551d87

https://bridge.renproject.io/welcome

https://bitcointalk.org/index.php

https://www.youtube.com/watch

https://www.btse.com/en/home/

https://knit.finance/

https://www.crunchbase.com/person/benson-samuel-3

https://www.youtube.com/watch

http://t.me/knitfinance

https://twitter.com/Prime_Trade_AI

Posted Using LeoFinance Beta

Hilarious write up thanks you !

your welcome, thanks for reading it

Posted Using LeoFinance Beta

Congratulations @renegadetrader! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 200 replies.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPSupport the HiveBuzz project. Vote for our proposal!