It feels like an age since I've done a monthly expenditure review, so time to get to it!

I did originally do an analysis of the last six weeks, but then I adapted it so it's just for August, I just feel it's more meaningful to do this on a monthly basis, then you're comparing like for like!

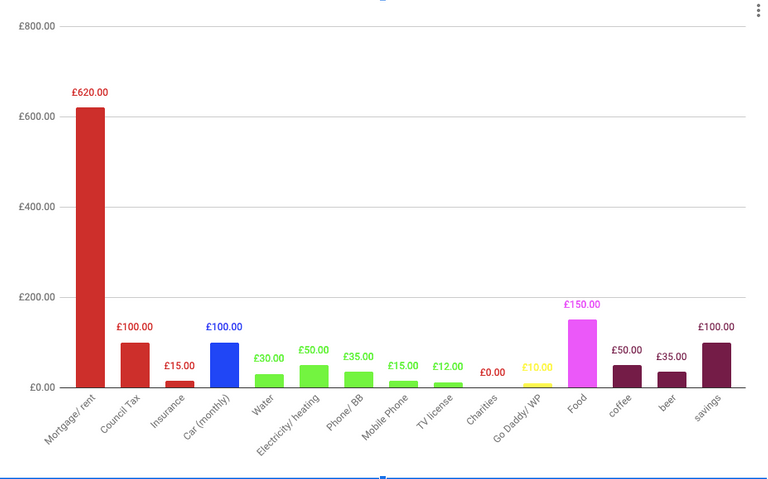

Regular expenditure - £1300

My 'really regular' outgoings such as the mortgage, insurance, council tax (red), the car (blue) and utilities (green) have just been the same as ever - even with the slight increase in the mortgage since my 3 month repayment holiday, no really significant change - I pay about £15 a month more on the mortgage now, no big deal, as long as there's no further increase. Everything else has stayed the same.

My 'optional expenditures' have crept up a little - Food was at £150, which is OK, Ive bee in a lot and I quite like cheap food (porridge for breakfast, and a simple lunch and dinner) and I'm going to say that my beer and coffee expenditure has been 'reasonable'.

The coffee is the only trip out I have some days, and the only IRL human contact, so it's a relatively small price to keep me sane.

Prepping for Portugal expenditure - £900

This hasn't been too bad, given that I've got to get the house up for rent and move.

- I've bought about £450 worth of additional stuff - mainly a roof box, some tubs, and a leisure battery. A new one, my old one is just knackered.

- It's cost me £260 to get my electrics sorted to rent the house.

- I also paid for my Shuttle ticket and Air B and B for my first week in Portugal back in August, which cost around £220 all in

Overall August Expenditure = £2200

So my total monthly spend in August 2020 = around £2200, which is quite a lot more than I earned, but about 40% of that is 'transitional', so I've just put it on 'draw down' from the old wealth pot.

The theory is that by the time I'm settled in November, that large red section in the chart above will be half what it is, and everything else will hopefully reduce by about 30% too, which means all the prep money will have paid for itself by around Spring 2021.

So it's all good, as really the 'prep expenditure is more like investing, so I can bring down my monthly regular expenditure, that's the plan anyways!

Posted Using LeoFinance