If you want to get into liquidity pools but find ETH gas fees prohibitively expensive then two much cheaper alternatives you can use, via Binance Smart Chain, are:

These two sites both offer several options for staking and receiving a very decent return on a range of coins with returns ranging from 20 something to 100% APY, paid out in a combination of both the token you stake and AUTO on autofarm and just Cake if you go into the liquidity farms on Pancake. (I think there may be an option of just adding liquidity on Pancake too and earning fees, but that's not the route I explored.)

It's taken me a few hours to get my head around connecting my Metamask Wallet with the Binance Smart Chain, moving some liquid sums around, exploring the various pooling options and deciding which to stake to, but I've ended up with funds in four different pools, two on each platform, yielding me from between an 85% to a 200% return at time of writing.

(These returns can go go up or down depending on the value of the native token you are rewarded in and presumably depending on the respective popularity of the pools.)

Below I'm going to outline my experience with setting up Binance Smart Chain and getting starting on these two platforms.

NB I was initially just looking for somewhere to park my stablecoins, but I also staked some LTC/ BNB and TWT along the way. These sites kind of suck you in, but I was reasonably constrained!

A big shout out to @dalz who put me onto these two options - Autofarm and Pancake, following a query I made in the Leo Discord, so this is another win for LEO as far as I'm concerned.

Getting set up with Binance Smart Chain

NB I'm not an ETH whale, and so I've rejected Uniswap and Curve as staking options for the time being (and possibly until ETH 2.0 is up and running) because the ETH fees are just too prohibitive at the moment.

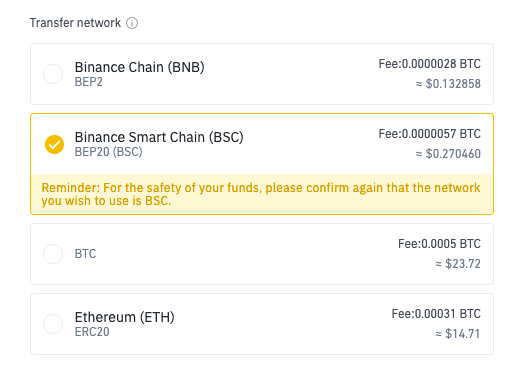

Both Pancake and Autofarm use Binance Smart Chain (Bsc) which allows you transfer (compatible) funds out of Binance for around $0.20 and to stake to pools for just under $2, with signing fees being around $0.10.

So compared to ETH, you can transfer and pool for $3 rather than $30!

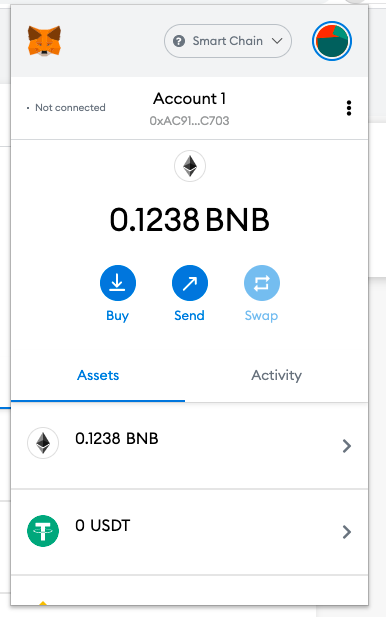

How to get started in Binance Smart Chain with MetamaskTo get started with Binance Smart Chain I integrated it with my Metamask account, simply by following word for word the instructions in this most post by the most excellent @empoderat: - of course @empoderat is three months ahead of me, but trust me, read that post it will tell you exactly what you need to do to get started with Binance Smart Chain. Maybe send him a Hive tip too!

Once you're set up, your Metamask wallet will function in exactly the same way as it does when interacting with ETH except it will be interacting with the Binance chain, and cost you 10 times less per transaction - OK it's more centralised, but it's cheaper!

Transfer of funds from Binance to Metamask

I sent five different coins in total to my Bsc metamask wallet over the course of the evening:

- BNB - which you need to pay for transactions (like ETH) - annoyingly its symbol is that of ETH even though its on Bsc!

- USDT

- USDC

- LTC (yes, on Bsc!)

- TWT (Trust Wallet Token)

You send every token to the same address - your ETH address on your Metamask wallet - you just cut and paste that address into Binance, but make sure you've got the Binance Smart Chain option clicked when you set up the address and when you withdraw.

Note the low fees compared to ETH!

It took a while to set up these five addresses simply because I had to double verify all of them with email and text codes. I also sent a few small test amounts first of all, which I tend to do to new addresses - and you can do this with the small fees.

The transactions are pretty fast - everything arrived within 2-3 minutes, so another advantage over ETH is the fees.

Don't forget to add the tokens to your list of assets on Metamask, otherwise you won't see them in your wallet. Although even without them added you can see your transactions on the block explorer, and I also found that the two defi sites managed to read my wallet fine even though my USDT (for some reason) never registered with Metamask itself.

In short, everything arrived safely and quickly!

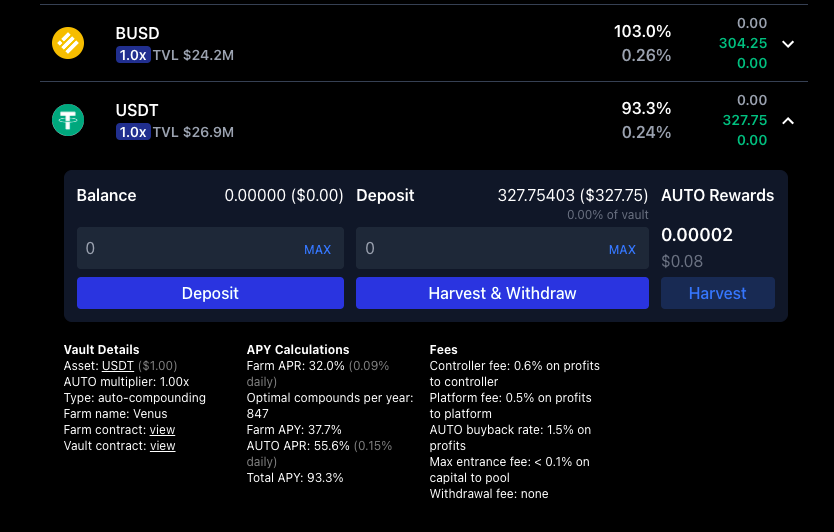

Connecting to and staking to autofarm

This was very simple. I simply connected my Metamask wallet, there's an option when you go to the site for the first time.

And once my USDT and BUSD were transferred, autofarm could read them in my connected wallet and I simply 'Deposited' them to the various individual token pools for a 90% ish return, to be paid out in a combination of USDT/ BUSD and AUTO. You can see the proportions in the APY calculations below...

It really was that simple. NB there are other options which offer a much better return - the BNB - AUTO pool is offering > 500% for example, but I just wanted somewhere for my stable coins for now, I might explore the more exotic options later.

It's pretty cool to be able to watch your balance just go up and up and up!

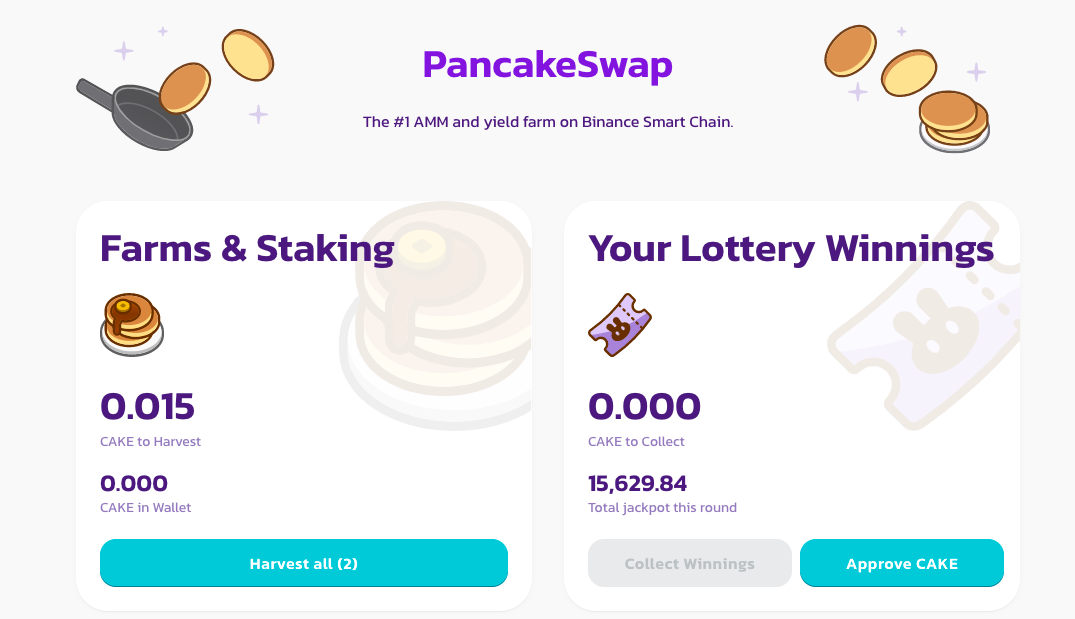

Getting started with Pancake

I was quite surprised by the feel of Pancake. It's got a very accessible front-end - which isn't what I was expecting from a defi project built on an Eth alternative like Bsc, but they've done a great job of gamifying defi and making it seem fun.

(Although given the risks involved I'm not sure this is ethical!?!)

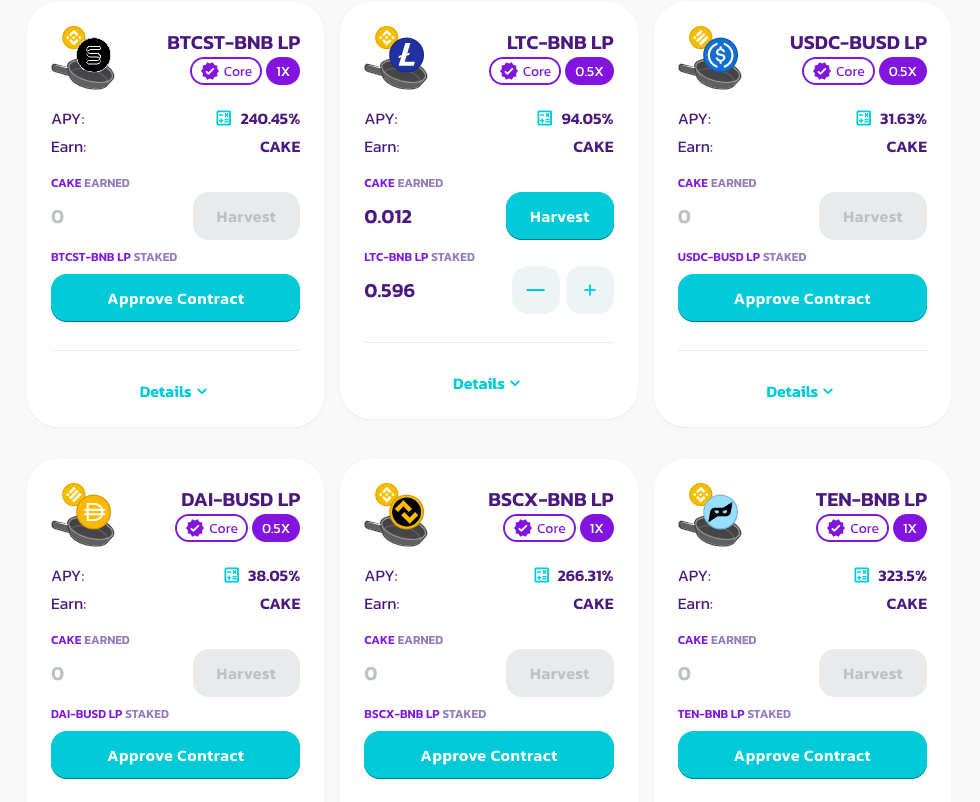

If you click on the 'farms' options to the left you get to the liquidity pooling choices, of which there are several:

It's a bit more complex than Autofarm to stake to one of these pools, but if you're used to Uniswap, you'll recognise the format.

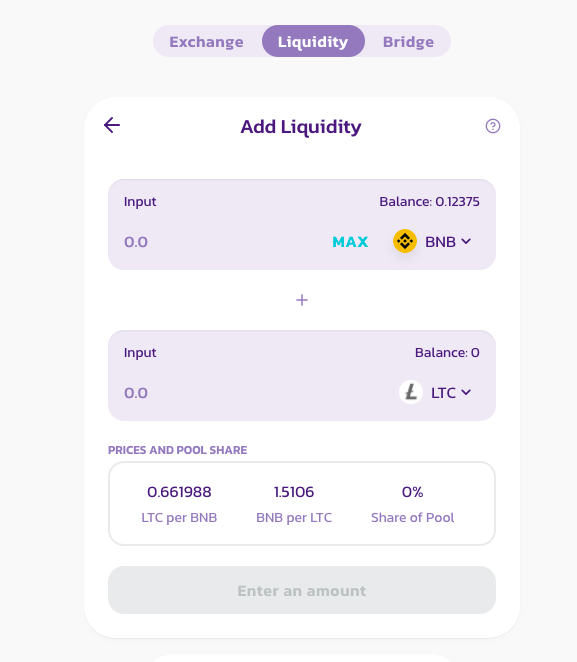

I opted to stake into the BNB-LTC pool - I've got a bit of an irrational soft-spot for LTC - to stake you just click on the details option of the pool from the page above and you get a link to where you add liquidity:

As with Uniswap, you add to both sides, so you'll need both tokens in your Metamask wallet, and (still on Binance Smart Chain remember) you then do your confirmations and add liquidity.

What's different from Uniswap is that you then get 'pool tokens' which you have to stake to farm for cake, and there's one more click to activate this phase back on the 'farms' page.

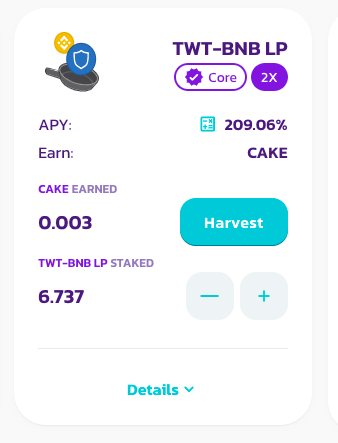

Once I'd got my LTC-BNB pool up and running for a 90% return, I couldn't resist punting on this one too:

Rewards in platform tokens not fees

Just remember on these two platforms you're rewarded in AUTO and CAKE respectively and you'll need to claim them periodically - I'm guessing there is a gas fee for this, so every few days I imagine would be optimal.

Further risks and rewards

Whether you compound your token rewards is up to you - there are some very high returns on offer for Auto and Cake pools - but you might prefer to sell and take profit while defi is still pumping.

There's a risk that the returns will go down as mentioned above, and with returns all round of 100% per annum, this is clearly a bubble, it can't go on forever, so enjoy it while it lasts!

Also there's a hacking risk too, and impermanent losses apply in any pool, although if you're pooling stable coins, that will be almost non-existent.

Final thoughts...

I'm VERY pleased with my evenings work exploring Defi options, very happy to have some more funds staked and earning for me, I've now got funds in four different pools and I've made about $0.20 in the time it took me to write this post.

One just has to be careful to keep an eye on the defi market and be ready to jump ship as and when the returns dip.

But for now, it's all good so happy days!

Posted Using LeoFinance Beta

Y'all should have a look at Wanchain. The cheapest way into Defi, totally ignored and a sleeping giant. We all know what happens to sleeping giants when people wake up.

Damn, now I need to go explore this but I'm just starting to flag after only getting 5 hours sleep last night, I'll have a gentle look though.

Thanks for the tip.

I am, naturally, on the look out for the next exchange/ platform that's going to do a nice airdrop that could become the next Uni!

It is at the moment the cheapest Defi platform out there as far as im aware and a growing ecosystem of finance in general. The only way is up for Wan now. It has been building all throughout the bear market over the last 3 years and finally the entire eco system is starting to flourish perfectly in time for this Bull run. It is stupidly cheap and under appreciated. Not doing any air drops but still its one of those coins that is perfectly positioned for massive returns this year.

Disclaimer - i have a lot of them, but its nice to see things coming together now. The most important thing is its the only Defi out there that is truly decentralised.

At first they ignore you, then they laugh at you, then they fight you, then they join you and then you get rich. :)

I'm downloading their wallet now, I'll have a look!

Great write up!

Someone stayed late at night :)

Posted Using LeoFinance Beta

A couple others stayed up later following :D

Honestly I was pumped after 4 hours of exploring - I got an espresso on the go at 1.30 a.m. - I'd been hankering after one all evening but just couldn't drag myself away from the computer until I'd had all my stuff staked.

Cheers for your help.

I decided to stay away from the insane return pools, I prefer the single pool options for now - when I've got some auto I'll go in for that 500% one though.

Posted Using LeoFinance Beta

I prefer the syrup single sided staking! I'm not keen on the risk of impermanent loss on the double pools.

I might get into those once I start harvesting some cake.

I have put most of my money into single pools on autofarm - I found a nice 50% return pool for BNB which was appealing.

I didn't put too much into the pools on Pancake, like 0.5 LTC and the equivalent BNB - it's nice that it's still worth it for small amounts with the fees!

Posted Using LeoFinance Beta

Nice writeup!

Most people don't care about decentralization - they care about usability, and Pancakeswap is leagues ahead of Uniswap in that regard. The decentralization of Ethereum is debatable anyway, considering that three mining pools control over 50% of the hash rate.

And for people who are concerned about impermanent loss, they can deposit their CAKE into syrup pools and earn tokens risk-free.

Thanks for the clarification, I almost certainly didn't cover everything, I wrote that up at 2 a.m. after a pretty excitable Friday evening going down the rabbit hole for the first time, I'm sure you remember the feeling!

Posted Using LeoFinance Beta

From a decentralisation point of view, isn't this network just entirely run by Binance?

Posted Using LeoFinance Beta

Thanks for this. I was just starting to think I needed to start exploring liquidity options. I don't have a huge stash to put to work so ETH fees are certainly preventative for me at this point.

Posted Using LeoFinance Beta

Binance smart chain really is the way to go, you probably want to look to stake/ pool at least $100 worth of assets to make the fees worthwhile, much better than ETH, I'd say it's more like $1000 minimum there!

Posted Using LeoFinance Beta

I used Pancake Swap recently, and the fee is very much lower than Ethereum. That's the upside of BSC. Even Pancake Swap token went multiple dollars on its price.

Posted Using LeoFinance Beta

It's a relief isn't it!

Posted Using LeoFinance Beta

I bookmarked your post as it might proof very useful. On the same note, also on BSC until it becomes multi-chain there is Thorchain, and many recommended it.

Posted Using LeoFinance Beta

Oh is that on BSC I hadn't even realised? I've got a fair bit of Rune to play with, but I just regard it as TOO precious to stake and get drained.

I might well explore my options thought.

Posted Using LeoFinance Beta

I didn't know that either.

Have a look at this post:

https://leofinance.io/@jk6276/asynchronous-liquidity-pooling-on-thorchain

Posted Using LeoFinance Beta

Good post sir! :P

Well CZ wants a piece of the pie and it seems he's gonna have it.

BNB is really hot right now exactly becuse of those pools. I haven't tried their pools yet but those ETH fees are ridiculous...and if there's one way to save 90% that has to be by using BSC

Posted Using LeoFinance Beta

The fees seem so cheap compared to ETH you can play around a bit, I've had to be careful to not get carried away, I just cashed out >$1000 of ETH for BNB and related coins, I need to remember that it's still around $3 a pop to stake, but when it feels so cheap you're tempted to micro-pool across several coins.

The saving grace that's made me stick to a few coins is that I need to cut and paste my MM wallet address for every coin - that means dual verification via text and email, and then the same again to withdraw - but it's handy as it means you can't face doing this for more than a few tokens!

Posted Using LeoFinance Beta

Autofarm and cake are very useful. One thing I like is that they support DOT and will add more features in the future.

Also, I’m glad I moved almost everything from Ethereum to BSC. I still have something in uniswap, harvest finances and yearn finance but I will wait for gas fees to relax a little bit.

Posted Using LeoFinance Beta

You know my gut feeling is the 'averagely rich' crypt guys are all going to move their funds out of ETH - it'll be interesting to see what the Whales do.

Posted Using LeoFinance Beta

Thanks for your help on this mate, let's see how it goes!

It's been fun, I did have a panic moment this morning about how to get AUTO out, but I figure out a relatively easy route, you just have to go via pancake.

Posted Using LeoFinance Beta

Besides diamonds (good ones), is there anything more expensive than ETH fees these days?

Posted Using LeoFinance Beta

And at least you get something tangible with diamonds!

Posted Using LeoFinance Beta

Very good introduction to BSC DeFi.

On pancakeswap people can stake cake to get other coin as well (like EGLD for example). That’s a good way to enter some coins you would have not buy and allow to diversify a bit the risk of being over-dependant on cake/bnb.

Posted Using LeoFinance Beta

Yes I could hardly NOT notice those other coins, but I'm holding off for now, the price of those could go anywhere!

Posted Using LeoFinance Beta

Nice article, Thanks for sharing this. I have been saying for a long time now that bnb is going to be the next one to reach highs due to the low fees and binance setting it self up nicely for new crypto people.

Posted Using LeoFinance Beta

I am assuming the reward tokens can be sold off or be used to farm further? I wasn't quite clear on that point when I discovered BSC the past week.

Yes - you can exchange it out on Binance, or stake to farm further - some of the pools involving Cake and Auto offer insane returns - I guess because they want to encourage people to hold them!

It's a little more complex with AUTO - that goes to pancake exchange then swap for whatever, then from there to Binance.

Posted Using LeoFinance Beta

Brilliant guide thank you!

It's still pretty expensive, don't you think?

Posted Using LeoFinance Beta

I think you probably want >$100 per stake/ pool to make it worthwhile - with the current rates you'd have broken even after a month or two.

Compared to Hive everything is pricey!

Posted Using LeoFinance Beta

That's so true, HIVE is just another level.

Posted Using LeoFinance Beta

Nice post. This could be a well written beginner's guide to users who want to start with Binance Smart Chain.

Posted Using LeoFinance Beta

I didn't know there even was a Trust wallet token. Did you buy that or get it from an airdrop?

Also, can you use any ETH token on BSC, or only ones that have some interface with BNB?

Posted Using LeoFinance Beta

I bought the TWT - just not very much, I just have a feeling it's going to keep going up. Also a great return on Pancake.

The tokens have to interface with BNB but quite a few of them do. https://bscscan.com/tokens

The rub is that if you've got ER20 tokens in your ETH wallet you need to pay ETH gas fees to get them out first, i think the easiest way is just send them to binance then on with the BNB chain.

Just be careful to double check what options you've got checked at all the various stages!

Thanks.

Posted Using LeoFinance Beta

This is cool. I have been applying staking on my trust wallet. Although mine is on Julb. The fees are quite cheap but still a constrain. I am thinking of getting on Doge/bnb pool. There is potential in Defi that i find interesting.

Posted Using LeoFinance Beta

I think I need to check out the Trust wallet, I'm going to download it later tonight in fact!

If you've got Doge you may as well stake it.

Never heard of Julb, I guess there are lots of options out there.

yeah so much. i just downloaded metamask myself. I have linked it to my leofinance wallet. Who knows what will happen later eh?

Very informative and detailed, thanks for the info.

I haven't yet fooled around with Binance to much yet, seems I've been able to get what little crypto transactions I perform outside of Hive done with Coinbase and Blocktrades so far, but these are very affordable fees.

Posted Using LeoFinance Beta

Based on my very limited experience I'm enjoying it so far, it's nice seeing the numbers go up, obviously I can't recommend it as it's not financial advice but let's just say I put about $2K in and I woke up this morning $2 richer overnight!

You can also send hive there through the bridge (very simple)

https://peakd.com/hive/@fbslo/introducing-bhive-bep20-hive-on-binance-smart-chain

This article is awesome Karl. Gr8 learning resource.

I am in the process of moving around some crypto to stake some LINA I took a punt on in the autofarm pool (Farm APR: 199.9% yield is crazy coconut gains). The LINA has just been sitting in my wallet waiting for a YouTuber to start a pump on that coin lol Might as well put it to work stacking in anticipation of any major price surge on LINA.

Thanks for sharing your knowledge, I am going to reference this post in a Leofinance post I'm putting out this afternoon.

Posted Using LeoFinance Beta

What is Lina>? I've seen that in various pools with high returns. Best of luck with it! Just keep an eye on the fees, they can mount up!

LINA is a Defi app/exchange/swap where you can stake LINA to their app.

If you 100% understand that then you're better with this crypto stuff than me lol

The project is called Linear Finance, and it is one of a few Defi punts I've taken for this altseason. Some other ones have already come off big time. Anything with a working dapp in the Defi arena is a decent bet for me. I do understand what they're doing enough to throw $300 at it, but I have to admit that I haven't gone deep dive on the project.

Will do, cheers for the heads up :)

Posted Using LeoFinance Beta