So I approached my old mortgage broker to remortgage a few days back and he told me that HSBC had the best deal on offer - I was after a 3 year fixed on a 6 year term, and their rate was around 5.5% which is OK, marginally better by £3 a month than the next on the list.

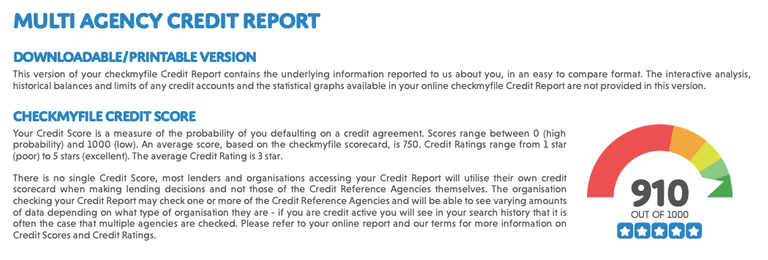

As part of the application process - entirely handled by the broker except for a credit check which I had to get done which was achieved via a free trial period with a certain company (actually I must remember to cancel that!) and my score came out at.... 910/1000...

With absolutely NOTHING bad on the whole several page report.

So I thought this was a done deal, but today the broker phoned me back saying HSBC wouldn't lend to me, because of some 'unsecured credit' on my account, of which there is precisely none.

I have one loan for around £2.5K which is on there, two credit cards with £20 on one of them, practically the same amount in FIAT in my bank as the mortgage amount, asking to borrow an amount 5 times less than my house is worth and with repayments < 30% of my disposable income, evidenced by tax returns submitted by a qualified accountant.

So WTAF is wrong with HSBC....?

No matter, the next lender on list already agreed to lend to me in principle, so congrats to them, they'll get my several thousand pounds in interest over the next 5-6 years for what is practically a risk-free mortgage.

Fucking HSBC, totally irrational! Boners, but I guess that's the FIAT economy for you, just totally unreliable.

And if they're not lending to me, this means they're not lending to hardly anyone I guess.

I think they dont like self employed.

You may have a point.

Wankers.

That makes me wonder if they're about to go under or something, that is sus af!

Certainly risk-off!

Nothing makes sense when it comes to lending especially when you are low risk.

Could be a couple of reasons. One as someone else has mentioned, you are self employed......Big banks hate this. Secondly, for credit cards, they look at your credit limit, not how much you own on it or your prompt payments. Thirdly, your loan amount might be below their internal threshold. Banks like big loans.

Ah yes fair point, although personally I would have thought I'm easy money!

Yours' isn't easy money as you most prob won't struggle to make your payments, so they can't whack you with even higher interest rates and any chances of late fees......

I guess it's all relative! Personally I would have thought a locked-in almost 0 risk £4-5K interest over 3 years is easy! I'd take that!

If you follow all the SPL Mav chat, its all abt ROI....stable payers are lower risk = lower ROI

The banks can afford to be choosy it seems, but maybe it was something random that caused your rejection. Mortgages must be their biggest earner and high prices plus high interest mean boom time.

I don't get it!

!PGM

!PIZZA

!CTP

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-0.1 THGAMING-0.05 DEC-15 SBT-1 STARBITS-[0.00000001 BTC (SWAP.BTC) only if you have 2500 PGM in stake or more ]

5000 PGM IN STAKE = 2x rewards!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

$PIZZA slices delivered:

(7/10) @torran tipped @revisesociology

The way you are telling all these things, it is clear that the banks as they are now do not want to give profit to people.