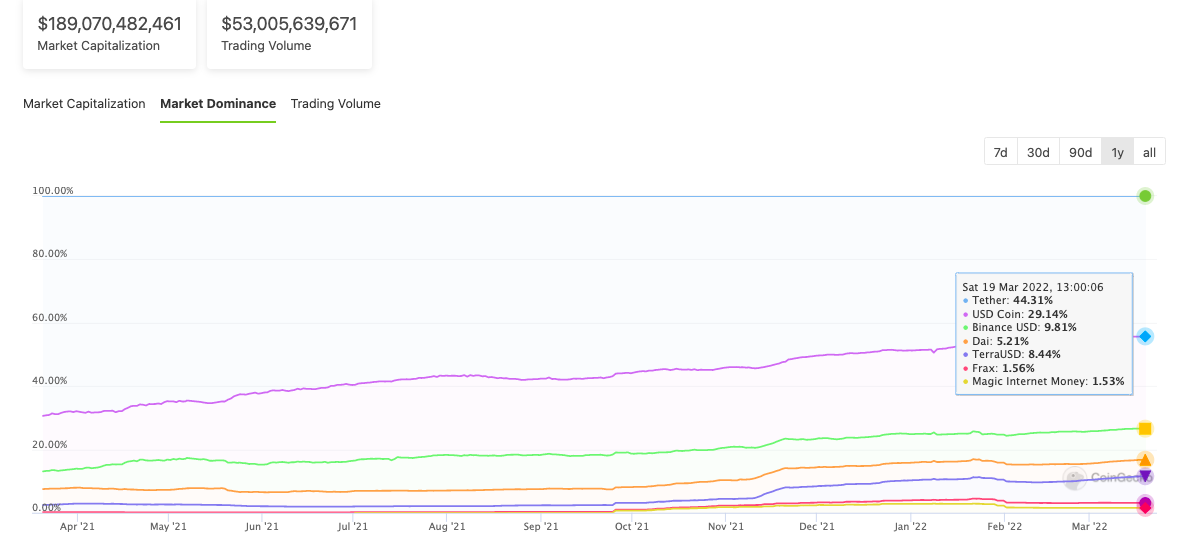

Tether's (USDT) Dominance in the Stable Coins Market has dropped from over two thirds to under a half in the last year.

Back in March 2021 68 percent of funds invested in stables were in Tether, today only 44% of stable funds are in Tether...

The Changing Landscape of the Stables Market...

CoinGecko is a reliable place to monitor the changing trends in Stable Coins and these are the main changes of the top seven coins (today) over the last 12 months:

Over the last 12 months, the relative percentage of stable market cap attributed to each coin has changed thus:

(The final column is today's market cap, approximately)

Tether - 68% - 44% - $80 BN

USDC - 17% - 29% - $52 BN

BUSD - 5% - 10% - $17 BN

UST (Terra) - 2 .5% to 8% - $15 BN

DAI - 5% - 5% - $9 BN

FRAX/ MIM - min to 1.5% each $5.5 BN

Others approx. 9% - 11% - $19 BN

The shift from USDT to USDC...

The main shift over the last 12 months has been from USDT to USDC, another centralised stable coin.

I imagine this is because the company behind USDC has more regular audits of its fiat funds backing USDC and from a more reputable company compared to Tether.

It's pretty basic, really:

Circle's audits are monthly by a reputable accounting firm.

Tether's last audit was in December of last year by a company which has rebranded itself recently, possibly because it's under investigation by the UK's Financial Conduct Authority.

Not that Circle's accountants are necessarily more above board, but if you had to opt for one of these stable coins you're probably better off going with the one which isn't CURRENTLY being audited by a firm that's being investigated CURRENTLY for financial misconduct.

BUSD has also seen a doubling in growth since this time last year, I don't see any reason to be too suspicious of Binance's coin, other than the usual reasons you might distrust Binance!

The growth of UST is also impressive...

The massive growth of UST, and the corresponding increase in value of TERRA probably hasn't escaped your attention - I guess this is because of people's desire to hedge out of centralised stable coins and into an 'pure blockchain stable coin' - although clearly this is a hedge compared to the growth of USDC and BUSD, which started from higher basis.

It will be interesting to see how this grows (or not) now it's on a par with DAI.

And more diversification into other coins..

There's clearly an appetite for a greater diversity of stables as the share of stable market cap taken up by other coins, starting from a low base has also increased.

The biggest gainers are MIM and FRAX, both of which I know very little about but are on my raider for further investigation!

Stable coins - from 5% to 10% of TMC of Crypto

It's also worth keeping in mind that the value of stables overall has doubled in the last year compared to the total value of all crypto - from 5 to 10% of market share....

I personally don't think this is anything to worry about, 10% is a relatively small number, and no doubt this has been influenced by the REASONABLE returns you can get on stable pools or even just staking UST.

HBD not even on the radar

The Circulating supply of HBD is currently around 26 million, so $25 million in value, making it tiny in market cap terms compared to the larger players, and very underrated IMO given the Hive backing and generous 12% holding return...

Final Thoughts on the Current State of stable coins....

People still prefer centralised stable coins, with TETHER loosing out RAPIDLY to the more regulated and hence trusted USDC, with BUSD also having seen huge growth.

However there is clearly a growing demand for properly decentralised stable coins too, so I expect a trend towards greater diversity going forwards!

ATM the proportion of stables to other cryptos is still relatively small, but it's worth keeping an eye on this ratio as the higher it is the less potential there is for yield in DEFI markets as thing stands, unless 'synthetics' can grow to make the connections between crypto and fiat even more fluid?!?

Posted Using LeoFinance Beta

HBD needs to get on the radar. We certainly need to expand the supply faster.

Hopefully we will see Hive Savings Bonds coming through soon.

Posted Using LeoFinance Beta

Aren't there plans to drastically increase the debt ratio? That would go some way to helping - the more DEFI we can get with Hive the better I think!

Hive Bonds are an interesting idea come to think of it - like giving people the option of NOT using Hive like a blogging platform where you have to reward people.

Coinbase does know what they are doing and clearly are still the leader when it comes on onboarding new people into crypto. They have some questionable things in the past however I do give a lot of credit towards crypto adoption because of coinbase and respect that.

I've used them in past, so i've nothing against them in fairness!

Posted Using LeoFinance Beta

I actually expect USDC to flip USDT by the end of the year.

Probably earlier!

The limitation hbd has really comes down to demand. If hbd as more universally accepted I think it can rival that of usdt. Imagine billions of hbd in circulation. This means billions in evaluation for Hive. Let’s go Hive!

Well I guess if people bought lots of HBD it would pump the Hive price!

Tether will drop even more as DJED is coming in the next few months and will be really big for Cardano's eco system. Would be nice to see HBD but honestly is just too small and we need much more HBD.

Posted Using LeoFinance Beta

DJED... Never heard of it? I'll dig into it!

Tethers past shaddy backing reports regulatory problem all made it less favorite. It's still popular probably bcz of Tron low transfer fees

That shady past is something I'm aware of, it's catching up with it I guess. I don't think the transfer fees are that low are they? I tend to transfer in LTC still!

market sentiments, and attitude of the investor to safeguard his interests play a major role

Posted Using LeoFinance Beta