Having recently sold my land in Portugal and with no intention of putting more FIAT into crypto because (1) I've got enough in there and (2) pretty much all the FIAT I've got from the land sale I'm going to spend probably in the next year on some sort of tangible investment: either a van or going back to school, or land, or hell I might just even pay the mortgage off, but whatever I'm just stacking it in 'high' interest accounts.

It's all relative of course, nothing in the FIAT world comes close to the 20% return on offer on HBD, but at that rate it's a disaster waiting to happen if it doesn't come down, but anyway...

The problem with High interest accounts is that the ones with the highest interest rates don't allow you to hold that much money in them.

For example, the three I've got are:

- Account 1 which offers 5% up to £1500.

- Account 2 - An ISA account (flexi) - 3% on up to £20K

- Account 3 - 2% up to £10K

Anything over these amounts is rewarded with a paltry interest rate!

Now obviously what I've done is fill up account one first, then it's account two and then account three.

But the thing with account one is that I've also got loan payments going out every month for the next two years. The loan is at 3% so it's not worth paying off when it's balanced with the ISA return, and it's lower than the mortgage too, so it makes no sense to pay this off first.

But what I got to thinking is hmmm.... what would be the opportunity cost every month of my not topping up that £150 every month by just keeping the money in the 3% ISA.

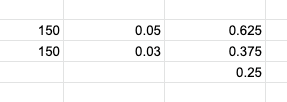

The answer is simple, its: (£150 times 0.05/ 12) - (£150 times 0.03)/12

Which = 0.25 a month...

Now why that doesn't sound like a lot that is £3 over the course of a year, or 0.01% of a £30K a year salary, which personally I think is pretty significant when all I have to do is set up a monthly Direct Debit from the 3% account to 5% account for £!50.

That took me about 10 minutes and that's equivalent to £18 an hour, or getting on for double the national wage!

It's one of those micro work tasks that you simply makes no sense not to do if you do any work for a living!

Posted Using LeoFinance Beta

And here I am hoping the witnesses increase the HBD savings rate since if Task is right, the Hive ecosystem is going to need a lot more HBD. :-)

Task is just some bald bloke from somewhere in America, the same guy who seemed to think that PolyCub would go to, what was it.... $5?

Writing about it has made you even more! We've got some excess cash at the moment, so we're keen to earn at least something on it. I may still buy more $HIVE though. That's gone up a fair bit since I bought at the start of the year.

Yeah I'm not sure what to do about HBDs and Hive - below $0.40 and I'm game, until then it's just stacking those HBDs, but no more FIAT in!

Buy some solar panels or insulation!

We hope to get panels this year. Planning for the long term.

Ah nice, good plan!

Just stick it in HBD, what could go wrong? 😉

Best case scenario is HBD remains at $1 but Hive goes to $0.05 or something around there, if interest rates stay at 20% it's literally inevitable at some point!

so are you thinking a Deathspiral like last year in Terra for HBD?

Anything offering a 20% is a fantasy, it's a crash waiting to happen. Simply unsustainable, it's just a matter of when - could be 6 months, or 6 years!

TSB got some nice saving accounts called Bond 1,2,3 years, Santander give something for current account up to 20 K i think. They do have some good cash Isa too.

Ah OK good to know!

How high is the inflation on the pound atm? Not to ruin your mood!

Posted Using LeoFinance Beta

0h I am planning on spending this money fairly promptly, don't you worry!

I know you can. Never doubted this skill :)

Posted Using LeoFinance Beta