Yes that's right the Anchor Protocol on the Terra Network will PAY YOU in ANC for borrowing UST against collateralised bETH.....

I recently decided to do this as I wanted a way to get my ETH yielding more than it currently does in the Cub Kingdom, which is < 10%, but I didn't want to risk loosing any ETH by pooling it with something else....

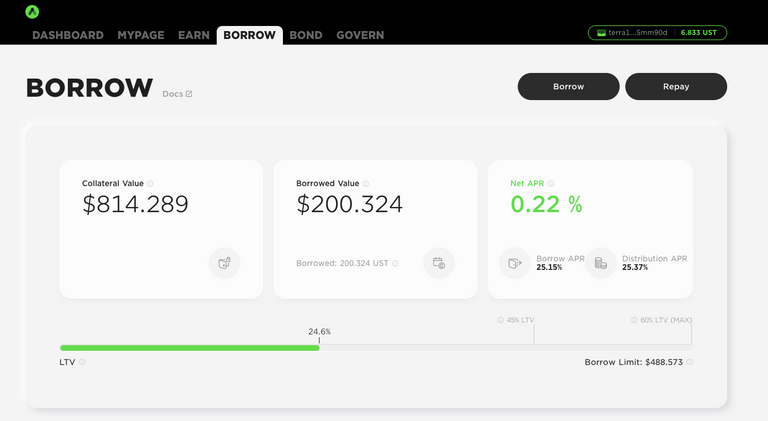

I only started with a small experimental amount, and NB the return is actually BETTER than the 0.22% shown above, it's nearer 5% at my minimal risk level, could be up to 15% if you went 'all in' and borrowed the max. I'll explain more below, first of all the how to.....

I had to get the ETH across from Binance Smart Chain which took going through a few stages, and here's how I did it in case you want to try it....

How to Bridge ETH from BSC to Terra and Collateralise it....

Unfortunately it's not that straightforward, you'll probably want to be familiar with both Pancake Swap, the MetaMask Wallet, TerraStation Wallet and the Anchor Protocol first.

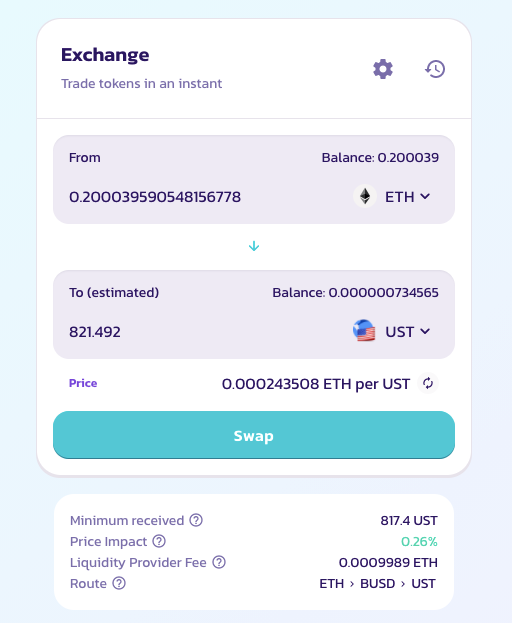

ONE: Swap your ETH for UST on Pancake

You'll need to swap your BSC ETH to UST first as you can't bridge BSC ETH on Terra Bridge (NB it has to be UST so you can then swap it back for bETH on Terra).....

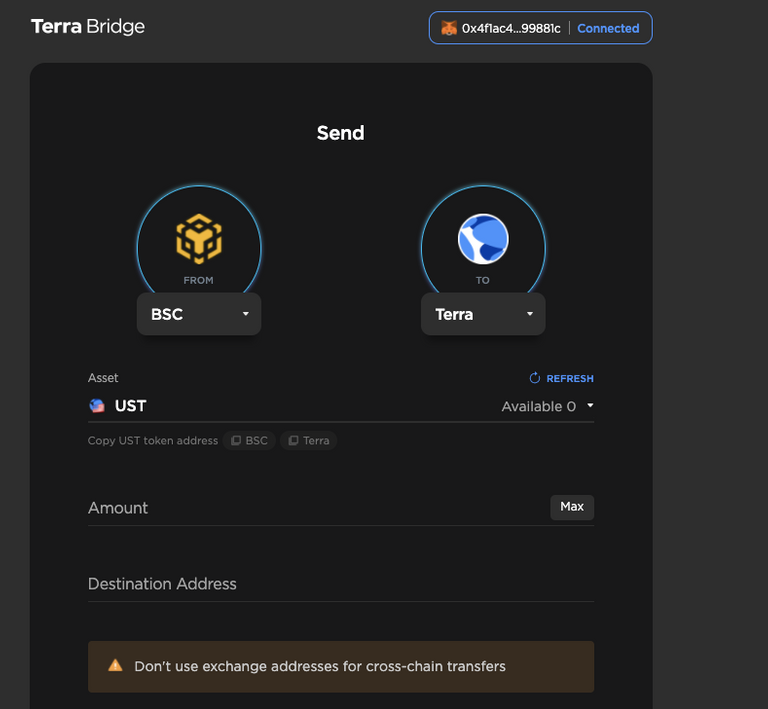

TWO: Transfer your UST from BSC to Terra

You can use Terrabridge to transfer the UST from BSC to your terrawallet (I use TerraStation, a browser wallet, which connects to Anchor and works no problem).

It should arrive within one minute.

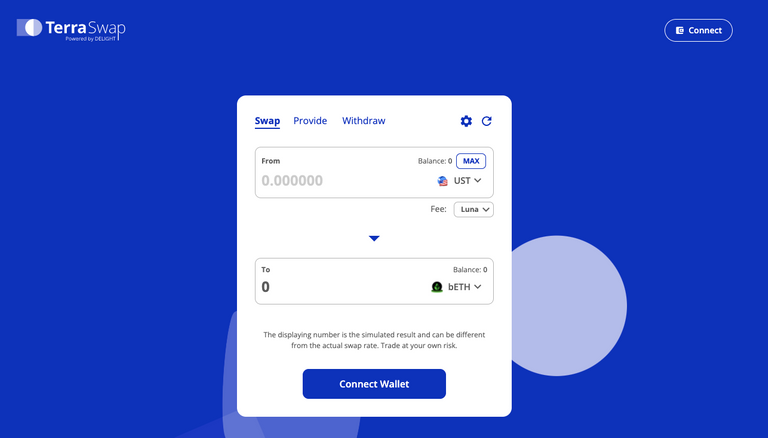

THREE: Swap your UST for bETH (on Terra)

You can do this with TerraSwap - and you're on the TERRA network now don't forget!

You should get back an equal amount, near enough, to what you had on BSC, the fees are minimal!

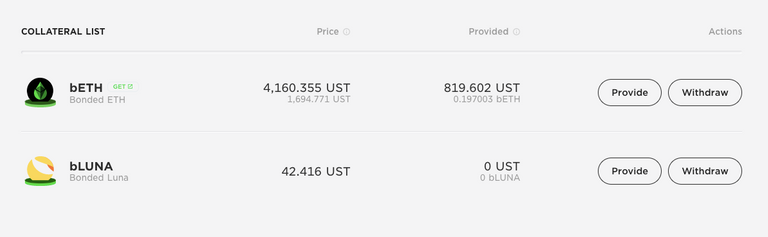

FOUR: Provide bETH as collateral

Go to the borrow page on Anchor and 'provide' bETH'

Or you can do this with Luna if you so choose!

FIVE: BORROW UST

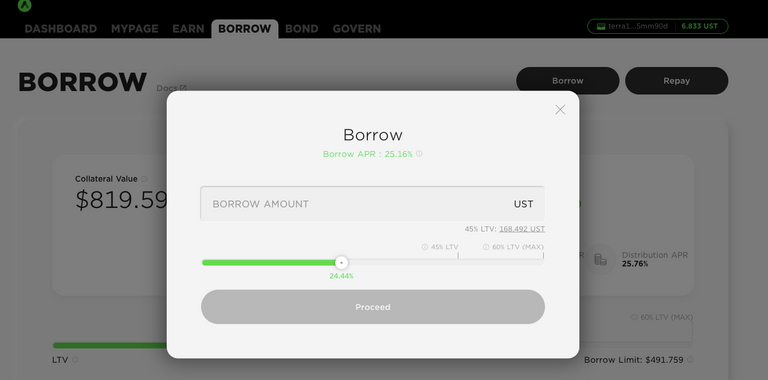

You can borrow up to 65% of the value of the bETH (or bLuna) that you've collateralised) although you're recommended to stick with 45%, note that I've gone even lower (I might up it!)

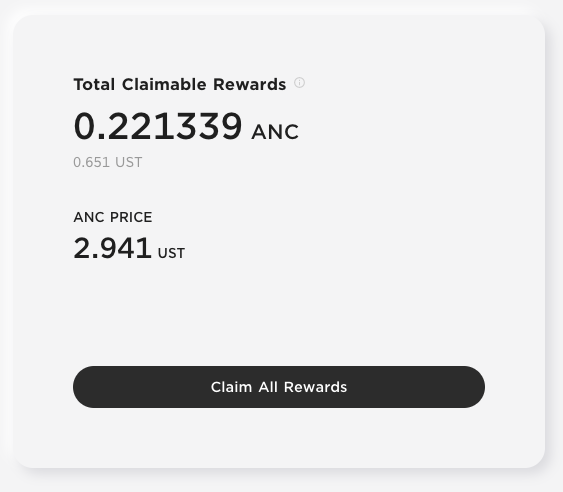

SIX: You earn ANC when you borrow UST - so don't forget to claim it

You have to click that BORROW button to start getting ANC dropped to you, YES it's odd, but Terra actually PAYS YOU in ANC to borrow UST....

ATW you only get slightly more in ANC than the APR on the loan, but it's still profit and that's BEFORE you put your UST or ANC to use.

You will need to claim your ANC, keep in mind the fees (around $0.25 a pop), so only claim when it's worth it depending on how much you've got staked!

NB the ANC will be dropping on UST borrowers for at least another year, so there's plenty of time to get in on this if you so desire.

SEVEN: What to do with your UST or ANC?

You have to get that UST and ANC working for you to maximise the yield on that collateralised bETH, the options are yours, you can:

- stake your UST on Anchor for a 20% return

- you could swap some for ANC and pool with UST for a 50%, or save this until you have some earned ANC to pool

- of course you can simply SWAP the UST for something else and venture to another chain in search of a higher return elsewhere!

Collateralising bETH on Terra to borrow UST to earn ANC, is it worth it>?

Hmmmm - it is quite complex, but I like Anchor, and I like the BIZARRE oddness of being PAID to borrow UST.....

Using ETH as collateral on Terra to borrow UST pays me more in ANC than the interest on the UST I borrow, AND I can stake that that UST to earn an additional 20% return.

However that additional 20% is only on the smaller amount I've borrowed, NOT on the full value of the ETH bonded! (I've gone with an initial 25% of the value to be REALLY SAFE), so I'm only actually earning around 5% on the ETH I've got staked, but I could easily up this, by borrowing more, or swapping for something a bit more adventurous than UST.

In addition to the above, I can also stake the ANC I earn or pool it with UST for a 6 and 50% return respectively.

To my mind this is a relatively risk free way of converting ETH to stables (UST) NOW without cashing out the ETH, and it's NOT on the ETH network, it's on Terra, so the fees are low low low!

Having said that I'm now wondering whether I shouldn't just swap half of my remaining ETH for BNB and pool it for a 30% return on Cub, or just swap it all for DEC, I'm not a fan of ETH TBH!

Posted Using LeoFinance Beta

Oh, this looks cool. I'm already thinking through borrowing UST, and then using it in an LP on Osmosis. Not that I have much ETH. Can other assets be used for collateral, I've never played with Anchor before?

Incentives just started, APR will drop no doubt as funds build in the pool, but...

Posted Using LeoFinance Beta

I'm very happy with the returns on Osmosis BTW so thanks for putting me onto that....

Me too, so thanks from me as well.^^

I'm getting a bit deeper in, it's been so good to me!

You can also use Bluna - there's only two - I do like the simplicity!

That pool hadn't escaped my attention either!

This reminds me of the buy, borrow die scheme that the rich do.

You never sell, you just borrow agaimst an appreciating asset. Thing is most of the crypto assets still have nice yields directly on them, so the borrowing seems not as an attractive atm. Might be more attractive going down the road.

Yes I could have just pooled the ETH with BNB for a similar return, but I wanted to try this out, I like Anchor too!

You make a good decision

I see that terra is a very promising project and it will have a good future, May be next Solana

I think I'm going to give anything new a miss, already feeling like I'm spreading myself a bit thin!

Got some ANC on Kucoin staked right now, so it is coming from Luna, ok. Mistery solved. !LUV !PIZZA

<><

@revisesociology, you've been given LUV from @mightyrocklee.

Check the LUV in your H-E wallet. (2/10)

PIZZA Holders sent $PIZZA tips in this post's comments:

@mightyrocklee(2/10) tipped @revisesociology (x1)

Learn more at https://hive.pizza.