THE BEAUTY OF DCA AND PROFIT BOOKING:

When it comes to the crypto market the pump and dump are the beauty of the market besides the fascinating blockchain world. You can call it boom and bust, bear and bull market, or whatever you name it but the important thing isn’t about the name. The crucial thing is how well we prepared for it and can we handle our emotions along the journey with proper mindsets. This article is all about the long-term players who have long-term goals. Few things may be applicable to the mid-term player so they should take this thing with a grain of salt.

- INVESTING= DCA

Don’t get overwhelmed by the name. You will learn everything, just stay tight till the end. The first term you should know is Dollar Cost Averaging or you can simply call it DCA. It refers to the process of dividing your fund into multiple parts and investing in the bear market at different levels. The main reason for doing this is it is pretty difficult for us to find the exact bottom. So, investing in every dip during the bear market helps to get the perfect entry and you will be buying when everyone would be panicking, which is really a plus point for you.

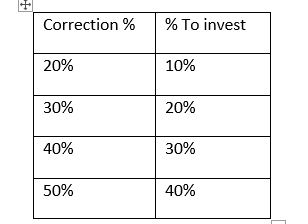

In exact number: If you have 100$ to invest and you use the DCA method for investing this would be like this. From the top, you can calculate the % decline and accordingly invest the amount you are willing to do as shown in the table below.

This is just an example; you can manage your style accordingly. The principle is that the more it dips the more you buy. And don’t invest all at once. This completely reduces your risk of missing the dip and buying at the peak. The average BUY price of your asset will be lowered continuously because of which you will be in a good position when the cold winter finishes.

- SELLING=PROFIT BOOKING:

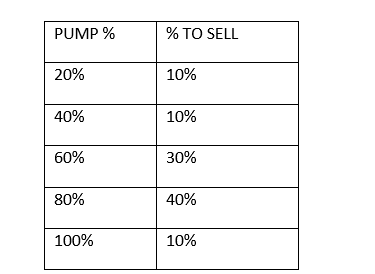

This is a reverse strategy to the DCA and is applicable during the bull market. At the time when everyone will be buying in FOMO, you will be enjoying the ride and selling your profit at different levels. It will be really happier, stress-free, and wise Bull Journey for you. The strategy should be to sell more % of your asset if it pumps more. You can look at the table for an example:

In the bull market, BTC alone may pump more than 100% so make your mind-makeup accordingly and try to return the amount you have invested as fast as possible. And let your profit ride the journey and book your profit at different levels.

DISCLAIMER:

This article is only for educational purposes. Please don't make any reference to this article. Use your own brain for your own money.

Posted Using LeoFinance Beta

Congratulations @ridam! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 50 comments.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

This is something I'd like to try, a very healthy process to accumulate a robust portfolio at the end of the day after the dip.

Posted Using LeoFinance Beta

Yes and it also helps to stay calm because we see when everyone is buying and we buy when everyone is selling

Posted Using LeoFinance Beta