We all know that the Bitcoin that was supposed to go to the 20K$ last time, goes to the 52K$ instead.

And the Bitcoin that was supposed to go to cross the 62K$ ATH this week, plummet and is now trading at around the 42K$.

WHY THIS THING HAPPENS? WHY I ALWAYS open a long position and Bitcoin starts getting down and whenever I open a short position Bitcoin starts moving upwards.

Is this happening to me only? or Everyone faces the same problem?

Yes, a lot of questions and a lot of vague statements. I will try to explain every one of them and how to be safe from each of them in this article. Be sure to read the all articles and stay ahead of the crowd.

We should begin with what happens to Bitcoin This week?

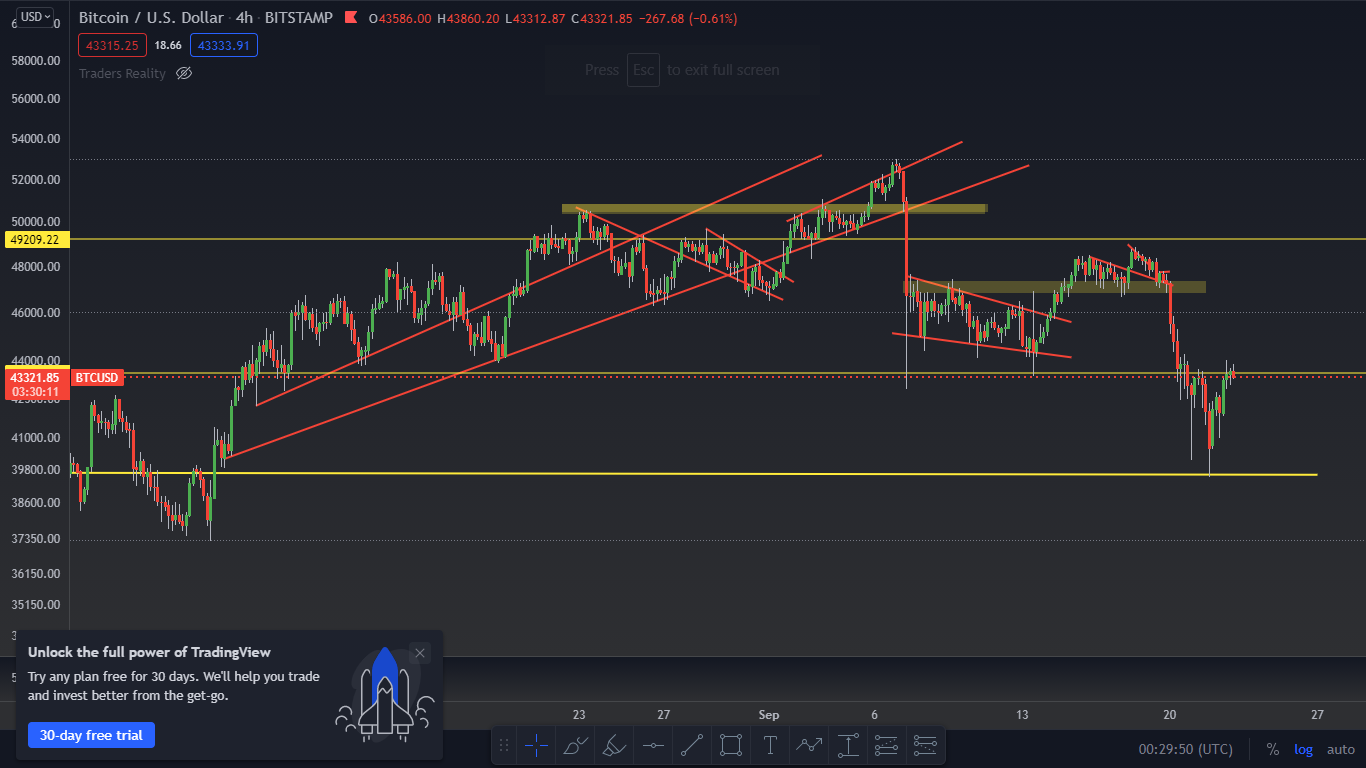

On September 07, the BItcoin sees a small dump and the price has touched the 42K$. The move was so quick that the wick only appears on the chart and even couldn't get the advantage of that crash. I will explain how to get the advantage of such a crash in the latter portion.

After that, we have headed to the ATH again and the longs were building up and again we came below the 39K $ mark, and as you can see Bitcoin is trading at the 42K $ mark right now.

But this is teething that every one of you knows.

WHAT ARE THE IMPORTANT LEVELS TO LOOK FOR THE BITCOIN RIGHT NOW?

The Resistance that is acting seriously right now is the one of between 43K $ and 44K $. I am keeping the difference of 1K $ in the resistance because a wick appears and if the candles don't get closed above the resistance, it is just the game of the exchanges to liquidate the shorts and then they create the FOMO of price going up, and move the price down. Basically, the theory is liquidation, they will liquidate you whatever your position is if you follow the retail investor's strategy.

THE GAME OF LIQUIDATION:

The whole trading ecosystem is based on the game of liquidation and it is the only way for the big traders and whales to make the money.

Imagine the scenario:

I am not that good at the paint but I try my best to explain the scenario. In every market, this thing happens either it is Crypto, Forex, or Stocks. Market Makers have the capital of the Billions and they don't do Leverage as their capital is so high they don't need to leverage their capitals. They can stand in the loss for a long time without being liquidated because their accounts count- on Billions.

- While the price is rising= Market Makers Opens Shorts. For their shorts to be filled, there must be the opposite contract opens with opposite positions. So, the game of FOMO comes in and retail investors become their liquidity.

You aren't buying anything, you are filling their liquidity.

- The same thing gets reversed when the price is in decline and they play with the FUD. Now you should have got why the big media praise the crypto during the Bull Market and fade away or criticize during the cold winter.

This is the pattern of the market movement and it plays on the basics of the emotional and psychological concepts. NO matter what other says, the emotions of the person towards money don't changes so the history keeps repeating and because of the same reason:

Summer follows Winter.

HOW TO BE SAFE FROM SUCH ACTION?

- Don't be a moon boy. I mean stop using more than 5X. I repeat don't use more than 5X.

- Don't fall for the FOMO or FUD. Bitcoin will not go to 100K tomorrow and Bitcoin won't go to the 4K$ the next day. Price recovers after the crash and always bounces from the support line either it is of EMA or a normal one.

- You will get the chance, you aren't missing the ride. Hold on.

If you keep these things in mind, you can exploit the market makers' method and you can make good money playing with them. Don't try to play against them. Play with them.

HOW TO EXPLOIT?

Look in the first wick, the price didn't touch the support line, if you have hurried at that time you would have longed for sure. But if you wait for the perfect setup yes it touched and in a 4hour time frame that would have been the perfect swing for you.

Follow the simple method of doing the same thing in the green letters as you see in the picture of the paint above. How you can do this is by following the method of the DCA and Profit Booking which I have discussed in the past article. You can find the link to the article here: DCA AND PROFIT BOOKING EXPLAINED IN EASY WAY|| BEST WAY TO BUY IN BEAR AND SELL IN BULL

Try to grab the dump as the opportunity and keep the coins that recover the fast or your long-term bags.

NEVER INVEST 100% of your portfolio. If you are going to invest 100$, then don't invest that at once. Try to divide it into different parts and buy accordingly.

DISCLAIMER:

This article is only for educational purposes. Please don't make any reference to this article. Use your own brain for your own money.

PS:

No matter how best you explain, I am going to buy the top sell the Bottom. XD.

Thanks for reading.

@ridam

Posted Using LeoFinance Beta