In this article, I will discuss some of the key comparisons between Hive Blockchain and Ethreum Blockchain. To make the comparison fair, I will not talk about the price of Hive is mooning when the crypto market is facing a major crash and Ethereum is down by nearly 8% this week. I will also not compare the Market Cap of these two blockchains. Basically, the comparison will be all about the Blockchain and the features these two crypto projects provided. Honestly, The more I am studying Hive and its ecosystem the more I am becoming a fan of it.

THE REASON FOR THIS POST IS TO INFORM ABOUT THE FEATURES OF ETHEREUM AND HIVE BLOCKCHAIN NOT TO TELL ONE IS BETTER THAN ANOTHER.

DISCLAIMER:

The main motive of this comparison of this post isn't to say one is a bad one is good. I Hold both of them and love both of them. All information presented is from the whitepaper of both projects and isn't my personal view. The Whitepaper link is presented at the end of the post.

DECENTRALIZATION:

The main moto of the cryptocurrency and Blockchain-based projects is decentralization and I am presenting decentralization as the major point to be considered here in the comparison.

- The consensus model used by Hive Blockchain is DPOS which is delegated Proof of Stake whereas the model used by Etheruem after the London Hard Fork is Proof of Stake.

- Block Producers in Hive are referred to as witnesses whereas in Etheruem they are produced by the Validator.

- For proposal and a hard fork, Etheruem has EIP(Etheruem Improvement Proposals) whereas HIVE has Protocol changes.

DAAPS AND DE- ECOSYSTEM:

Both of the Blockchain supports the decentralized ecosystem and both have many much-decentralized applications. Decentralized applications are those applications that are built upon another Blockchain network and work upon them in which the transactions are recorded into the base Blockchain layer.

- In number, Etheruem has more than 3000 Dapps and I am sure the number is more than that. Talking about Hive, it has more than 136+ Dapps they are called Web3 applications in Hive Blockchain.

- I would also like to add Axie Infinity and Splinterland here. These are the games quite Popular in their own Blockchain. Axie Infinity in Ethereum whereas Splinterland in HIVE Blockchain.

TRANSACTION FEE AND TRANSACTION PER SECOND:

The transaction fee in Etherum and Hive is completely different because Etheruem uses the base fee and tip fee model whereas Hive Blockchain uses the Resource credit model.

- In Ethereum, the transaction fee varies from 10 $ - for ETH transactions to, 60$ for swap and exchanges, and 30$ for stable coins transactions. (ETH gas fee is volatile so these data are from the time of writing this article. SO, if you are reading this after 1 year please don't consider these data.)

- Whereas, the transaction fee on HIVE Blockchain is nearly equal to 0. This is because for transactions unlike ethereum in a hive you need to pay in Resource credit and Resource credit is automatically generated every day to your wallet according to the amount of Hive Power your account hold.

- Transaction time in HIVE Blockchain ranges from 1-3s whereas in Etherum it ranges from 15 seconds to 10 minutes according to the amount you for your fee. The more you pay the faster your transaction will get verified on Eth Blockchain.

INFLATION :

More than the price and MarketCap of the coin, I prefer to look for the inflation in any coin because it shows how much new coins are coming to the market and the effect they will have on the price of any asset class.

Hive has adjusted Inflation where the inflation after the 250K block is reduced by 0.01% making it a total of 0.5% per year until it reaches up to the 0.95%.

Whereas Ethereum on other hand has a slightly different approach. In Ethereum the max Ethereum that can be generated per year is 18Millions. It is in the genesis block and after the genesis block, this number gets decreased by every year. I have made a detailed article on this topic on platform named Crypto talk forum, if you are interested you can look at it HERE: What is Ethereum Max Supply? (Described)

The important thing to look at here is the: Ethereum burning fee which means for every transaction there will be the base fee that will be burned and the inflation will decrease faster than calculated in coming years because of this. Recently, a few days ago it was reported that ETHEREUM has become deflationary for the first time.

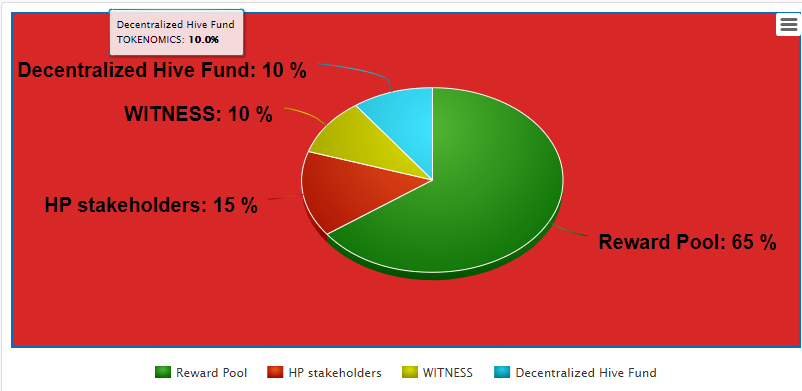

INFLATION TOKENOMICS:

Tokenomics refers to the number of tokens divided among the holders. Usually, during the launch of the project, it is looked at but inflation tokenomics refers to the distribution of new tokens into the market.

- This is the Hive token Inflation tokenomics. You can look at how the new number of tokens are divided and distributed into the network.

-For ethereum, the inflation is distributed to the stakeholders of ETH 2.0 staked and to the Validators. I didn't found the exact number for this so if anyone has an idea. Let me know in the comments I will update it here.

OVERVIEW:

Both of the Blockchain is doing really well in their place and are offering the best to the users. The best part of both of these blockchains is that both of them are innovative and development is going on both. I think project whose teams are dedicated and has real use-cases should rank higher in the market cap also and I am sure sooner or later it will happen. Because shit coins won't survive the Bear Market.

If you stayed till now. Thanks for reading.

Information Source:

ETHEREUM WHITEPAPER: ETH WHITEPAPER

HIVE WHITEPAPER: HIVE WHITEPAPER

@ridam

Posted Using LeoFinance Beta

Pulling out the decentralization card never gets old, I wonder if Ethereum will ever achieve that level of growth where this card won’t be as effective anymore. But at that stage, If at all..,hive will have also achieved some level of success in number of dapps and community like Ethereum, so it is one thing to say that Ethereum sacrificed decentralization for usability in the beginning, whereas Hive sacrificed usability for decentralization, albeit in their both beginnings. One thing that makes Ethereums centralization a double edge sword is due to the presale that largely belongs to Vitalik and Ethereum Foundation.

Posted Using LeoFinance Beta

When it comes to decentralization, the only competitor for the Eth is Cardano, and other than that I haven't seen any of the ETH killer projects being anywhere near to the Eth Blockchain. But what is the benefit of that if it is the network is available only to the limited people who can afford 100$ per transaction?

Posted Using LeoFinance Beta

Wow, that will be great I will look for that for sure. I am excited for HIVE on BSC mostly because I used the BSC chain most of the time.