US Securities and Exchange Commission

has recently announced the notification regarding the lending features is the Coinbase. This is just the Well Notice which basically means the SEC is going to Sue Coinbase for the lending feature they have on their platform. This is really big for the overall crypto market because the same law will be applied to all other financial services available in the crypto market.

I will try to explain exactly what is going in the best easy way here so please read it fully. Just to let you know, this will be the regulatory sue and will take a long long time to be dealt with. It is a matter of fact to be known as fast as you can but you don't need to panic and convert your USDC to USDT. That is the stupid thing don't do that.

WHAT COINBASE IS OFFERING?

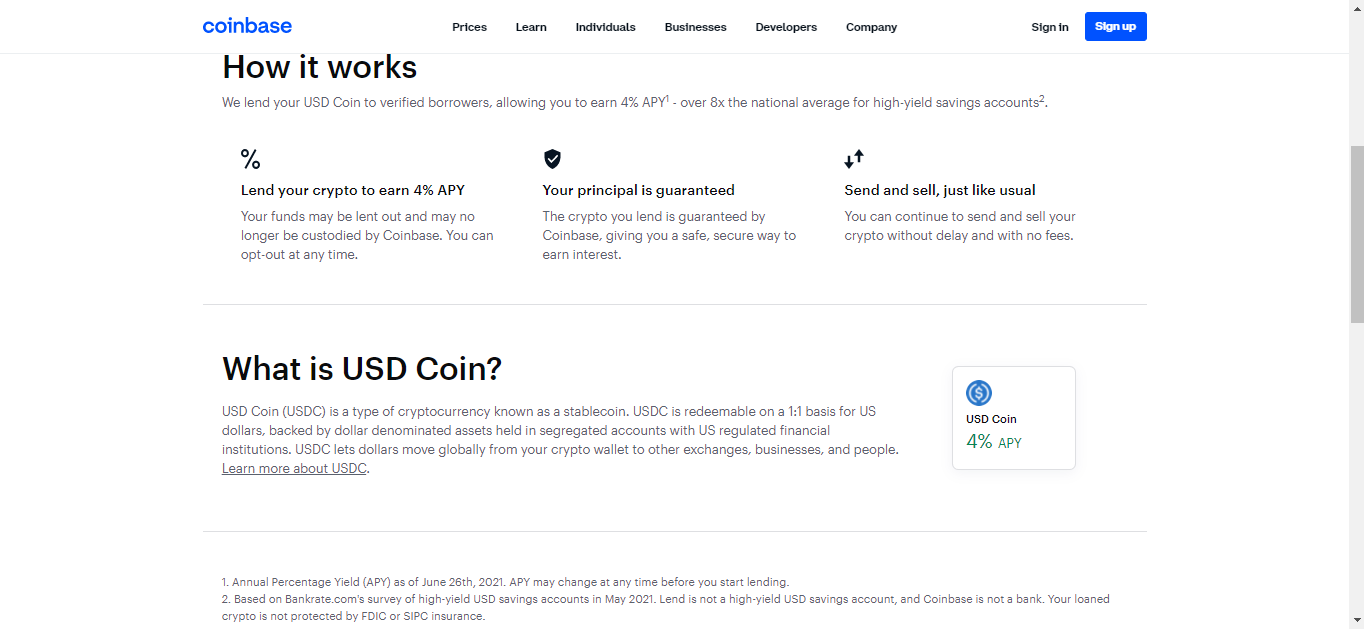

Coinbase has a feature called COINBASE LEND on which you basically lend your cryptocurrency more importantly your stable coins and you can earn passive interest on your stablecoins without doing anything. Some of you may find the interest rate to be really low, but it is loved by most people, and Coinbase Lending is one of the most successful in the crypto industry. We know about USDC and USDT and USDC are being used here and Coinbase is now a public company so those who don't like risks and like more interest than what is offering right now become the best option to go for.

AND HOW DOES COINBASE MAKE THE PROFIT AND PAY FOR YOU?

Coinbase has a lending platform that basically lends money from the user and the same blended USDC is borrowed by the Coinbase Client at a much higher interest rate. The margin between the interest rate becomes the profit for the coinbase.

In simpler words, Coinbase is doing what banks do use Stablecoins and by keeping less profit to themself than the banks do.

SO WHAT IS SEC SAYING?

Accordingly, SEC is calling this property of the coinbase as the Security and for that thing, the banks are allowed because they are highly regulated but crypto doesn't. And the problem starts from here. For Coinbase to provide the same services the regulation should be the same level as of the banks and coinbase isn't offering such strict regulations right now. Just like you have seen in the information in the tweet fromCOINBASE OFFICIAL TWITTER ACCOUNT.

The reason why hasn't been answered by SEC according to the tweet from Eric Voorhes and Brian Armstrong's tweets and retweets about the issue. The direct link is here: HERE

HOW WILL THIS AFFECT TO THE CRPTO INDUSTRY?

According to the SEC, if the lending feature is considered a Security then only banks will be allowed to do that. Coinbase isn't Bank so it can't do that. Also, other platforms that do provide such service will need to follow the same rule which applied to Coinbase. It will result in the passive income being allowed only through the custodial services and limited to the banks only.

HERE COMES THE DEFI:

If the service Coinbase is offering is security then all the DE-FI staking platforms which also technically provide passive interest will come to the same radar and will face the actions. But it is a matter of question, who they will sue? The founders of most DE-FI Platforms are known with their Nickname and their identity is hidden. It will be a fun journey.

So, What is your view about this topic? Do you think Coinbase service is security and shouldn't be allowed OR should be?

SOURCE:

Coinbase Blog: COINBASE

Once Again, Thanks for reading

@ridam

Posted Using LeoFinance Beta

Congratulations @ridam! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 2000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz: