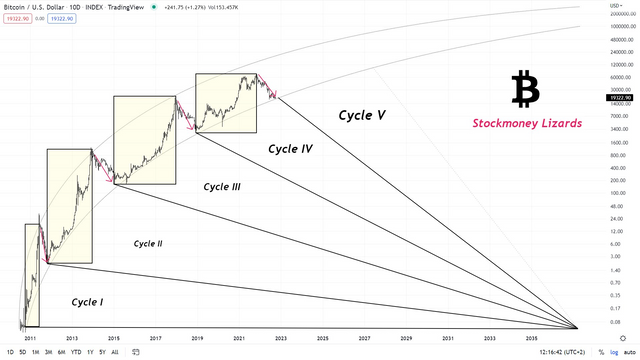

Wandering around on Twitter, I found this very interesting chart.

We have arrived at a crucial point, Bitcoin's fifth cycle, and the question arises: will Bitcoin be able to continue the trajectory it has arduously built over the years between volatility, bullish trends and bearish ones?

Yes, I know it would take a crystal ball!!

But Bitcoin always shows its potential in the long term.

We should keep in mind that with the next halving in 2024, the rewards for miners will decrease from 6.25 BTC in 2020, to 3.125 BTC per mined block, and will continue to decrease until the limit of 21 million Bitcoins is reached.

Why should we be interested in Bitcoin's imminent halving?

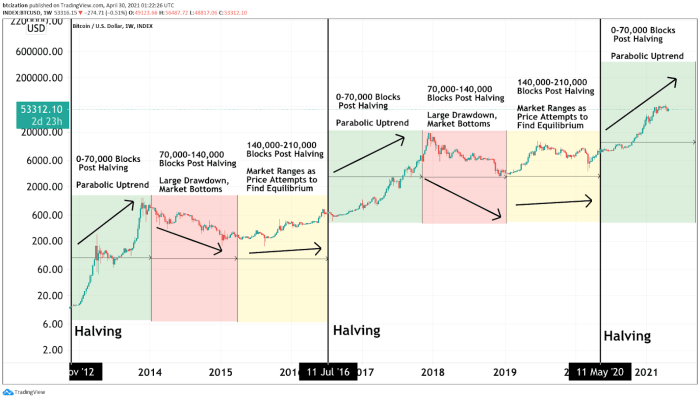

Usually after every halving, Bitcoin starts its upward race.

For example, within a year of halving in 2016, Bitcoin went from $665 to $2,250 and, analysing all cycles, it seems that Bitcoin follows a pattern.

Out of curiosity, I looked for some more information on the various halving and found this chart of bitcoinmagazine that explains Bitcoin's various cycles and halving in detail.

At each cycle of Bitcoin's halving, the supply of new Bitcoin gradually decreases and this leads to an increase in its price, as happens with anything to do with the law of supply and demand.

The only problem may be the boredom of waiting, although it is not long now, as I suspect Bitcoin may continue with its wearisome sideways trend.

In the meantime, everyone will make their own choices, I continue to set aside small amounts of BTC according to my financial possibilities, because the first rule always remains not to invest more than you can afford to lose.

But if you continue in small steps, sooner or later you will reach your goal.

I hope I have provided useful information, thank you for reading my post.

Posted Using LeoFinance Beta