When you think about Cryptocurrencies, one name immediately comes to mind, Bitcoin. Bitcoin is the largest cryptocurrency with the largest total market capitalization. Since the creation of Bitcoin, there has only ever been one cryptocurrency at the top of the market cap rankings…Bitcoin.

Since the inception of Bitcoin, bitcoin's market cap has added about $80 million in market cap each day.

When the price of Bitcoin rises, generally you can expect altcoin and other digital currency prices to rise with it. Likewise, in a bear market, when the Bitcoin price drops, altcoins also follow. And sometimes when Bitcoin is rising, the altcoins are declining due to cash moving from the altcoin market to Bitcoin and vice versa.

Bitcoin dominance or btc dominance is used to measure the percentage of the cryptocurrency market that can be attributed to Bitcoin. Another way to look at bitcoin dominance is its bitcoin's market capitalization vs. the total cryptocurrency market capitalization or the overall cryptocurrency market. Bitcoin's dominance is tied to the perceived scarcity of bitcoin due to the bitcoin halving that takes place every four years.

Thus, it’s very easy to determine the relative strength of Bitcoin at any point. Not the case for the altcoins…until now. I have taken the more popular altcoins and determined their relative strength, relative to Bitcoin using just moving average. Whether you are a crypto investors, cryptocurrency trader, retail investor, institutional investor, I hope this post adds value to your trading and investment goals.

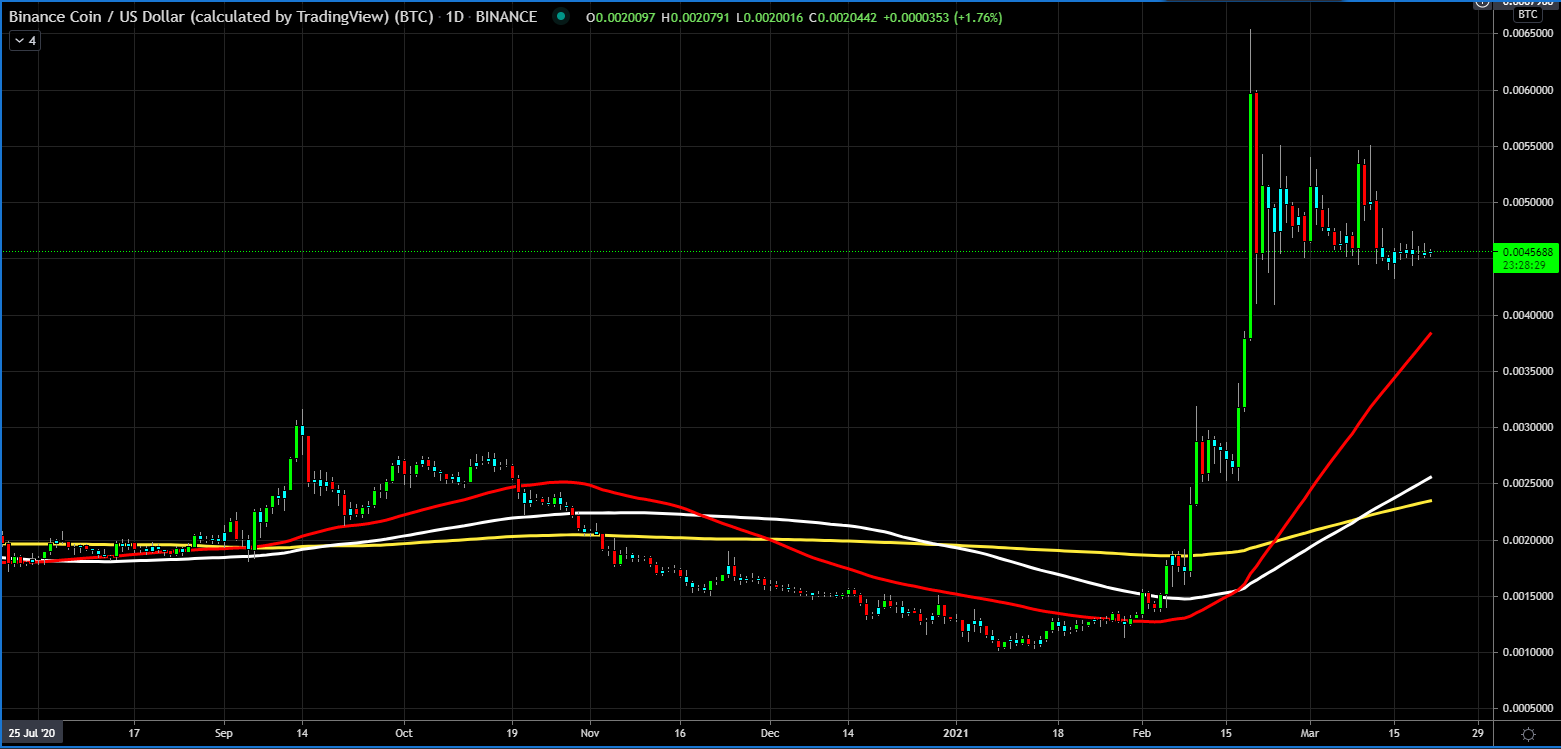

Binance

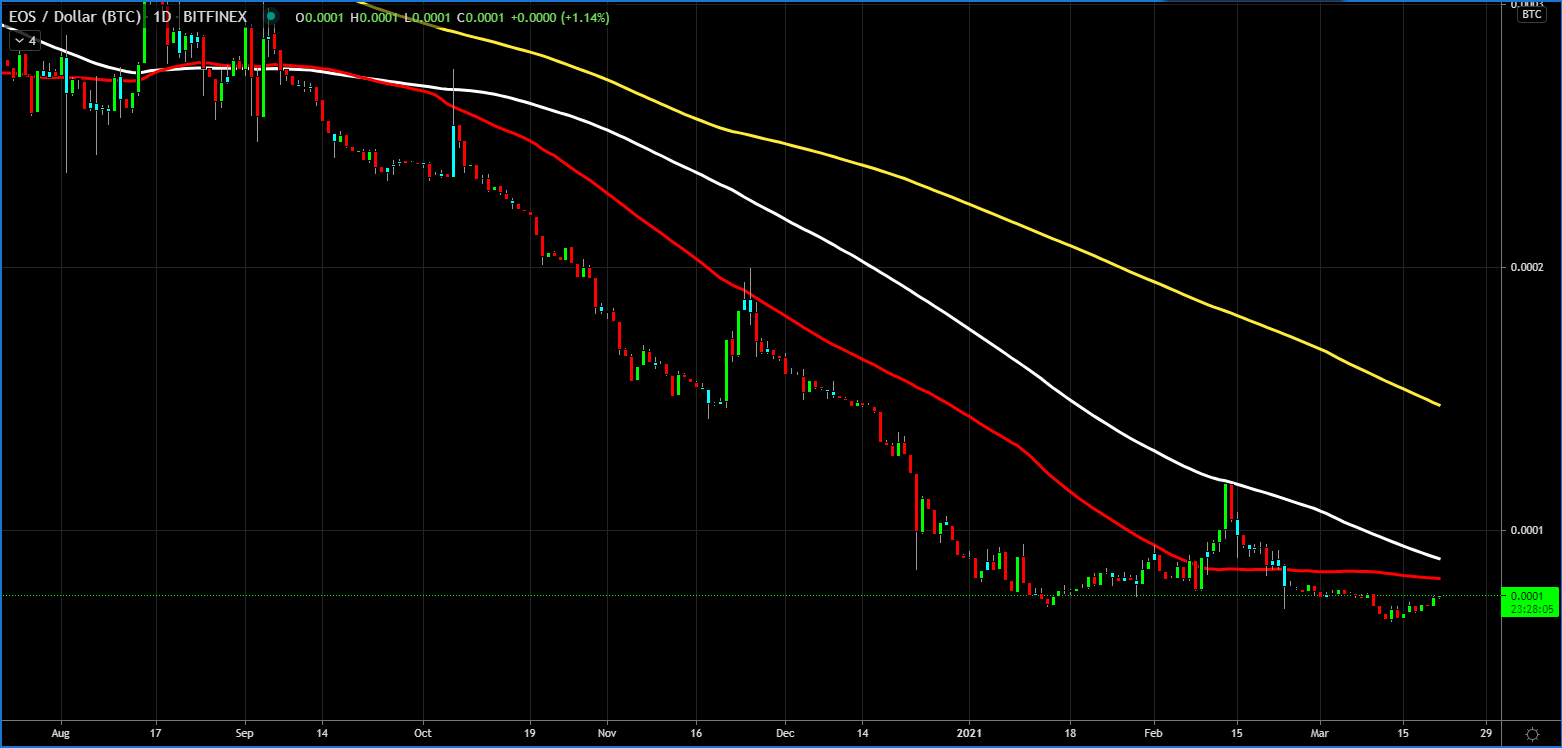

EOS

Ethereum

Litecoin

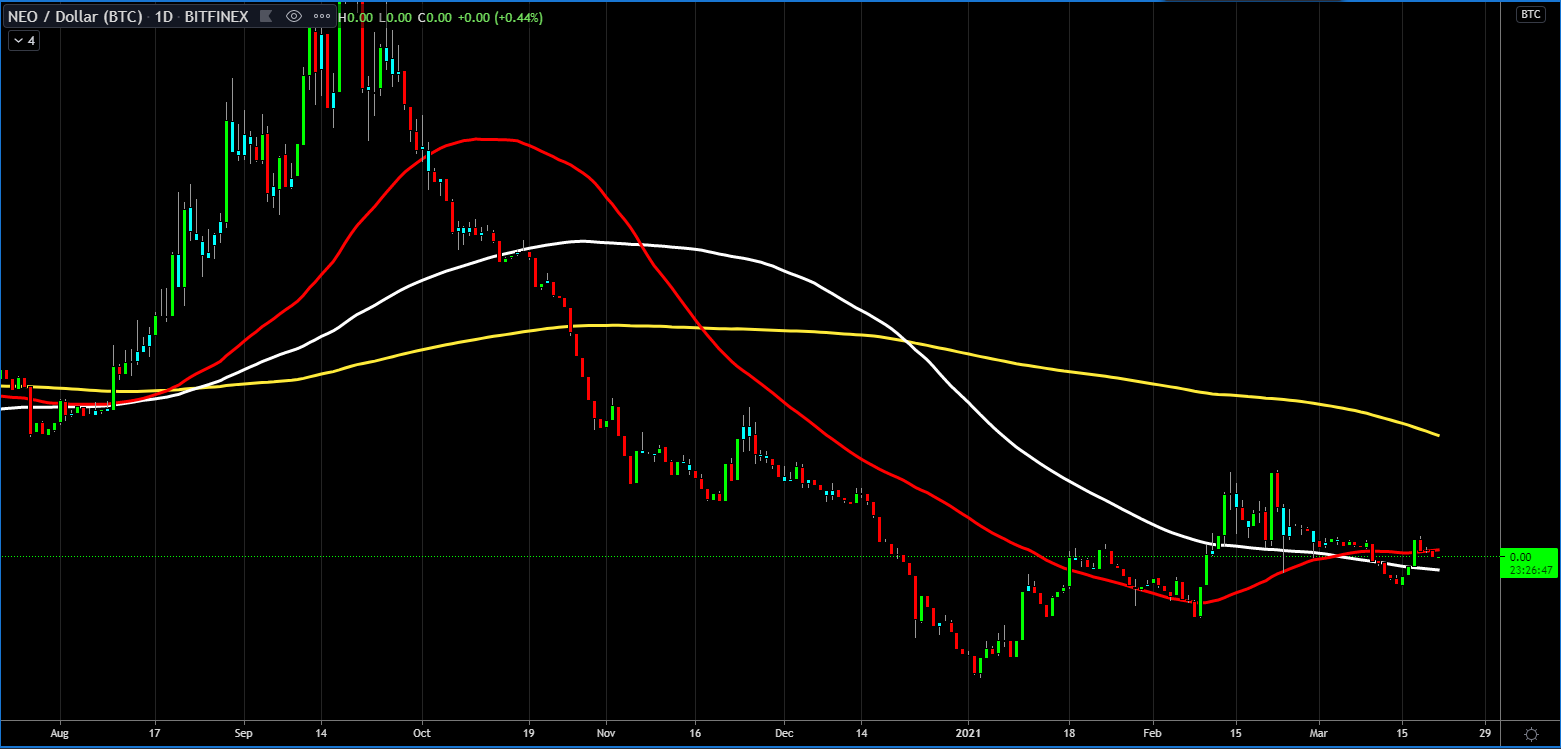

Neo

Steem

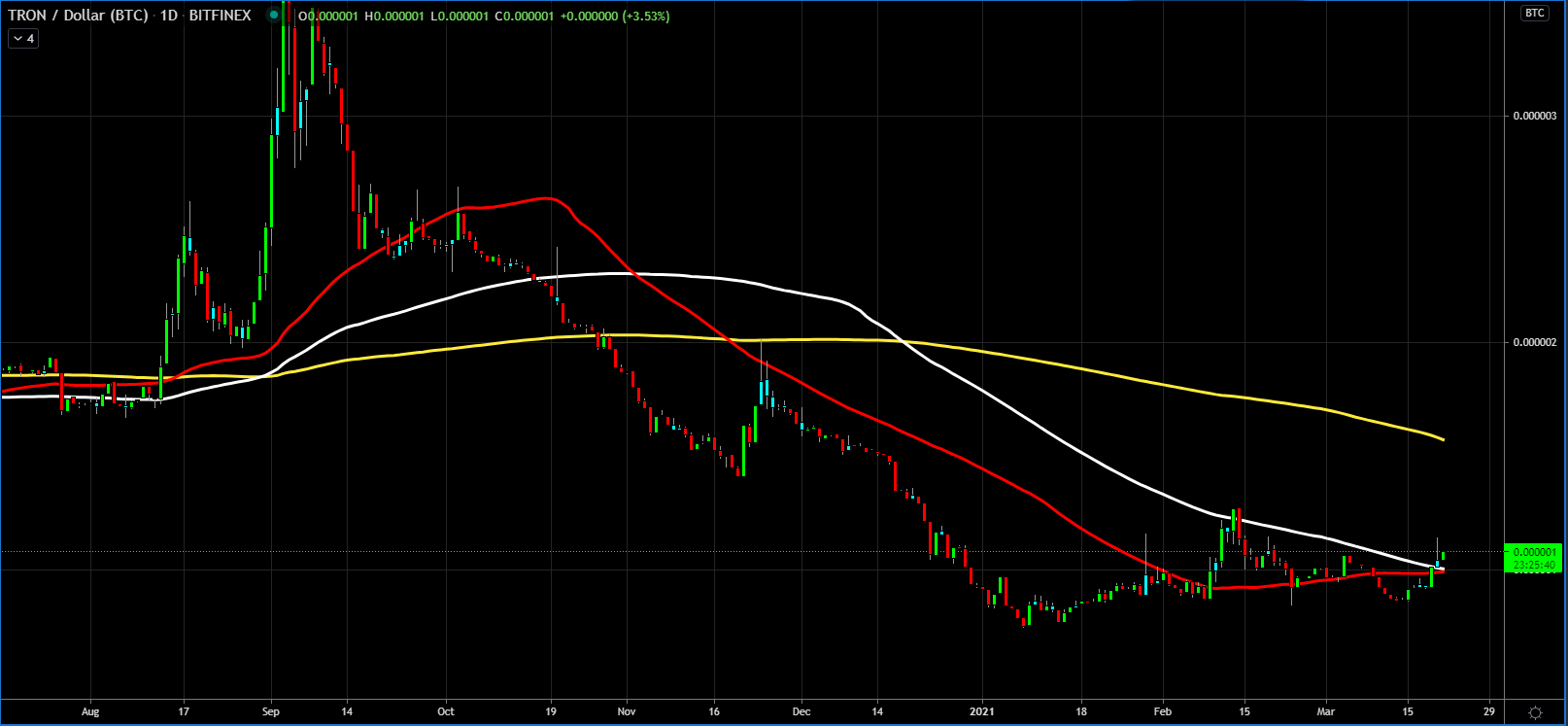

Tron

Zcash

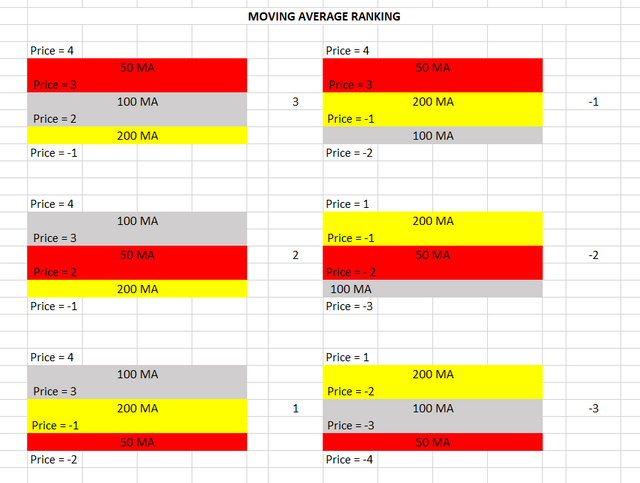

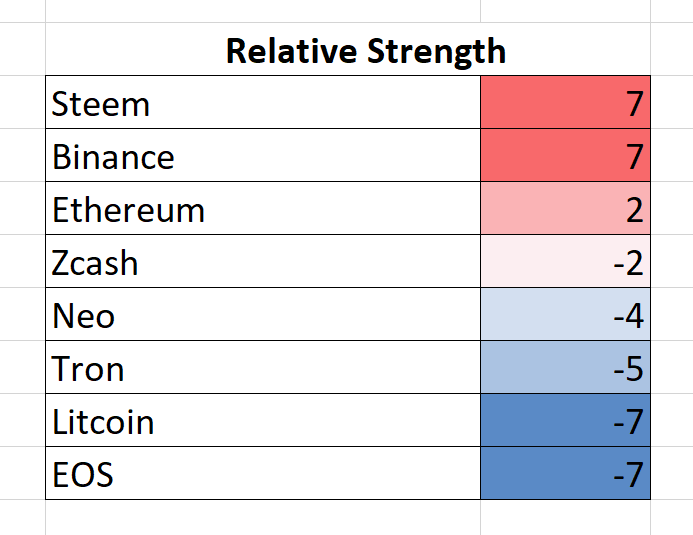

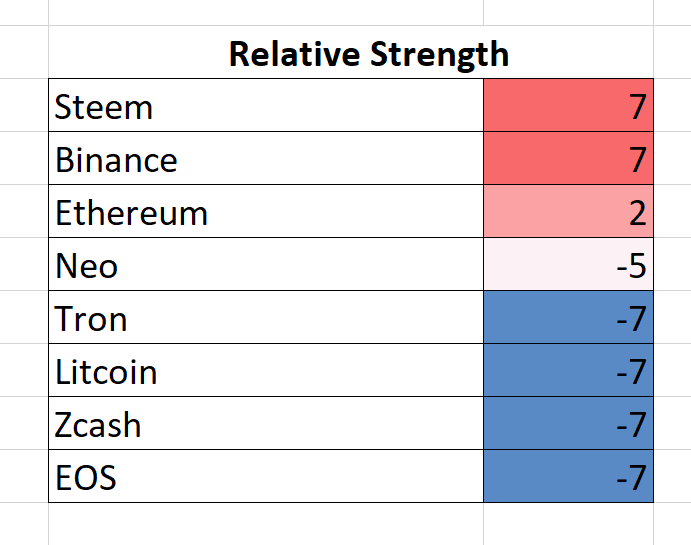

Based on the moving averages and the last daily closing price, relative to the moving averages,

the altcoins relative strength, relative to Bitcoin are the following:

Two Weeks Ago

LeoFinance is a blockchain-based social media community for Crypto & Finance content creators. Our tokenized app allows users and creators to engage and share content on the blockchain while earning cryptocurrency rewards.

| Track Hive Data | New Interface! | About Us |

|---|---|---|

| Hivestats | LeoFinance Beta | Learn More |

|  |  |

| Trade Hive Tokens | Hive Witness | |

|---|---|---|

| LeoDex | @financeleo | Vote |

|  |  |

Posted Using LeoFinance Beta

@rollandthomas it definitely adds value to my trading because your analysis gives me a good information about the crypto market and things i should be expect when trading on the market....

Posted Using LeoFinance Beta

Awesome to hear :)

Posted Using LeoFinance Beta

It's amazing how bitcoin has increased in value since it came to light in 2011. I remember the bull rally a few years ago when BTC hit $20K, most altcoins were dragged up by it and reaching record highs. People who invested early made a lot of money, just as there were others who entered very late and lost a lot of money.

This new BTC explosion to 61K has mostly dragged Ethereum alone with it. Many analysts predict that this year btc will close between 100K and 300K. At the end of the day these are speculations, we will see if they are right or not.

Best regards! 👋

Posted Using LeoFinance Beta

it would be interesting to see bitcoin price reach the $100000,that would make alot of people become richer this year..lol

Posted Using LeoFinance Beta

I think Btc hits at least $100k because of all the institution scrambling to enter the space. I also think Eth is way undervalued and a steal at these prices.

Posted Using LeoFinance Beta

We agree my friend!

@rollandthomas tron holders should just keep holding the tron because the bullish run will continue on the market and they will be able to make profit when the price increases in value....

Posted Using LeoFinance Beta

I don't follow Tron much except when I do this analysis. However, they have a great marketer in Justin so anything is possible.

Posted Using LeoFinance Beta

Your analysis is always valuable and your content brings value to our community.

Thanks @shortsegments...that means a lot coming from you :)

Posted Using LeoFinance Beta