Some of the world's currencies are accepted for most international transactions. The most popular currencies are accepted for most international transactions are the U.S. dollar, the euro, and the yen. However, the U.S. dollar is the most popular.

And in the foreign exchange market 90% of forex trading involves the U.S. dollar. Thus, when assessing the relative strength of the most popular currencies in the world, it’s always against the U.S. dollar, using the dailytime frame chart.

The “major” forex currency pairs are the major countries that are paired with the U.S. dollar (the nicknames of the majors are in parenthesis).

AUD/USD – Australia dollar (Aussie) vs. the U.S. dollar

EUR/USD – Euro vs. the U.S. dollar

GBP/USD – British pound (Sterling or Cable) vs. the U.S. dollar

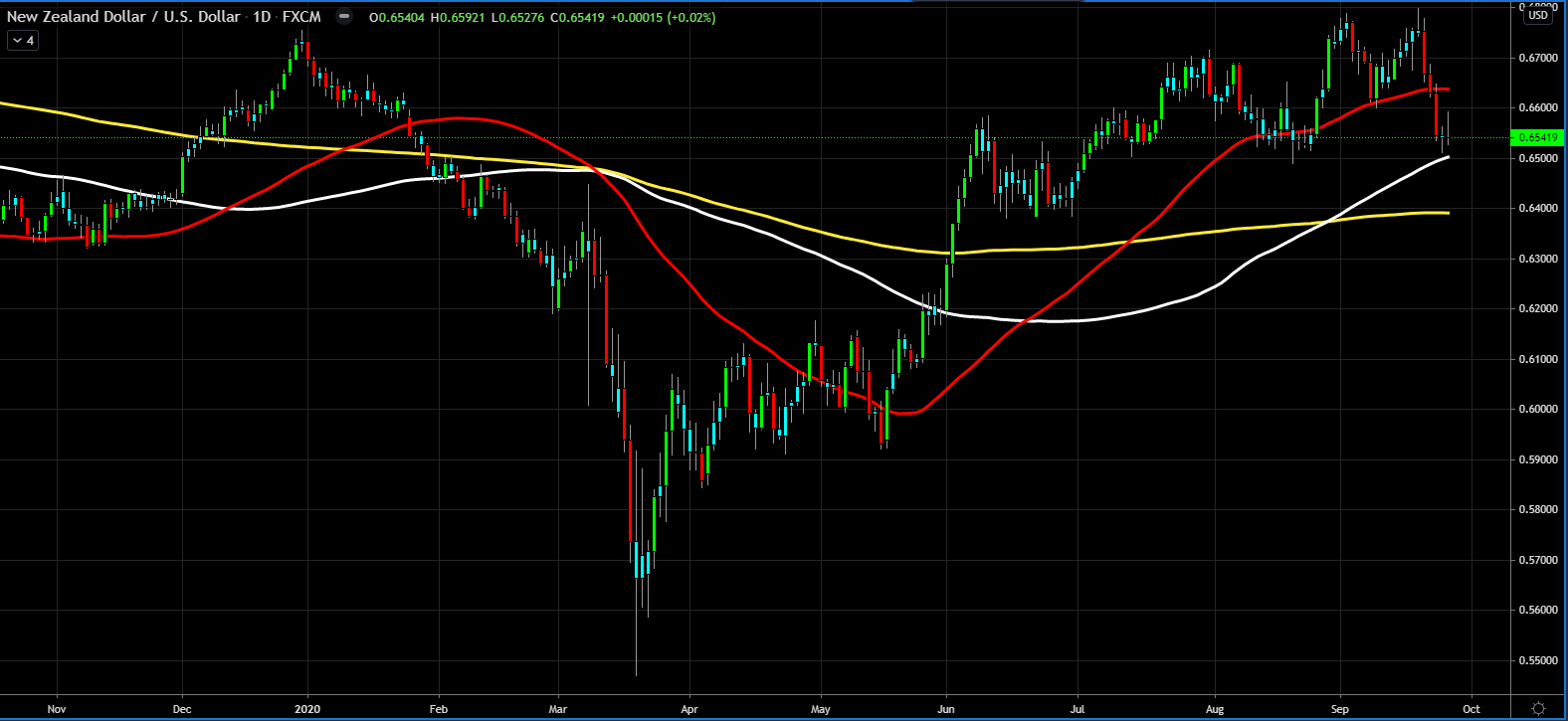

NZD/USD – New Zealand dollar (Kiwi) vs. the U.S. dollar

USD/CAD – U.S. dollar vs. the Canadian dollar (Loonie)

USD/CHF – U.S. dollar vs. the Swiss franc (Swissie)

USD/JPY – U.S. dollar vs. the Japanese yen (the Yen)

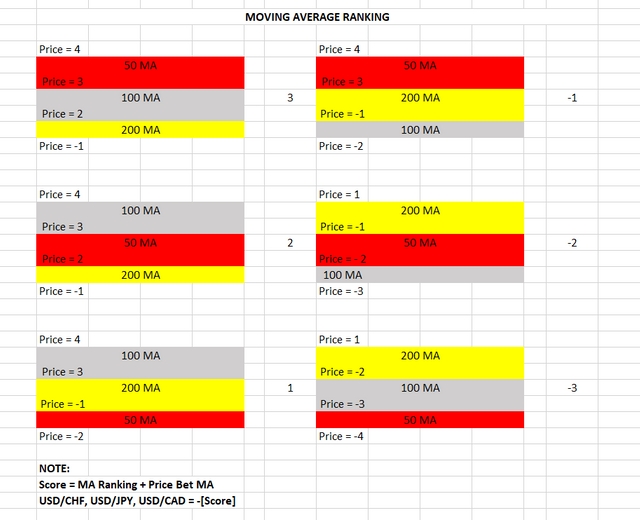

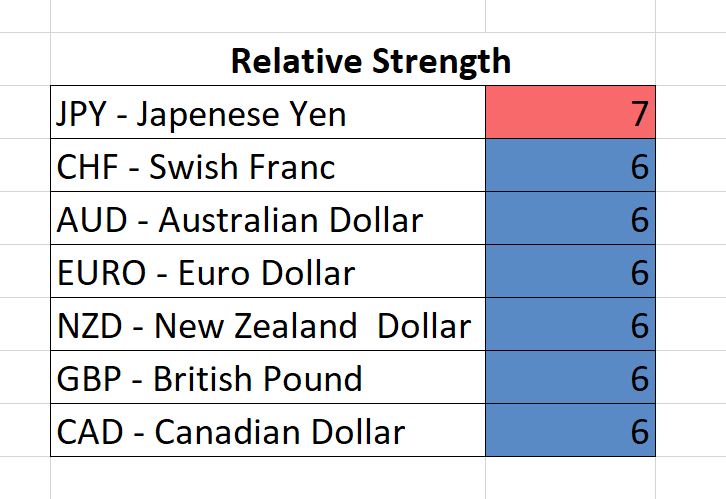

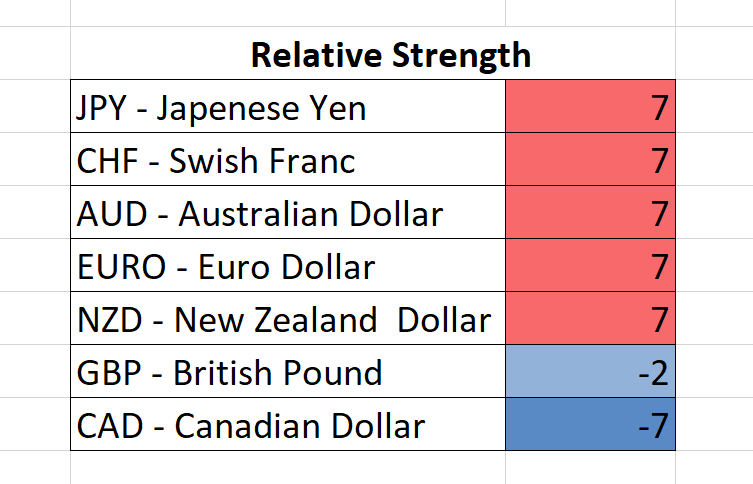

Based on the moving averages and the last daily closing price, relative to the moving averages,

the currency relative strength relative to the US dollar is the following:

Two Weeks Ago

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

Posted Using LeoFinance

Posted Using LeoFinance Beta

This is great @rollandthomas, it's a way to manually measure the relative strength of an asset using the EMAS closing price of 200,100 and 50?

Thanks @lenonmc21. Yes, it's something I started over a year ago and helps me stay abreast of what's going on.

Posted Using LeoFinance Beta

Great, does it help you define more or less what trend or reversal the asset might have?