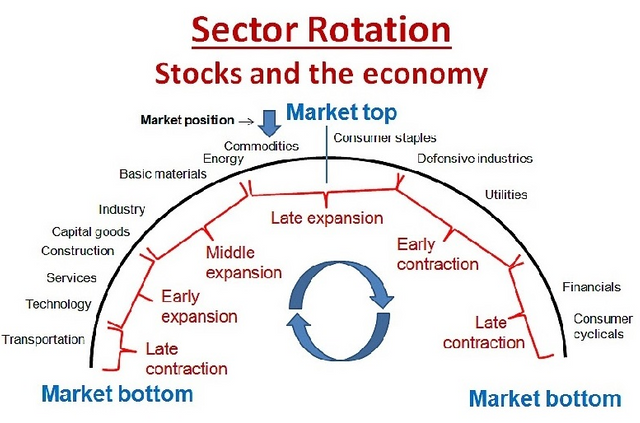

Sector rotation is the action of shifting investment assets from one sector to another to take advantage of cyclical trends in the overall economy in an attempt to beat the market. Sector rotation seeks to capitalize on the theory that not all sectors of the economy perform well at the same time because sectors of the stock market perform differently during the phases of the economic and market cycle.

For example, defensive sectors such as consumer staples, utility and health care stocks tend to outperform during a recessionary phase, while consumer discretionary and tech stocks tend to fare well during early expansions.

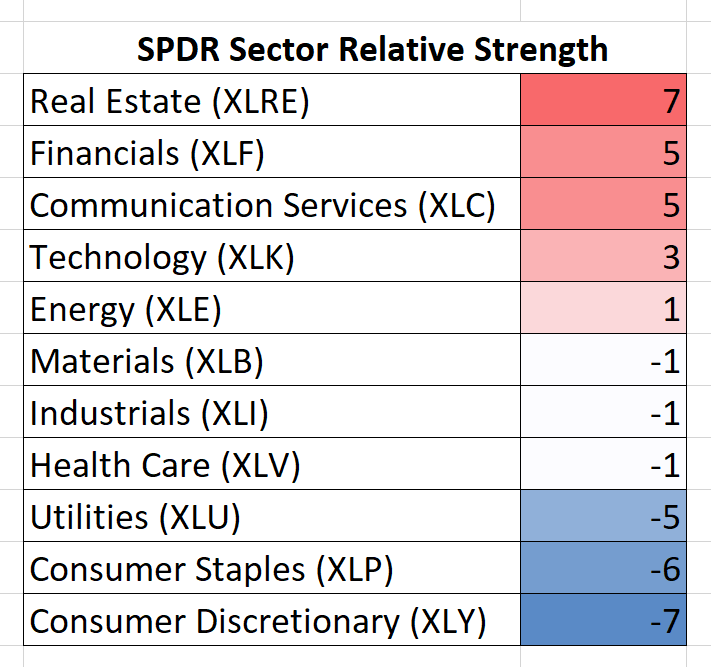

When you trade, you want the strongest stocks in the strongest sectors, which is why you should monitor sector performance carefully. With that said, lets determine the relative strength of the sectors relative to the S&P 500 ETF, SPY for the upcoming week.

For example, defensive sectors such as consumer staples, utility and health care stocks tend to outperform during a recessionary phase, while consumer discretionary and tech stocks tend to fare well during early expansions.

When you trade, you want the strongest stocks in the strongest sectors, which is why you should monitor sector performance carefully. With that said, lets determine the relative strength of the sectors relative to the S&P 500 ETF, SPY for the upcoming week.

Communication Services (XLC)

Consumer Discretionary (XLY)

Consumer Staples (XLP)

Energy (XLE)

Financials (XLF)

Health Care (XLV)

Industrials (XLI)

Materials (XLB)

Real Estate (XLRE)

Technology (XLK)

Utilities (XLU)

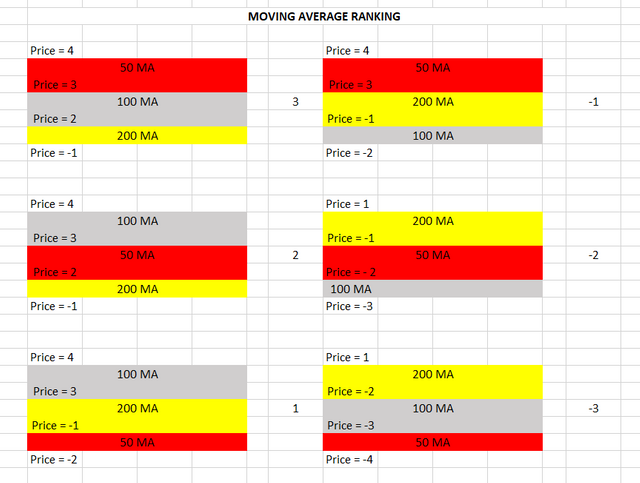

Based on the moving averages and the last daily closing price, relative to the moving averages,

the SPDR sectors' relative strength, relative to the SPY are the following:

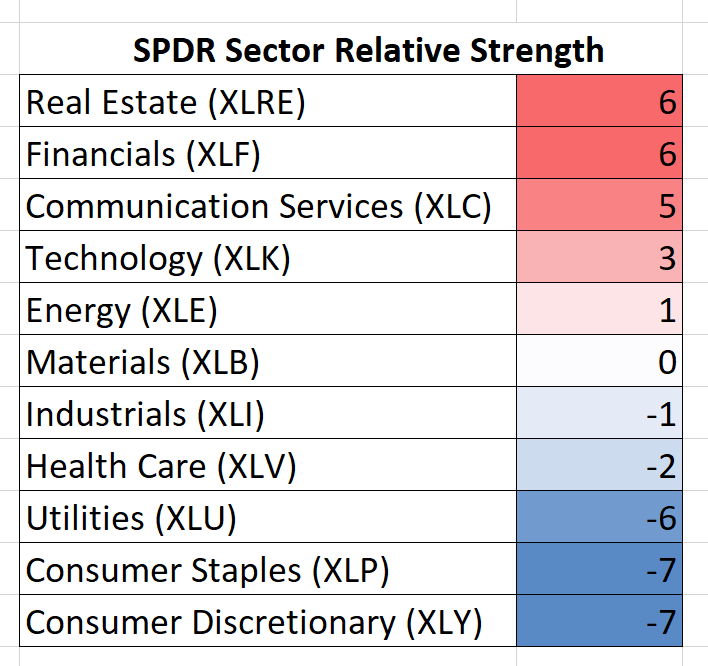

Two Weeks Ago

LeoFinance is a blockchain-based social media community for Crypto & Finance content creators. Our tokenized app allows users and creators to engage and share content on the blockchain while earning cryptocurrency rewards.

Posted Using LeoFinance Beta

More plagiarized content. I am sure people putting real effort and struggling to get engagement on leofinance are thrilled to see an official curator making a killing by posting pliagged crap 5 times a day. As an early investor I want to thank you from the deepest depths of my heart for all the effort you put for the ongoing development and growth of Leofinance.

Source of plagiarism

Plagiarism is the copying & pasting of others' work without giving credit to the original author or artist. Plagiarized posts are considered fraud and violate the intellectual property rights of the original creator.

Guide: Why and How People Abuse and Plagiarise

Fraud is discouraged by the community and may result in the account being Blacklisted.

If you believe this comment is in error, please contact us in #appeals in Discord.