Bullish Sentiments?

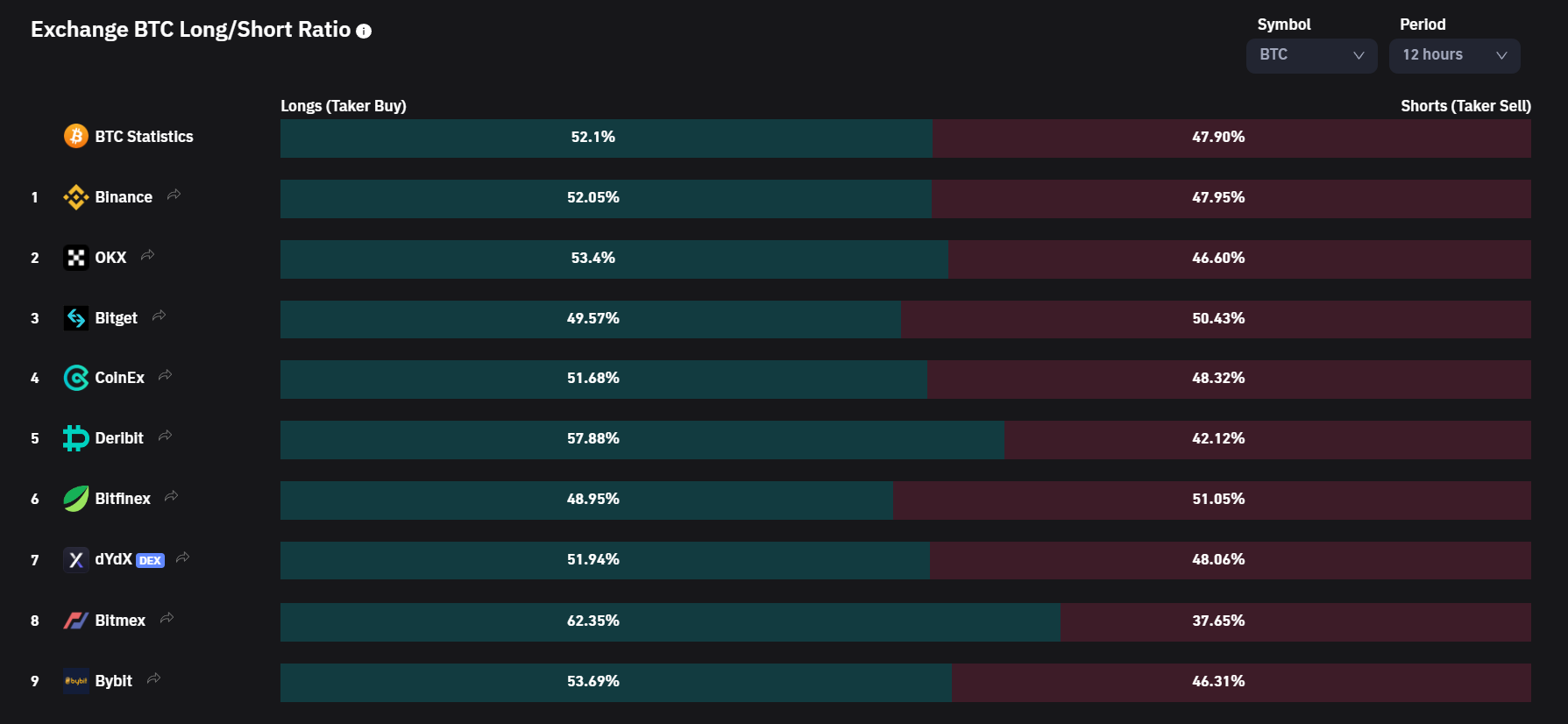

It's easy to get caught up in the hype surrounding a bull market and lose sight of the potential risks. Whether you're trading stocks, cryptocurrencies, or any other asset, being too bullish can lead to losses if you're not careful. In this blog, we'll explore why over bullishness in market prices is harmful and how to avoid it.

When prices start to climb, it's often tempting to jump on the bandwagon and invest heavily, hoping for massive profits. This type of behavior is known as FOMO (fear of missing out) and it can lead to disastrous results. When the market is running hot, it's just as important to exercise caution as it is to take advantage of the opportunity.

Over Bullishness can lead to overinvestment and losses if the market suddenly reverses direction.

Key

The key is to be aware of the risks and make sure you don't get too carried away. If you do decide to invest, diversify your portfolio and be prepared to take losses if the market turns against you. Don't let over-bullishness get in the way of making smart investment decisions.

A Man from Ohio

Gary Harmon, a 31-year-old resident of Ohio, has pled guilty to charges related to the theft of 712 BTC worth $4.8 million at the time, now valued at over $12 million. He is due to be sentenced in March and may face up to 20 years in prison.

Harmon had swiped the crypto stash from his brother Larry's hardware wallet, which was being seized by law enforcement during criminal proceedings against Larry for operating money laundering service Helix. Investigators were unable to access the funds due to added security features on the device. Having used his brother's credentials to recreate the Bitcoin wallets stored on the device, Harmon then laundered the stolen Bitcoin through other coin mixers, before making a series of large purchases. As part of the plea, he has agreed to surrender 647 BTC, 2 ETH, and 17.4 million DOGE.

Weirdos...🤣😂

Source: coinmarketcap

Some Technicalities...

At 6:35 pm on 8th January, the price of Bitcoin had dropped to 16,928 USD. However, it experienced a surge in value and is currently trading at 17,248.75 USD. Trading volume has increased by 69.64%, while its market cap is 332.308 billion USD, with a slight decline in its dominance of 0.57% compared to the day before. In light of recent events such as the fall of FTX and an increase in the Federal Reserve’s interest rate, Bitcoin has been struggling, showing a continual decrease in its value. This year could be problematic due to the International Monetary Fund's prediction of one-third of the global economy entering a recession. The total crypto market capitalization is 850.35 billion USD and the total cryptocurrency market volume during the last 24 hours is 30.98 billion USD, representing an increase of 89.94%.

Price in Various FIATS

The cost of a single BTC token in India is 14,20,779.54 lacs.

In Singapore, it is 22,940.83 Singapore dollars and...

In the UAE it is 63,302.91 UAE Dirhams.

Not a financial advise, your losses are your responsibility, markets are extremely volatile and risky. Take care.

In conclusion, you are the best ;)

Posted Using LeoFinance Beta