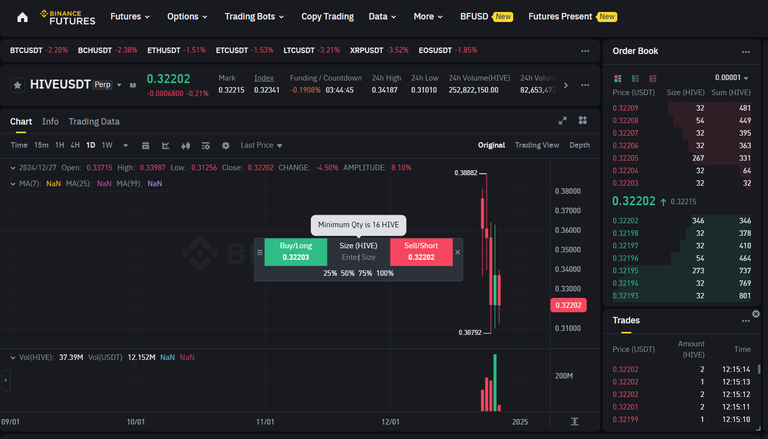

When I first heard the news that HIVE/USDT was available in Binance’s futures market, I was intrigued. What exactly is futures trading? How does it work? Is it really a great opportunity, or just another high-risk game? These questions kept swirling in my mind, especially after seeing HIVE’s price spike significantly following the announcement.

As a beginner, I started gathering information to understand the concept. After a while, I managed to simplify the explanation, ensuring it’s easier for others like me, who are new to this field, to grasp.

What is Futures Trading?

Imagine being able to buy or sell something at a predetermined price at a set time in the future. That’s the essence of futures trading. In the crypto world, it means predicting whether the price will go up or down.

For example:

- If you believe the price will rise, you open a long position.

- If you think the price will fall, you open a short position.

Sounds simple, right?

Futures trading differs from spot trading, which I often use to sell HIVE. One of the main advantages of futures is leverage—essentially borrowing money to amplify potential profits. However, leverage also increases risks. With 10x leverage, you only need $100 to open a $1,000 position, but if your prediction is wrong, you can lose funds much faster.

How Futures Trading Works

To get started, you’ll need to transfer funds to a dedicated futures wallet. On Binance, this is just a matter of switching to a different page from the usual spot trading interface. Don’t worry; the funds in this wallet are separate from your main balance, so your risk is limited to the transferred amount.

Here’s a simple example:

- HIVE’s current price is $1, and you have $1,000 in your futures wallet.

- With 10x leverage, you open a position worth $10,000.

- If the price rises to $2, your profit could reach $10,000. But... if the price drops to $0.90, your position will be liquidated—meaning you lose your funds.

While the potential profits are tempting, the risks are equally real. To avoid liquidation, you can add funds to your futures wallet or adjust your trading strategy.

Costs to Consider

As the saying goes, there’s no such thing as a free lunch. Futures trading comes with costs:

- Trading fees: Around 0.075% per transaction.

- Funding rate: Additional fees to maintain positions.

- Slippage: The price difference that occurs during fast market movements.

For instance, if you open a $1,000 position with 10x leverage, the initial fee is about $7.50. This means you need at least a 0.15% price increase just to break even. Always double-check calculations to avoid losses from fees alone.

The Importance of Strategy and Stop Loss

Strategy is key. There are two main types of orders you should understand:

- Market order: Executes immediately at the current market price, fast but may experience slippage.

- Limit order: Executes only at a specified price, ideal for minimizing risks.

Additionally, use a stop loss to limit potential losses. For example, if you open a long position at $1 with a stop loss at $0.98, your position will automatically close when the price drops to $0.98, protecting your capital.

Tips for Beginners

Starting out in futures trading can feel overwhelming, especially with the promise of big profits. However, the risks are equally significant. Here are some tips:

- Start small: Use a small amount of capital to familiarize yourself with how futures trading works. Once you understand, you can decide to invest more.

- Keep a reserve: Ensure you have enough funds to top up your futures wallet if your position worsens.

- Leverage analysis tools: Platforms like Binance provide data and trading tools to help you make informed decisions.

- Avoid trading during major news events: High volatility can lead to liquidation.

Important Notes:

High-leverage trading carries significant risks. Please ensure you understand the implications and trade responsibly.

Futures trading offers great opportunities, but it’s not without risks. By understanding the basics—like leverage, fees, and risk management—you can start trading with more confidence. Always begin small and never risk more than you can afford to lose.

Good luck with your journey, and who knows? This could also positively impact the HIVE community in the future. Happy trading!

Thank you for reading this far into my article. Hopefully, there is something you can get from what I have shared.

🫶🫶🫶

🫶🫶🫶

Sending Love and Ecency Curation Vote!

Follow Eceny's curation trail to earn better APR on your own HP. : )

Follow Eceny's curation trail to earn better APR on your own HP. : )

Thanks a lot for the support