What is Titan Bull Finance?

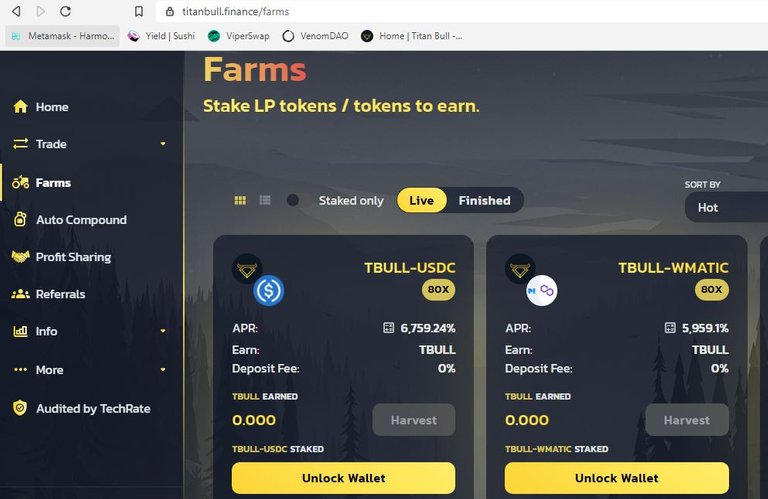

TitanBull finance is the 4th yield farming of Bull Ecosystem on the polygon network. The native token is TBull and the farm will have a max supply of only 19,999 tokens, with 999 tokens pre minted for initial liquidity. Farming is scheduled to be finished in around 16-18 days, and once the max supply is reached a new Bull token will be released. Investing in pools with native tokens has no deposit fees, whereas non native token will require 4% fees. 30% of this fees will be distributed among users through profit sharing. The emission rate is fixed at 0.015 TBull per block, and 80% of the dev fees is to be burned daily (already 2 burns have taken place).

An important check before investing in any of these DeFi farms is to first look at their rating on the RugDoc. You can see RugDoc's rating here on titanbull.finance.

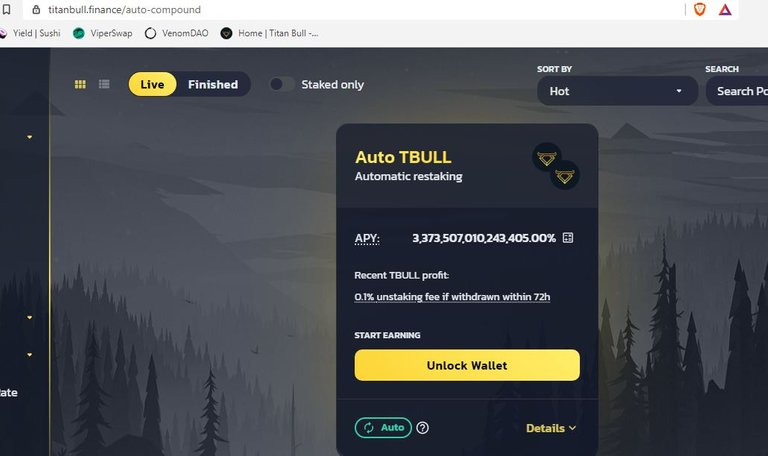

Auto Compound Feature

Apart form the point that the farms have good APRs, there is an Auto Compound pool vault feature using which investors can stake their harvested TBulls to earn insane APRs on the TBull. There is a 2% performance fee and 0.1% un-staking fee, if un-staked before 72 hours. In addition, there's an auto compound bounty feature which enables users to earn 0.25% of all auto compound rewards users pending harvest. It's on first come first serve basis and is dependent on the number or amount of TBulls one has in both Auto Compound vault and farms.

Farming on titanbull.finance

This was my first full rodeo wherein I had to transfer funds from Binance to Polygon network. I had to watch a lot of videos and read on internet to understand how to do it with minimal fees. I hope this article will help new users like me, who are looking to dive into the world of yield farming.

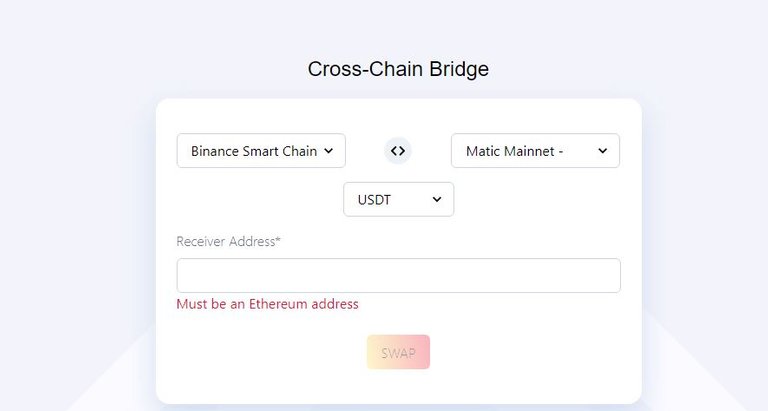

The above step is only applicable if the funds are being transferred from Binance. If you have funds or Matic in Ascendex you can directly transfer them to Polygon network. Send via ascendex's 'Matic Netwrok' and receive in metamask on Matic Mainnet. titanbull.finance has another native pair with Matic (TBull-WMatic).First USDC needs to be transferred from Binance to Metamask wallet as the native pairing on titanbull.finance is with USDC (TBull-USDC). We need to first setup Binance Smart Chain Network (BSC) on our metamask wallet. We can do this via Metamask -> Settings -> Networks -> Add Netwrok. Any custom RPC netwrok can be added here by putting relevant details. BSC Mainnet can be added by referring to https://docs.binance.org/smart-chain/wallet/metamask.html

-

-

For transfer via Binance, there are few more steps. After transferring USDC from Binance to BSC Mainnet on metamask (please ensure to use BEP20 (BSC) network on Binance for this), we need to transfer this USDC to the Polygon network. Remember that for this transfer we will need to have some BNB in metamask in BSC network to pay fees (you can transfer this too using BEP20 netwrok from Binance to metamask wallet, minimum transfer is of 0.02 BNB). I used (xpollinate) for transferring my USDC from BSC to Matic Mainnet, remember to connect your metamask wallet with xpollinate using BSC Mainnet and check liquidity of the networks in xpollinate before starting transaction. You can put BSC address itself in the 'Receiver Address' address as both BSC and Matic Mainnet address are same in the metamask wallet.

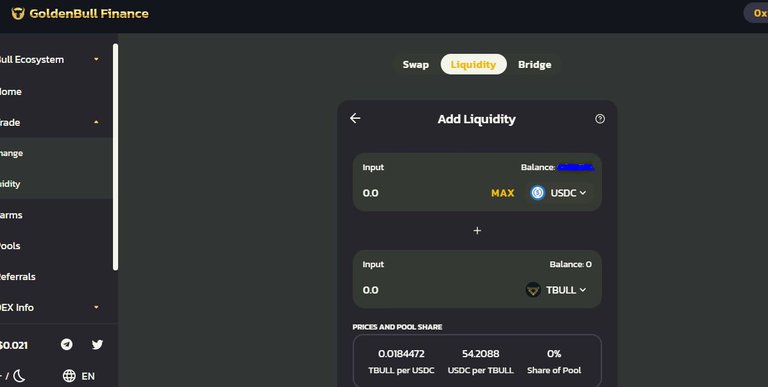

To perform this transfer/ swap of funds in xpollinate, we will need to have some Matic in our metamask wallet (in Matic Mainnet). One can easily get small amount of Matic from faucets available. Two of these faucets are matic.supply and macncheese.finance. We can now move to titanbull.finance to provide liquidity. We need assets of the LP pair, that we have chosen to invest in, in 50:50 ratio. For example, if we have 100 USDC, we need to swap roughly USDC 50 into TBull (50% of Matic if you are investing in TBull-Matic pair). We can do this swap on titanbull.finance itself, or if the price impact is big, we an use sushiswap for this (I used sushiswap). titanbull.finance will take you to goldenbull.finance for swapping and adding liquidity.

We will now create LP tokens to add liquidity. Choose Max of TBull and the system will automatically choose corresponding amount of USDC or Matic. Now add or supply liquidity. Again these transaction will need to be confirmed in metamask and will require small amount of Matic. Once you have LP tokens, head over to Farms and in the chosen pair Unlock wallet, approve contract and finally stake Max of your LP tokens. We are done with providing liquidity!

After we have earned some TBulls, we can then choose to either stake these harvested TBulls in the Auto Compound vault and earn the insane APY or stake in profit sharing and earn TBull or USDC.

Final Thoughts

There are many things going for titanbull.finance. It has more than decent APRs on offer and has the availability of auto compound and profit sharing features. It has good tokenomics with limited supply. It's code has been audited by both Tech Rate and RugDoc. In addition the farm has been floated by pollybull finance.

Note:

This is my first post on leofinance, hope you will get something out of it.

As I am not a certified financial advisor, please carry out your own research before taking any investment decisions.

Posted Using LeoFinance Beta

Congratulations @sarjaria84! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 50 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP