It's been a month that the PSE Index has been trading within a downward channel. There have been multiple attempts into breaking out but seems like resistance has been strong. I'm considering buying the index next week if there is no significant increase yet to average down. It should not break 5900 though as that would be another bearish sign.

Meanwhile, some stocks may lead towards getting positive momentum which is what I'm trying to look out for.

Metropolitan Bank and Trust Co. (MBT)

Earlier bought MBT shares this week as the MACD has crossed zero and prices broke the cloud. Though it corrected back to the 200 MA by Friday. Some analysts posted a Buy recommendation on this given as they think it's at least 20% undervalued at current prices.

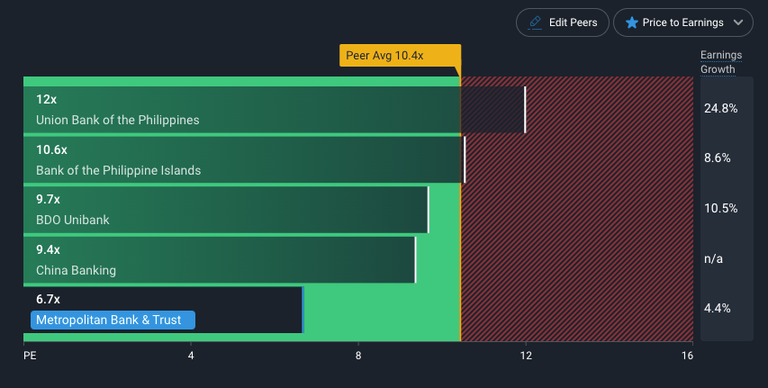

If we compare MBT's Price-to-Earnings ratio with its peers, it's relatively low at 6.7x. However, earnings growth is notably not that high.

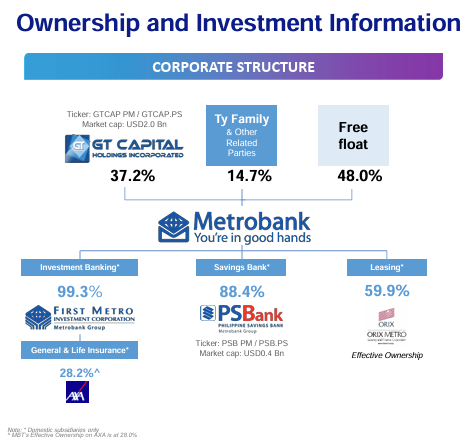

Metrobank was incorporated in 1962 by a group of Filipino businessmen (led by George Ty) to provide financial services to the Filipino-Chinese community as it started its first office in Binondo. It was the largest bank in the Philippines for 2 decades (80s-90s) before being overtaken by BDO. George Ty passed away in 2018 and is succeeded by his son Arthur. The Ty family continues to have a significant influence on Metrobank through their conglomerate GT Capital Holdings and direct shareholdings.

Metrobank's net interest income coming from lending activities is its main contributor to 2024 earnings. Investing into this stock is more of a Value play as it gives dividends (upcoming this March 5). Recent charts are still 50-50 in terms of a breakout.

Watchlist: PLDT Inc (TEL)

Here's another stock that is above MACD zero and kumo; hence, looking into getting in if it remains to look good. Let's see in the coming week.

This is not financial advise. I use this as my trading journal/notes for ongoing reference for the succeeding week. The above technical analysis (charts) are just used for guidance while studying market behavior and trying my hand on market timing. Please Do Your Own Research (DYOR).