A week after my post, PSEi dropped consecutively. It was so steep it easily erased all the index gains for the past 3 months in just a week. It was only the 5th day where we had a green candle.

A drop this steep leads to a stock overhang. I don't think a bullish reversal will come in too soon. Market will be sideways for weeks/months and you can see from the chart below the range it will be trading.

Unfortunately, I can't do my Fund Swing Trading at this point unless market drops to near support at 6200. For the meantime, let's try to see some selected stocks which I'll base from broker reports.

This week's watchlist: Aboitiz Equity Ventures [PSE:AEV]

AEV has been trading at very low levels similar to early 2021. It has lost 40% of its value since February of 2022 when it was trading for around Php60s. Philstocks (broker) recommends this stock with a target price of Php50. I'm seeing a MACD Divergence in the one year chart; however, it's a bullish divergence on a negative trend. This may lead to a change in trend, although it's still considered a weak signal.

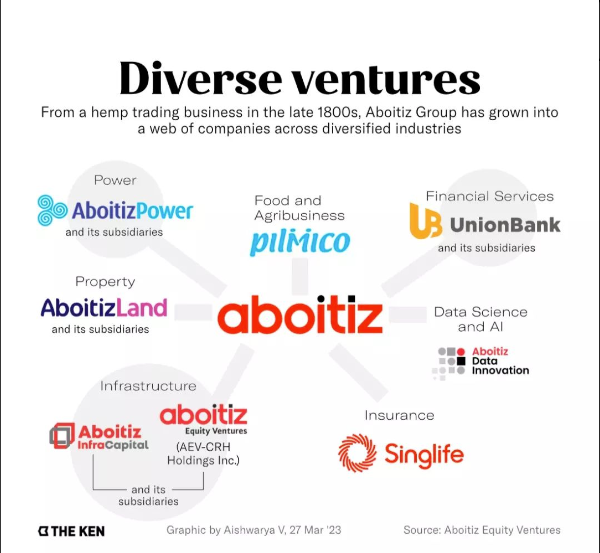

Looking at AEV's businesses, it does seem to be a decent family-owned conglomerate. Basing from 2023 Net Income, 70% is coming from Aboitiz Power, while around 20% comes from Unionbank. It seems management is composed of next Generation Aboitiz family members and this is why we see progressive takes shifting from its traditional business (i.e. shipping) into power and banking.

They also treat their Data Science initiative as a company on its own.

Who knows, I might start entering. Risk seems to be lower at current prices with an upside of around 47%. I might just be a bit overweight on Aboitiz stocks though, since I already do cost averaging with AP (Aboitiz Power). If I get stuck with it, they still give 2-3% Dividend Yield yearly. Probably just need to be patient with the market.

Whatever, I'm buying the dip and die. Ride or die.

too many dips to choose from :)

Congratulations @scion02b! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 3500 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

If you decide to get into this conglomerate what would be a conservative amount of units for exposure?

Just curious.

Good question!

I haven't fully checked its fundamentals yet so I'm just basing it on charts and mainly for short-mid term trading. I'm trying to reset my trading portfolio which I left behind years ago, having too many stocks on hold. I plan to simplify (just 1-4 stocks at a time).

I will buy in tranches so probably 8% on the first buy. Cutting losses is my biggest challenge, hopefully I can be more disciplined.

If it so happens that fundamentals are also good and I got a good entry, then I would consider transferring it to my long term portfolio.