In a world where Money seems scarce and financial struggles are an everyday reality, it's essential to take a step back and understand the complicated web of Debt that many find themselves ensnared in. Money, once a simple means of Exchange through barter systems and precious stones, has evolved into a complex economic regulatory system that often leaves individuals feeling trapped and suffocated. But fear not, for there are practical steps to untangle this web and regain financial freedom.

The Evolution of Money

Let's go down memory lane, our journey begins by understanding the evolution of money. Money is no longer just tangible notes or purchasing power; it's an Economic system designed to make you lack.

In the past, people traded goods and relied on cowries, precious stones, and even Gold as mediums of exchange. Fast forward to the colonial era and the birth of foreign policies, the world has indeed transformed.

The Birth of Debt

As time passed, the divide between the rich and the struggling grew. The peasants rebelled against their subjugation, leading to the creation of the middle class. This class was designed to keep you working tirelessly for money, never having enough, and drowning in debt. It feels like you can't breathe without getting a Loan, right?

Breaking Free from Debt

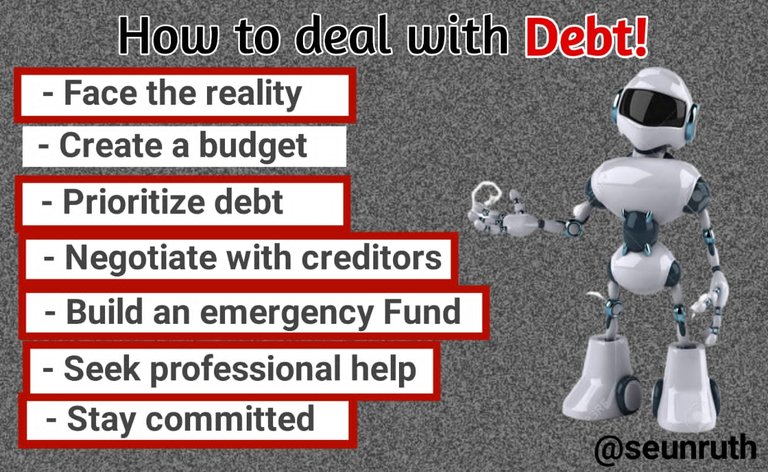

Now that we've unraveled the history, let's dive into practical steps to break free from the cycle of debt.

Step 1: Face the Reality

The first step in dealing with debt is facing the reality of your financial situation. Just like the landlords in the past had to acknowledge the peasants' rebellion, you must acknowledge your debts. List them out, including the amounts, Interest rates, and due dates. It might be a daunting task , but it's the first step towards financial freedom.

Step 2: Create a Budget

Much like the world's economic system, you need a plan. Create a monthly budget that outlines your income and Expenses. Be realistic about your spending habits, and identify areas where you can cut back. This budget will serve as your roadmap to financial recovery.

Step 3: Prioritize Debts

Not all debts are created equal. Some have higher interest rates, while others are more manageable. Prioritize your debts by paying off high-interest ones first. This will save you money in the long run and gradually reduce your debt burden.

Step 4: Negotiate with Creditors

Don't hesitate to reach out to your creditors if you're struggling to make payments. Many creditors are willing to work with you and may offer lower interest rates or extended repayment plans. Communication is key in finding a solution.

Step 5: Build an Emergency Fund

To break free from the cycle of debt, it's vital to have a financial safety net. Start by building an emergency fund that can cover at least three to six months' worth of expenses. This will prevent you from resorting to loans when unexpected expenses arise.

Step 6: Seek Professional Help

If your debt situation is overwhelming, consider seeking help from a financial advisor or credit counseling agency. They can provide expert guidance and help you create a personalized debt repayment plan.

Step 7: Stay Committed

Finally, staying committed to your debt repayment plan is important. Remember that the path to financial freedom is a journey, not a sprint. Be patient and disciplined, and over time, you will see progress.

Conclusion: Reclaiming Your Financial Freedom

In an economic system governed by lack, debt and financial struggle. it's essential to take control of your finances. By following these practical steps and understanding the history that led us here, you can begin the journey towards financial freedom. Just like the peasants who rebelled against their subjugation, you too can break free from the shackles of debt and build a brighter financial future.

Interested in more of my work

How to survive as a crypto investor

How to grow your savings by spending

Posted Using LeoFinance Alpha

Posted Using LeoFinance Alpha

https://leofinance.io/threads/seunruth/re-seunruth-25yjqgapp

The rewards earned on this comment will go directly to the people ( seunruth ) sharing the post on LeoThreads,LikeTu,dBuzz.