Yesterday on Twitter I ended up in a conversation with @eturnerx about an idea that has been festering below the surface of my frantic mind for a while now. Now that we've gotten past the annoyance of Justin's P&D (hopefully), we should start considering experimenting with ideas that would help improve the long-term token price of HIVE. The genesis for this post can be found here on Twitter. Feel free to add anything there if a tweet strikes your buzz chord. 🐝

Of course, our first concerns should be onboarding more users and making it as simple as possible for developers to build their passion on the HIVE blockchain. That goes without saying. But that doesn't mean we shouldn't also start gradually implementing means to improve the token economics of $HIVE. By no means am I trying to unilaterally implement some kind of autocratic proposal here. My goal with this post is to begin a community conversation that might eventually lead to a draft of a Hive Improvement Proposal (HIP) that specifically deals with token economics. Thanks to everybody for asking good questions and providing quality comments here and on Twitter. I'm sure there are plenty of great ideas about improving this micro-economy lying around this awesome community. Let the ideas free!

Now that we've seen the power (and the terror) of all the liquidity you could possibly want for a cryptocurrency, we need to start thinking about a use case for the $HIVE token that is directly related to value capture. Listings on Binance, Huobi, Bittrex, and MXC would honestly be enough for any project. But we also have Probit, Ionomy, the Engine dexes, the internal market and a few smaller listings that I've forgotten about and even CMC won't list. It's honestly an embarrassment of exchange riches around here. But, you know what they say, with great power comes great responsibility...

You've probably noticed that ether has been on a mission as of late. It's mounting up another attack on the ever illustrious $300 level. It almost got there before Black Thursday, but now it's back for another round. One could say it's riding on the coattails of bitcoin as it motors towards its next halving. But one could equally also say that the ETH run has been prompted by mounting excitement for the release of ETH 2.0. You can read the release from Prysmatic Labs here. If you don't know already, ETH 2.0 is when Ethereum becomes more like HIVE and implements its own version of Proof of Stake! But what I'm really most excited about is the little-known, outside of the hardcore eth heads I think, Ethereum Improvement Proposal #1559 (EIP-1559).

What Is EIP-1559?

You can find the technical details here, but for how it impacts monetary policy I refer to you David Hoffman, the leader of the Real.T project, whose writing about ETH I find very easy to follow. He writes a great piece calling EIP-1559, "The Final Puzzle-Piece to Ethereum’s Monetary Policy". You should read it.

But I'll recount for you the gist of it here: EIP-1559 is great because it burns ETH every single block. The burning of ETH distributes value to every single holder of ETH equally, from the validators to the whales to the folks with 0.1 ETH in their MetaMask. That's the way it should be. No blockchain-based economic system should promote oligarchy. The whole point of bitcoin and its descendents is to rage against such cronyism. And yet, here on HIVE we are in danger of doing just that with a long-term inflationary monetary policy that disproportionately rewards validators (Witnesses).

Now hold on a minute, I'm not saying we should rob the Witnesses to pay the minnows. I know they have expenses and do a lot for the ecosystem (like protect it from malicious attacks by crypto billionaires), but it just so happens that introducing a burn mechanism for HIVE is the best absolute thing we could do to protect the value of the HIVE token in the long run. Systematic burns benefit everyone equally. The EIP-1559 proposal effectively moves the ETH inflation rate from its current rate of 5.0% per year to anywhere between 0.2% and 1.5%, depending on the amount of ETH that gets staked once the Ethereum mainnet moves to ETH 2.0. Overall, that is a much better, more sustainable and less oligarchic economic system. That is EXTREMELY BULLISH for ETH price.

Advocating for a HIVE Token Burn Mechanism

On the HIVE blockchain, like it says right there on the PeakD wallet screen, "The Hive Token System is inflationary, new tokens are distributed every day. Inflation is 8.59% in 2019 and is reduced by 0.01% every 250,000 blocks." Now it's important to note that in a Delegated Proof of Stake system, particularly one used as a social media blockchain, you need to have pretty healthy inflation. After all, the tokens to pay people for their engagement and content contribution have to come from SOMEWHERE. I mean, I'm not giving anyone my HIVE, are you? But I will contribute a piece of what I control of the inflation pool to people who develop good content or make a good comment or whatever. That's how this chain works.

But I'm telling you. 8.59% INFLATION IS WAYYY TOO HIGH. We need to start experimenting to do what we can to counteract that inflation of the token supply. Because with each new token that is minted, the remaining HIVE tokens are worth that much less. I mean, come on here, guys. It's not like we're the Federal Reserve or anything here and can keep on just creating money out of thin air without any consequence!

Currently, the situation on HIVE is not conducive to promoting long-term token value while also attracting quality content creators. Especially if they are arriving after being de-platformed, they are going to be looking for a way to earn money. The truth is, right now on HIVE, if you’re blogging to earn and regularly sell your $HIVE on an exchange, you actually are removing value from the ecosystem because you only provide sell pressure. That's really bearish for the token economy. What's more, the constant selling of even a few de-platformed Youtubers arriving on HIVE to share their content censorship-free creates a negative feedback loop, by decreasing the HIVE token value, that actually disincentives more quality content creators to join the HIVE ecosystem and make it truly thriving!

On top of that, guys, and here's the real kicker... A token economy that actively sustains such a negative feedback loop on token price then decimates the $30 million or so that is locked up in the steem.dao wallet. We need to fundamentally support token price, via a sound monetary policy, in order to extend the runway provided by those community tokens for AS LONG AS POSSIBLE. Yeah, $30 million sounds nice right about now. But if we go back to where we were just two weeks ago, that amount will be less than $8 million. If we create a robust token economy and go back to ATH, that's $100 MILLION! You can incentivize the creation of a lot of blockchain games, mobile wallets, SMT's, whatever you want really with that kinda money.

It’s all about creating a sustainable circular economy. If you're blogging to earn (rather than blogging solely to build more influence on the HIVE blockchain like some of us do) then, quite frankly, you are extracting value out of the system without providing commensurate value in return.

That's not ideal for $HIVE token price.

Don't get me wrong. I think that's a perfectly acceptable way to approach using the HIVE ecosystem. If we want to get quality Youtube-level talent, we obviously need to figure out a way for people to make similar amounts of money without having to first spend months building up a grubstake with sweat equity. A lot of people just don't have the time to do that. And honestly, there are other blockchain-based social media options out there right now like Uptrennd, Publish0x and LBRY to name just a few. There's also something called Steem and another called Voice. 😂

In my opinion, we already have the best community out of all of those platforms. Now it's time we began shoring up the token economy to be the best of the best for the long run. And to do that, we just need to have an honest discussion as a community. We have tons of highly intelligent people here that think about, and have experience with, this stuff all the time. There's not too much of a rush here, but we do need to get the ball rolling.

LeoFinance Offers A Proven Method to Use Burns to Support Token Value

Look, I'm not a genius for coming up with this. I know that. We see burn mechanisms built in to the best tokens out there. BNB and MKR are top 30 coins due to their token economy, both of which have prominent burn mechanisms. What I propose is that we "monetize" the collective content of the community by selling modest ads alongside it. All funds earned, less some management fee, could be fairly returned to the community by purchasing #HIVE off Binance or (if you don't like them any more) Huobi, or anywhere where the token is most liquid. We don't want to lose value to the exchanges due to slippage fees caused by exceedingly wide bid-ask spreads.

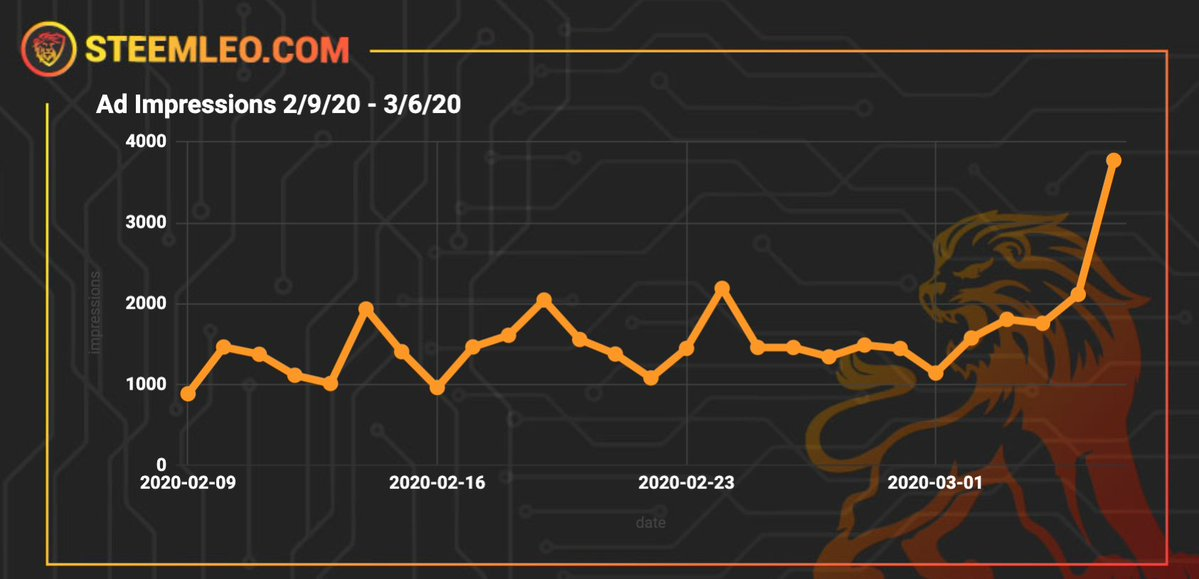

In fact, we even have a tribe that has been doing this to great effect for a few months already. The way LeoFinance.io does it is @khaleelkazi uses the money earned from selling banner ads on the platform to buy LEO tokens off the internal Engine dexes and burn them. He also uses the $BAT earned from entering the website into the Brave Creators program to contribute to this cause. Here's the most recent results from just the LEO ad campaigns:

Four thousand ad impressions is not a lot, but you can see that the trend is his friend. His experiments are panning out. You can see the line of thinking here in a post from 7 months ago where he lists 9 different sinks for the LEO token. Now, all of them did not work out to be worth the effort. However, we need to be doing this kind of experimentation on the HIVE blockchain to see which sinks work and which sinks don't for our 12,000 (and hopefully more and more) transacting HIVE accounts.

Unlike @aggroed, who uses the term "sinks" when he talks about token economy, I use the term “burn case” because it parallels to the oft-used "use case." Whatever - potato, potato. The idea here is that this "burn case" - buying HIVE tokens with ad revenue only to burn those tokens - produces buying pressure without any correlated selling pressure. And that's freaking bullishAF. In fact, if you look at all the old Engine tribes that use SCOT bot condenser front ends, the best performing token of those tribes is the LEO token. And it's not hard to see why. The team has aggressively implemented burn cases into its token economy.

Now, if we do end up conducting some kind of regular purchase of HIVE tokens off the exchanges with some kind of ad revenue, the purchased $HIVE does not necessarily have to be burned. It could be added to the @steem.dao coffers for later distribution to encourage community growth. Or, the option that I like the most is some kind of combination of both. I'd suggest starting at 50/50 and going from there. We could even make the split a variable amount that the community gets to vote on every quarter or so. Either way, tokens return to the community's hands, #HIVE price is supported, and the community can continue to grow organically as more value is captured (and retained) in the ecosystem.

I think we have a chance here to build something truly special. Although we shouldn't let this recent token price swoon affect our mentality, we should start thinking about how to better insulate the HIVE token price from such volatility. The success of the HIVE project stands on three legs: onboarding users, encouraging kick-ass devs, and having a robust token economy!

Thank you for attending my TED Talk on tokenomics! 🤑

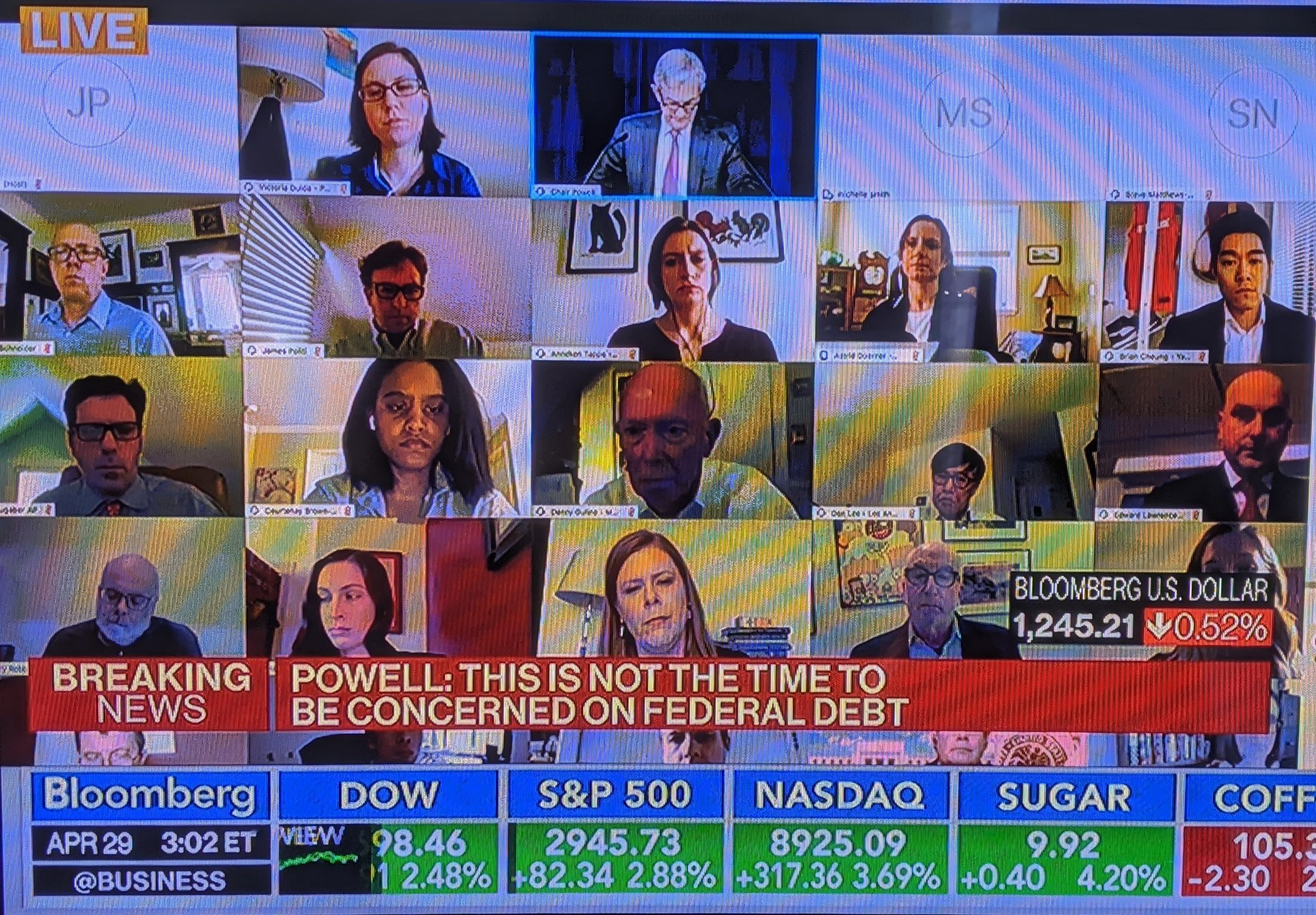

Remember monetary policy decisions are negotiated via Zoom all around the world, from Ethereum all the way up to the Federal Reserve. It would be easy to have a Zoom call about HIVE monetary policy whenever we want, just like the big boys!

Posted Using LeoFinance

It depends on many factors. If demand was to increase one could view it as not enough. If one considers distribution the fact is many don't get much of that slice here, and if we were to see any surge in popular creators come to the platform alone it would quickly shrink everyone's slice of the pie. Just look at how folks got upset with Haijen and a few of the other whales, the many projects to flag and place some of the poll back so there would be higher scraps for the masses.

I think if people were to actually view this project as worthy to invest in (and not just milk for what they can quickly) there is already more than enough people here to soak up the inflation. But to many that are here, investing even a pittance into this project wasn't what brings them here.

The focus always seems to be on projects coming that would add value while soaking up the inflation and causing a shortage. That line of thinking seems backwards to me. If others with value/talent/business structures look and see the majority here don't think highly enough in t he project to invest, preferring to think of it as a free faucet, then they will not hold a high value of it themselves.

Thanks for a thought provoking article. The more discussion we have on values and why they exist the more may understand that in a decentralized system the burden is on all to seek an increase of value to the community.

Yes, it is the free faucet perspective that can be combatted by a systematic burn mechanism. Thinking of the inflation pool is being "enough" or not is simply the wrong way to think of it, in my view. Quite simply, the economic bandwidth of that inflation pool is determined more by token price than by inflation rate (by definition). Therefore, we need to counteract sell pressure with buy pressure, thus restoring some of the economic bandwidth.

Fixed inflation formulas in crypto projects have always annoyed me. It's a recipe for disaster because you basically have to have economic growth that matches the rate of inflation just to stay even (not quite, but ok for this discussion). Most real-world currencies have some means to influence inflation when they need too.

I guess it comes down to what you want to control; exchange value is a pretty important metric in crypto. Most central-bank based economies use inflation manipulation to control their economy and exchange value (with other fiats) is a concern but often not the primary concern. I think exchange value matters so much in crypto because most tokens quite simply do not have a vibrant internal value transfers.

I often think that the demand here could explode if there were more draws for those not here already. We have famous artists, famous bloggers, personalities etc. But none of them are seeing this for what it offers (so far). If just a few would see it, whether here already or not, they could by the love of their own fan bases create such a demand the current inflation rate wouldn't keep up.

Yeah, afaik, we can't control the inflation rate in this economy. So we need to come up with other monetary policy initiatives that counteract its inflationary nature. Otherwise, by definition, we get a reduced token price in the long run. And, really, nobody wants that.

I think the crucial things for the ecosystem is to have marketplaces (shops) developed. We often talk about economy yet there is very little commerce.

If we want to stop people from blogging, getting rewarded, and then going to exchanges to sell the HIVE, we need to give them a place to spend those tokens. While in game purchases are great, for much of the world, being able to buy some basic necessities would go a long way.

This would ensure that the tokens operate in a circular nature and do not leave the ecosystem.

Commerce is crucial.

Posted Using LeoFinance

In my view, commerce will never be equal to a systematic burn mechanism that scales perfectly with every single impression delivered to site visitors.

The things like LeoShop and in-game NFT's are interesting and certainly have a place in the token economy. But, at its core, this is a social media blogging/vlogging platform. Most of the users will come here for that. Therefore, we need a flagship token mechanism (like BNB's "buy and burn") that is correlated with that overwhelming primary use case.

Stinc I think was already doing it, but using it to pay their developers if I'm not mistaken.

Why not both?

I think this is a good driver of value. Knowing that every time you viewed something on a site you increased, by just a little bit, the value of that economy.

Of course, having both is fine, like I said. We can sell investment reports, in-game items, Zoom consultations, whatever... But like you said, it's just keeping the turkey alive for another few days. Eventually Thanksgiving happens and someone sells the HIVE on an exchange.

Of course. Though exchange value matters less if there is an internal economy.

Exchange value matters a bunch because the development DAO is denominated mostly in HIVE. Increase exchange value, longer runway. Decrease exchange value, shorter runway.

Tokens never leave the economy (apart from burning). A sale is merely a transfer to an exchanger, hence the lack of economic activity manifests as an increase in the % held by the exchangers. But nothing ever leaves.

Staking is also one way to encourage tokens, at least temporarily to stay within the eco-system. But, for sure, the commerce that you describe could also be another. Except that commerce which accepts payment in a token and then immediately changes that for $$ is not much different in effect than somebody selling their tokens on an exchange and then buying something. The net effect is that tokens left the economy.

We already have staking. That's what Hive Power is. Are you suggesting another way to stake that provides some other benefit than increased influence (bigger votes) on the platform?

Hmmmm.....

We also have savings, but nobody uses it because the interest rate is usually zero.

Perhaps this is where we can better integrate the Hive DeFi vision of @rycharde to goose those yields and incentivize more people to save!

Thanks for the tags (both @shanghaipreneur and @eturnerx), but as you both also know my dislike of pointless burning as the only mechanism to deflate a highly inflated token - see scot tribes for recent experiential consequences.

Having said that, let's see if it would work on a macro level. The reward pool actually does a decent job at reacting to activity - the only economic activity being the generation of rshares and hence rewards - but what it doesn't do is react to liquidity, or more accurately, the money supply.

We have seen the consequences on Steem of pumping coins into an economy that has an oversupply. So what is need is a feedback loop that can change the minting rate to reflect the coin supply.

In the absence of such a feedback mechanism, burning coins could be used as a mechanism. We can define the coin supply as the ratio of HP over total HIVE.

If this ratio is high, most coins are vested and the burn rate can be low; if the ratio is low, it means most coins are unvested and liquid (and hence cannot participate in the economy) and so the burn rate increases.

We can look at historical values to gauge appropriate numbers and calculate the feedback effect on the reward pool!

On the specific point of fintech programs, the interest generated by the blockchain is far higher than the minting rate; how is it possible for dlease to offer 15% APR on an 8% blockchain? This is a legacy of the Steem economy that Hive has inherited. This can be changed but it first requires a deep and widespread understanding of how the chain actually works.

OH, that's nice! So using staking rate (HP/HIVE) to dynamically control inflation rate (using burns to reduce programmed inflation). This is exactly the mechanism used on Tendermint chains, so that's kind of nice.

My only problem with this is it doesn't directly create buying pressure, so it's not as robust in terms of being directly tied to economic activity as "selling ads to get money to buy tokens to burn." But on the flip side, it sounds like something that could be programmed, rather than managed, which in general is better for decentralization. Managed things tend to get corrupted eventually.

Look lively on The Bird.

Well, there already exists a burn mechanism that is native to the blockchain...account creation. I can think of a couple of ways that we can leverage account creation to increase the token economics.

https://peakd.com/steem/@onthewayout/how-to-create-demand-for-steem-using-social-influencers

It doesn't scale with activity, but it's definitely good to have in the "monetary toolkit"

@rycharde - this post might interest you.

Congratulations @shanghaipreneur! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare to others on the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @hivebuzz:

Vote for us as a witness to get one more badge and upvotes from us with more power!