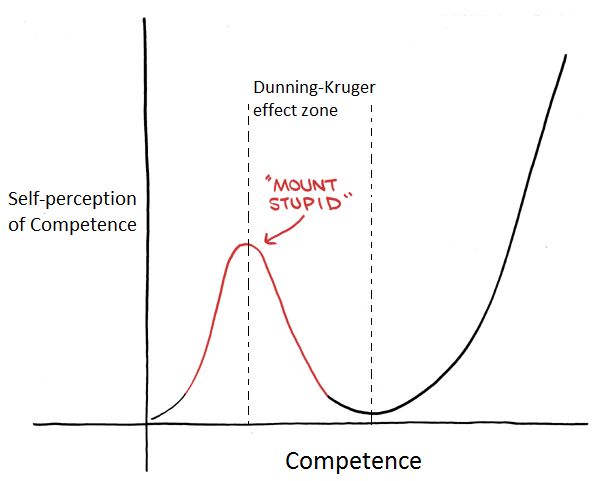

My new favorite random concept to drop into whatever conversation I happen to be having is the Dunning-Kruger effect. Ironically, I am currently somewhere near “Mount Stupid” in my understanding of this phenomenon.

So this post is, technically, an example of the Dunning-Kruger effect that uses an explanation of the Dunning-Kruger effect as its example.

They say "meta" is the new thing. So welcome to my metaverse, I guess.

How we usually think about the Dunning-Kruger effect is that, when initially encountering a new subject that they’re interested in, people tend to overestimate their competence the less they know.

A textbook example is that of a bank robber who was caught because he thought spraying lemon juice all over his face would make him invisible, and thus not recognizable after he washed it off. His reasoning was, of course, that if lemon juice was used in invisible ink then it would similarly obscure his facial features during the robbery.

Brilliant!

Traders in bitcoin and other crypto assets that joined our ranks in the past 6 months are now suffering hard from the Dunning-Kruger effect. It happens to everyone who begins their trading life in a bull market. Their early investing is so successful that they think they’re a genius. Obviously, the sick gains prove their strategy is correct! They forget to take profits. They leverage up. They sell long-term holds for assets further down the risk/reward ratio ladder. In the moment, these newb traders think they’re “diversifying” their portfolio, so they can capture even more alpha with their amazing strategy Big Brains. But in retrospect, they were just shooting themselves in the foot.

If this applies to you today, don’t worry! You just fell victim to the Dunning-Kruger effect. It happens to everyone. Full disclosure: It happened to me in 2017-18.

But there is a silver lining!

The Dunning-Kruger theory has an inverse corollary to its main takeaway that new market participants vastly overrate their competence.

It’s this:

As people become more competent, they have a tendency to underestimate their competence.

Next time around, you’ll do better even though you’ll probably be thinking the whole time about just how bad you’re doing!

Posted Using LeoFinance Beta

This actually happened to me in 2015, but not in crypto space. That year was my introduction to the Philippine stock market. After three months of trading, I got confident because gaining was so easy. I have no knowledge of bull and bear markets at that time, and I took technical analysis for granted. I thought, I was a genius because my strategy was working. I didn’t know that I entered the market during the last phase of a bull trend. After a year, I lost 49% of my capital. Though for many, $4,000.00 is not real money, for me, that was a big deal. Traders call it "tuition fee" you have to pay as part of your learning.

Entering the crypto space just July last year, I have a different experience. This time, since I know almost nothing about this new field, I just made a "test buy" of $300.00 and I no longer bother myself much about market trends. Though I still consider it important in case I will trade a coin, but my focus now is more on gradually growing my holdings. Interestingly, after 6 months and now that we are even seeing the prices of coins falling, but as I look into my position, still, the net yield is positive. Just thinking, how much more if the bulls start to rush again?

Posted Using LeoFinance Beta

That, my friend, is a question for the gods.

Posted Using LeoFinance Beta

Lol why does this sound like me 😩

Please support on Twitter and spread the word about $LEO

Posted Using LeoFinance Beta

Congratulations @shanghaipreneur! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 45000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!

Now am so confused after reading this. I will have to rethink my life in total because I have been going up the wrong mountain.