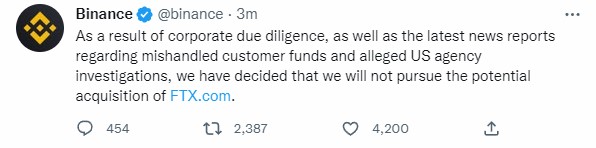

I wrote yesterday about the shocking revelation that FTX was entering into an agreement to acquire/bailout Sam Bankman-Fried's FTX. It only took one day for Binance to back out of the deal due to what they uncovered in beginning their due diligence of reviewing FTX's books.

Binance discovered misuse of customer deposits. This aligns with the theories floated over the past week that SBF had been using FTX's FTT token as collateral for his Alameda Research crypto hedgefund. Since so much of the scheme was backed by the perceived value of FTT, it will be shocking if holders of FTT will see a recovery anytime soon.

FTT is now trading under $3 each compared to the $25 just four days ago. It's unclear whether Alameda has been selling, but Binance says they froze all sales of their FTT holdings so this selling pressure is not from them. The bottom line is that there is likely little to no value in the FTT token any longer as the CEO of Binance has implied in his e-mail to his employees.

Continued Crypto Contagion

Unfortunately, this fiasco is causing investors across all asset classes to flee to safety. Bitcoin and HIVE are down big today, the US stock market was down, commodities were also down significantly. It's not quite a firesale, but there are certainly more sellers than buyers right now.

I keep nibbling at HIVE under $0.40 yesterday and today. I'm horrible at catching the bottom, so I wouldn't be surprised to see further declines as the SBF/FTX drama continues.

I'm not sure what to make of the decline in the price of HBD below $1, but all of the moves in HIVE and HBD are on reasonably light volume considering all of the global turmoil. Whether the light volume means there is little conviction in this decline, or that further larger volume sales are incoming - I'm still going to stick around and buy the dip.

Posted Using LeoFinance Beta

Posted Using LeoFinance Beta

All the best! Occasions like these mean opportunities too! ;)

!PIZZA