While analyzing an article on tokenizing securities I had a thought about using securities and non-fungible tokens to enable myself to perform fractional lending. Fractional lending is a banking income producing strategy made possible by banking rules which require banks to only keep 10% of their deposits in the bank and allows them to loan out 90% of their deposits. Let’s look at how this works in practice.

Example of Fractional lending

First, Adam deposits $1000 in his savings account at the bank, at 1% interest per year per year. The amount of interest the bank owes Bob for having his money deposited for a year is $10.00. However, the bank is only required to keep 10% of deposits on hand. It can loan out the rest. So, the Bank loans $900 of Adams money to Bob, at 10% per year which earns the bank 90$ per year, while they pay Adam $10.00. So the bank makes $90 minus $10 or $80.00.

Second, Bob deposits the $900 dollars in his account at the same bank. The bank pays Bob 1% or $9.00. The Bank is only required to keep 10% or $90 in Bob’s account, $900-$90=$810. The Bank loans $810 dollars of Bobs money to Charlie at 10%, that’s $81 per year. Now the bank makes $81.00 and pays pays Bob $9.00, so the bank profit is $81.00-$9.00 or $72.00 for the year.

Third, Charlie deposits his $810 in his account. The bank pays him 1% or $8.10.

The Bank is only required to keep 10% so $81, $810-$81=$729

The Bank loans Daniel $729.00 at 10% or $72.9 profit per year.

The bank makes $72.9 gross and pays Charlie $8.10 for a net profit of $64.8.

Fourth, Daniel deposits his $729 in his account at the bank.

The bank keeps 10% or $72.9 in his account, $729-$72.9=$656.1

The Bank loans $656.1 to Eric at 10% and makes $65.61 gross profit, subtracts the 1% they pay Daniel or $7.29 and their net profit is $57.32.

The cycle continues and the bank can loan out progressively smaller fractions of this loan with each creating an additional stream of income. This means instead of one loan for $1000.00 bringing them $90.00 per year, they have nine loans bringing them $90 + $80 + $70 + $60 + $50 + $40 + $30 + $20 + $10= $450 per year, a five fold increase in income. This is a simplification of how fractional lending works. But it is a tried and true formula. I hope it illustrates to you how the bank can make multiple loans from the same $1000.00 and have multiple streams of income from that same $1000.00 because the law requires only a 10% reserve of all deposits, so the bank keeps the money moving and each movement makes them money.

Now while you are not a bank, you can simulate one with loans on tokenized securities. You see in the bank fractional lending model we deposit dollars, a asset with guaranteed value. But with tokenized securities, we deposit an security with guaranteed value like a treasury note.

Let’s look at an example.

You want to conduct fractional lending. You start by spending $1000.00 on short term treasury bills with a 3 month maturation date and an expected 4% interest rate of return. Then you “Tokenize them, by creating $1000.00 worth of Ethereum ERC 20 Tokens which are non-fungible digital representations of the US treasury bills.security you hold. These Tokens have value because the treasury bills they represent have value. These Tokens are now pledged to the MakerDao as collateral for a line of credit with an interest rate of 1%.

Now a bank has a ten percent rule for fractional banking, while credit debt instruments have “collateralization” rules requiring “overcollateralization”. Which means for $1000.00 worth of collateral you get 100% minus 10% or 90% of your collateral as a line of credit.

So just like the bank got 90% of its deposits to loan out, you get a line of credit equivalent to 90% of your collateral. Which in this case is $900.00. The full line of credit is then withdrawn in MakerDao in the form of Tokens called Dai, which are then exchanged for cash. Then I suggest you buy more US Treasuries, $900.00 worth. These should be US treasuries bills with a 4% interest rate and a 3 month maturation. You then “Tokenize” this second group of US Treasury bills by creating $900.00 worth of Ethereum ERC 20 Tokens which are non-fungible digital representations of the US treasury bills you hold. These Tokens are now pledged to the MakerDao as collateral for a line of credit with an interest rate of 1%.

So just like the bank got 90% of its deposits to loan out, you get a line of credit equivalent to 90% of your collateral. Which in this case is $810.00. The full line of credit is then withdrawn in MakerDao in the form of Tokens called Dai, which are then exchanged for cash. This $810.00 in cash is then used to buy more US Treasuries, $8100.00 worth. These should be US treasuries bills with a 4% interest rate and a 3 month maturation. You then “Tokenize” these US Treasury bills by creating $810.00 worth of Ethereum ERC 20 Tokens which are non-fungible digital representations of the US treasury bills you hold. These Tokens are now pledged to the MakerDao as collateral for a line of credit with an interest rate of 1%.

So just like the bank got 90% of its deposits to loan out, you get a line of credit equivalent to 90% of your collateral. Which in this case is $720.00. The full line of credit is then withdrawn in MakerDao in the form of Tokens called Dai, which are then exchanged for cash. This $720.00 in cash is then used to buy more US Treasuries, $720.00 worth. These should be US treasuries bills with a 4% interest rate and a 3 month maturation. You then “Tokenize” these US Treasury bills by creating $720.00 worth of Ethereum ERC 20 Tokens which are non-fungible digital representations of the US treasury bills you hold. These Tokens are now pledged to the MakerDao as collateral for a line of credit with an interest rate of 1%.

Do you now see how starting with $1000.00 worth of capitol, you have purchased $1000.00 worth of US Treasuries, and then by Tokenizing the assets and creating a debt facility you were able to buy 1st $900 dollars of additional treasury bills, then $810.00 worth of US Treasuries and then $720.00 worth of additional US Treasuries and so on and so on...?

Do you understand how you would keep doing this 1000, 900, 810, 719, 651, 584, 526, and on and on until you have literally more then 10,000 US treasury bonds Tokenized and in 3 months you cash them in, earning not just 4% on a thousand, but 4% on 10,000 Treasuries for the cost of 1000 treasuries, inflating your return from 4% to 40%!

This is fractional lending, as done by banks, and deconstructed and reconstructed into a method available to non-banks, individuals or partnerships.

It’s a very interesting situation created by decentralized finance, non-fungible Tokens and the blockchain. The interesting thing about this is there are no investors, so there are no SEC regulations to follow, if you do this with your own capitol.

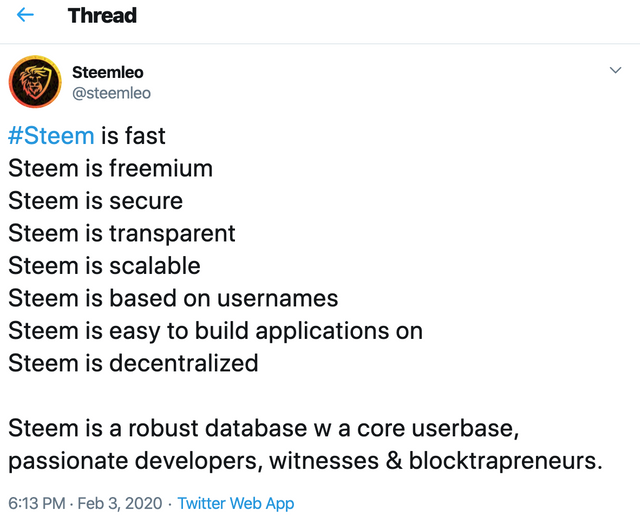

The future is coming up fast, but on Steem we have non-fungible Tokens, so we could Tokenize these assets. We could sell the Tokens for 99% of Face value and buy them back in 3 months. The Tokens are secured or collateralized by a loan default smart contracts. The securitizing smart contracts are standardize template software available on github. Similar to how Steem-engine platform tribes there are smart contracts components and simpler software coding components, with simpler being a relative not absolute term, as the software components require talented developers to create.

This I believe is the future and the future is coming up fast. @aggroed

“Steem is where the ball is going” @theycallmedan

✍️ written by Shortsegments

Shortsegments is a blogger or writer on the Steemit platform, where writers, photographers and video bloggers, along with other content producers get paid for posting their content.

Read other articles by @shortsegments on the Steemit Social Media Platform, where writers get paid for their content by the community by upvotes worth the cryptocurrency, called Steem.

Read shortsegments blog on the Steemleo investment Blog

Here

Please follow @shortsegments Twitter Feed

Please follow @shortsegments Twitter Feed

Steemit Steem

Steemit is a decentralized social media platform on a blockchain called Steem.

A very important difference between Steemit and centralized platforms like Facebook, Instagram or YouTube, is that there isn’t a central authority or owner to take your account away from you and your account can’t be deleted. You are the owner of your account. Find out more at this** Link

Steem Onboarding helps you apply for an account and is a series of videos which explains how Steemit works. You don’t need to understand everything about the blockchain to post content and our Onboarding help is available in six different languages.

Posted via Steemleo

$trdo

0.13696088 TRDO0.09130725 TRDO curation in 3 Days from Post Created Date!Congratulations @avare, you successfuly trended the post shared by @shortsegments! @shortsegments will receive & @avare will get

"Call TRDO, Your Comment Worth Something!"

To view or trade TRDO go to steem-engine.com

Join TRDO Discord Channel or Join TRDO Web Site

0.13696088 TRDO from below listed TRENDO callers:

Congratulations @shortsegments, your post successfully recieved

To view or trade TRDO go to steem-engine.com

Join TRDO Discord Channel or Join TRDO Web Site

@break-out-trader this is the most detailed info i have read about fractional lending...thanks for educating people like me....

Posted via Steemleo

Thank you for the compliment. I appreciate the engagement and I am happy you found it useful.

Please feel free to resteem.

this is an amazing write-up...

Posted via Steemleo

Thank you, I appreciate the compliment and I am glad you liked it.

Yes. I am studying the logistics of Tokenization on Steem and creation of the Credit Facility.

This video suggests that the Bible describes small particles which make up all things and are part of Hids creation of the Universe. Do the Bible is in agreement with science.