How dire would this crypto bear market be? Has it bottomed?

Source: Bitcoinist

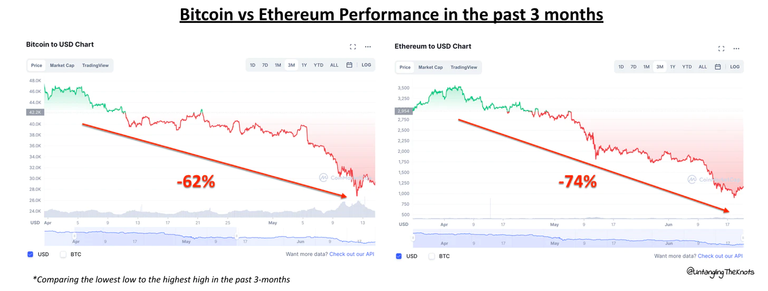

The market has seen a continuous decline since Apr. BTC/USD has dropped from $46,674 to as low as $18,084 in just two months while ETH/USD saw a steeper drop from $3,517 to as low as $921.

Source: Coinmarketcap

With such a continuous drop of more than 20% during a prolonged period, usually within the 2-month time period, it is no doubt a bear market in the making.

In this bear market that many dubs the “crypto winter”, we have seen the crash of the infamous Terra to the rebuilding of Terra 2.0, the freeze and speculation of the liquidity or insolvency problem of Celcius, and as of recent the possible insolvency of one of the biggest crypto VC, Three Arrows Capital (3AC).

If you have not heard what has happened to Terra, Celcius, and 3AC, here are some references for you.

- read about the Terra Luna crash here & the rebuilding of Terra Luna 2.0 here

- read about Celcius's halting withdrawal which poses the assumption of Celcius facing liquidity problems here

- read about Three Arrows Capital, a crypto hedge fund company that failed to pay several loans and is predicted to be on the brink of bankruptcy here

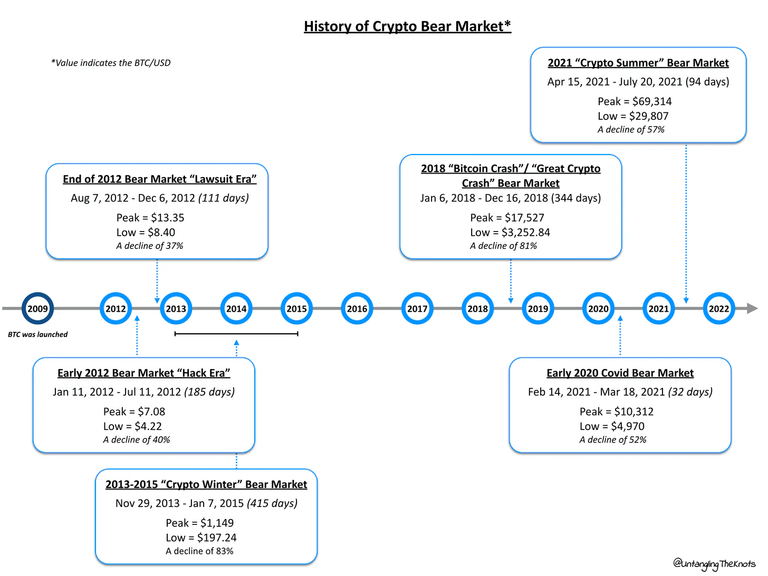

However, this is not the first time (and definitely not the last time) that the market has seen a bear market. In fact, the market has survived multiple bear markets with the latest happening back in the year 2018 and a mild one in 2020 and 2021.

Historical Trend of the Crypto Bear Market

Historically, we have seen multiple bear markets in the crypto space since Bitcoin was launched in 2009. Some are milder versions whereas some are harsher bear markets like the “Crypto Winter” bear market that happened in 2013-2015 and the “Bitcoin Crash or Great Crypto Crash” bear market back in 2018. The term Crypto Winter was popularized since the 2018 bear market and is commonly used to describe the longer-term bear market.

Partly in reference to Mosaic Network

Interestingly, the lowest low (of the BTC price) during each bear market supersedes the previous low, and some even surpass the previous peak.

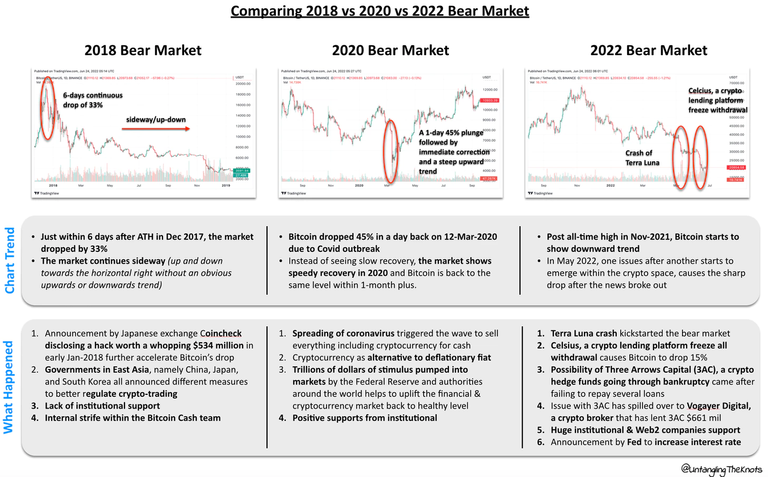

A lot equates the current bear market to the 2018 bear market. However, what is worth noting is that there is some similarity with the 2020 bear market, whereby both happen during coronavirus.

Putting these three bear markets side-by-side, it will be easier to compare how the 2022 bear market differs from the 2020 bear market or even the 2018 bear market.

A quick recap on what has happened in 2018, 2020, and 2022 bear market

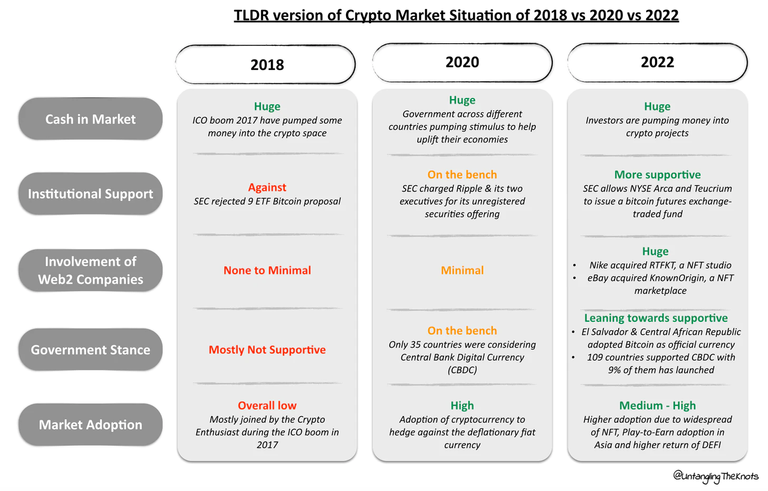

Here’s a simplified TLDR comparing some essential key factors that will possibly make 2022 onwards the year that makes crypto more mainstream and accessible.

Predicting the Future?

The uncertainty throws many individuals off their feet as prices across crypto tokens or coins dipped more than 50% in the past few months. Articles, polls, discussions, and topics surrounding price prediction and questions on how long would this bear market would last start to emerge as a way to curb the uncertainties that stem from this.

Volatility becomes the key theme as we see seemingly stable companies, projects, and crypto tokens fail, and with it, goes our trust and money. The job cutting across companies like Coinbase, Gemini, and BlockFi does not help either, in fact, it magnifies it.

Pessimism gets enlarged at the time of downturn similar to how optimism seems to be overly boosted at the time when everything is in the green.

The irony of news headlines and people warning of the crypto crash as if now is the end of the crypto era every time a bear market happens is rather amusing. Market correction in itself is a healthy indication albeit a painful one in order to flush out any overly bloated project or projects without real problems to solve.

While there is no way we can predict the future, the closest we can get is injecting the probability or statistics framework into the current trend with the historical trend as a reference.

One of the most commonly adopted probability frameworks is none other than the normal distribution. If this does not ring a bell, then perhaps the visual below would strike some chords.

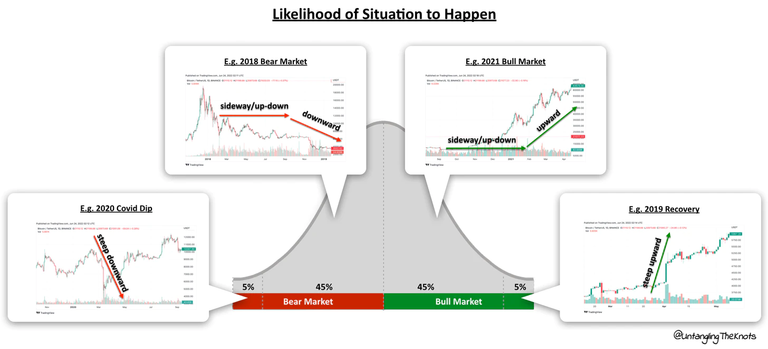

Cobie, in his Probabilistic Thinking article, touched upon 4 case scenarios of the possible trend in the coming months (or years) during the short bear market that happened from May 2021 till July 2021 which saw a drop of 49% from its all-time high (ATH) to its all-time low (ATL).

The visual below succinctly summarised all of the key points mentioned in his article, but with the showcase of real case examples from the past few years:

Assigning the top 4 most possible case scenario to the current situation to better evaluate what would happen in the coming months

As such, this is a broad view using the concept of probability for a situation to happen, which does not take into account various unforeseeable situations that may change the % of the likelihood of one situation happening.

This probabilistic thinking is important in blocking out noises and allowing emotional influence to be at its minimal.

Before That, Let’s Take a Step Back

Having a side-by-side comparison between 2018 versus the current bear market, we positioned ourselves embracing the harsher bear market as pessimism ensues.

That was from the bigger picture point-of-view.

What about the crypto community? Are they still in the space or have they left running to take their safe cover somewhere else?

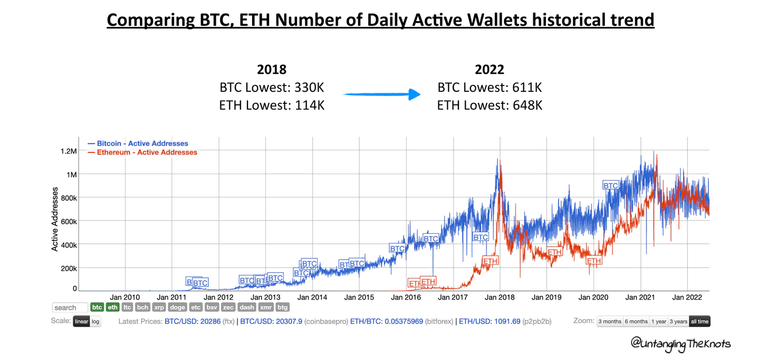

1. Active crypto wallets are the best indicator to see if users are still in the crypto space

Credit: BitInfoCharts (Data as of June 22, 2022)

The lowest number of active wallets this year (2022) exceeded the numbers in 2018 a lot more, with the number of active Ethereum wallets showing 6 times the 2018 figures, and the number of active Bitcoin wallets showing 2 times.

This is an indication that the users are still in the crypto space & in fact, there are more users now compared to the year 2018.

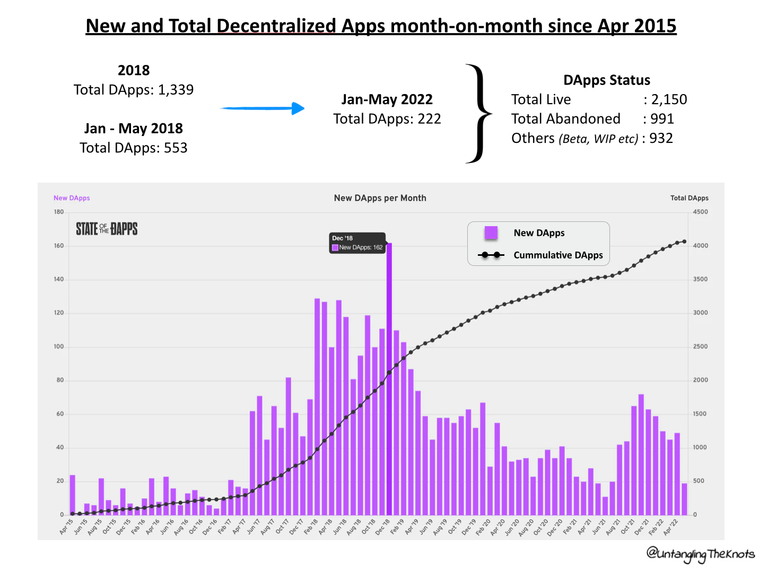

2. The number of DApps (short for Decentralized Application) is another indicator of what is happening in the space but from the perspective of builders.

2018, albeit an insane bear market year, proved to be the best time for DApps to emerge. The bear market proved to be the best time for builders to be building quietly behind the scene.

2018 proved to be the year most DApps emerged. Credit: State of The Dapps

Recent news reportedly made an assumption that the bear market might last for two years as the Bitcoin halving is approaching in the year 2024 (approximately May 24, 2024).

Hold On A Second, What is Bitcoin Halving?

Bitcoin halving is the event when the amount of Bitcoin awarded to miners becomes halved every four years until Bitcoin supply is depleted since Bitcoin has limited supply. With every halving happening, the limited supply of Bitcoin and the same or higher demand for Bitcoin will push Bitcoin price higher.

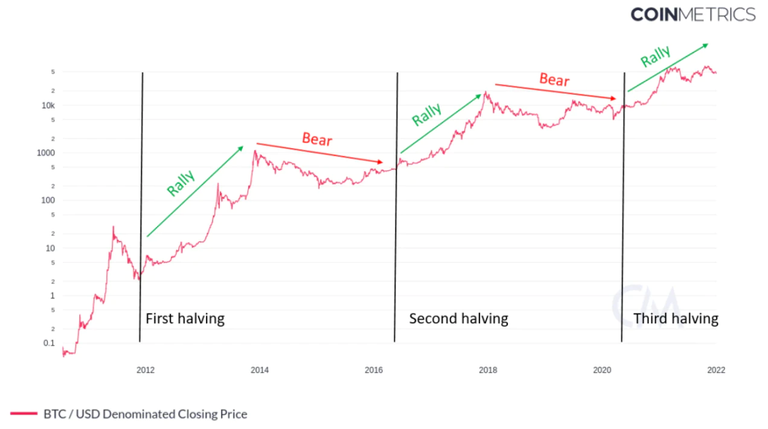

Visual trend on BTC movement after each previous Bitcoin halving. Currently, Bitcoin miners are awarded 6.25 BTC but in the 4th halving, they will be awarded 3.125 BTC. (Picture credit: CoinMetrics)

With a total of 64 halvings and right now we are at the 3rd halving, there are few references to point to with a strong valid reason that halving will rally the price of Bitcoin and even the crypto market upwards. Theoretically, it works because:

In reality, it is more complex than that.

1. Bitcoin Halving is reflected in the current pricing (Efficient Market Hypothesis - EMH)

This should work like the supply-demand relationship, in which Bitcoin halving will likely positively impact the price. However, Bitcoin is less mature than the other financial instruments from which EMH is derived from, therefore it is less likely Bitcoin halving has been reflected in the current pricing

2. Bitcoin Halving is not reflected in the current pricing (Chaos Theory)

If Bitcoin Halving has not been reflected in the current pricing, we can zoom out to identify the few key parties that have the most potential in affecting the Bitcoin pricing.

- Hodlers - long-term believers who will hold or sell at the peak and accumulate at the dip

- Opportunists - newcomers who are keen to dabble into the space and attracted by the upward trends but sell at the dip

- Miners - accumulated Bitcoin from the mining work and the selling of their Bitcoin holding will impact the price movement.

What Does The Bear Market Has Got To Do With Bitcoin Halving?

The news is saying that this round of bear market may be harsher than the 2018 bear market and they are predicting that this time, the bear market might last till 2024 because when it reaches the time when Bitcoin halving happens, the presumption is that the crypto market will rally upwards, hence ending the bear market.

However, there is no way we can predict and know where the market is heading and how long it will last.

Having an understanding of the probability of events that will happen and staying vigilant toward any changes that happen will help to give a clearer picture of what is going on.

The Bear Market In The Making

Of course, it never feels good to see the valuation of your holdings halved or see Web3 projects/startups fail one after another.

The ripple effects from Terra & 3AC are yet to be in their full-fledged state but the domino effect has started, as the Terra issue spillover to 3AC which in turn affects companies that have exposure from these two i.e. Celcius & Voyager Digital.

Perhaps the silver lining lies in the fact that the bear market helps distinguish the crypto projects that are solving the real problems from the others.

“The wipeout in the crypto market could actually be good, similar to how the dot-com burst wasn’t the end of internet companies” - Raphael Schoen in The Pomp Letters substack

As a builder, it is the best time to build and prove that you have what it takes to grow your company or project far and beyond.

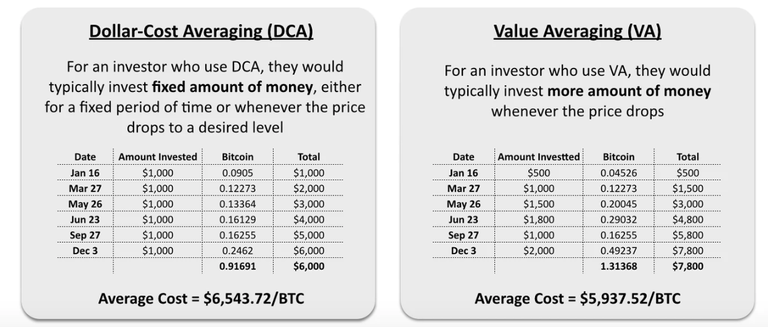

As a non-builder, there is no other time than the bear market to learn, to equip yourself with necessary skills or knowledge, and of course, for those who are keen to accumulate tokens at a lower price, you might want to understand how Dollar-Cost Averaging (DCA) and Value Averaging (VA) works.

An explanation of how DCA and VA work

“When you are in the bear market, you prepare for bull market. When you are in the bull market, you prepare for the bear market”

TLDR

The current market is rather volatile, as we see prices of cryptocurrency down more than 50% and various issues pop up one after another (Terra Luna crash, Celcius halt withdrawals, the potential of 3AC bankruptcy, and crypto companies like Coinbase and Gemini laying off people).

Officially declared as the bear market, this results in the decline of interest towards NFT, and overall lower market sentiment.

The inflationary macroeconomics factor and the hike in interest rate by the Fed add to the dire situation.

Price may drop.

Companies may fail.

People may disappoint.

Technology, however, will never.

Disclaimer: This is not financial or investment advice, please do your own research & evaluate your risk appetite before investing.

This post was first published in Untangling The Knots Substack publication, an original publication by Siaw Hui.