This is the second biggest "Bank"ruptcy after Washington Mutual in 2008.

If you haven't checked out this article, it is worth a read: https://www.cnbc.com/2023/03/10/silicon-valley-bank-collapse-how-it-happened.html

- I also wrote a piece as the market action was ominous yesterday: https://peakd.com/hive-167922/@slhp/so-it-begins-bank-run-silicon-valley-bank-crashed-60-nasdaq-sivb

Silicon Valley Bank did not even "open" today at the bell...

- It was "pending" news, then later in the morning the "Regulators took over the bank"

- Silicon Valley Bank clients were lining up to get the "money out" (sorry it's too late), and the bank even called the cops!

- Ironically Jim Cramer was touting SIVB as a "great investment" one months ago

- Side track a bit, "inverse Cramer" portfolio would have done very well #lol

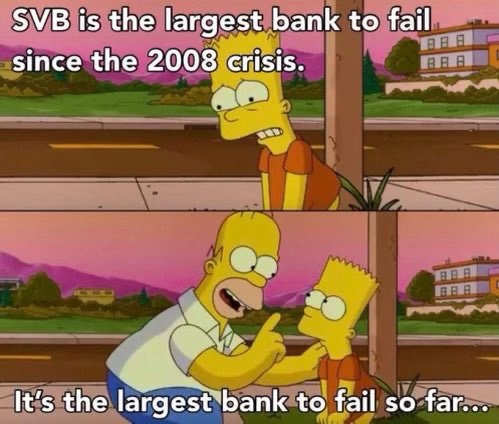

So what's next? This meme...

- The Simpsons have been "foretelling" upcoming events for decades

- Obviously someone else created this meme, but it may not be too far from the truth, unfortunately we will only be able to confirm or reject after all the dust settles

What we have learned from the 2008 The Great Financial Crisis...

.. is to watch out for contagion

- FDIC only insures deposits up to $250k

- 97% of clients have deposits greater than $250k, consider them lost

- FDIC is probably also "insolvent" to cover all the lost deposit

- Who's going to write off this loss? The depositors? Or the taxpayers? Or another bank or banks to take over Silicon Valley Bank including all its liabilities? Or will Elon Musk come to the rescue and have Twitter buy out this failed bank?

- Whatever it is, the impact will be felt quickly and deeply if nothing is done by Monday

The impact is wide spread

- There will be bills unpaid - if your bank goes under, how are you going to pay your bills? If your clients are impacted by Silicon Valley Bank and unable to pay you, how are you going to pay your employees and bills? Now imagine the entire downstream impact...

- Even if most are able to recover some of the losses, without government intervention many could be days or weeks to become insolvent themselves and many businesses will have no choice but to cease operations

Crypto Market Impact - USDC

- Binance already paused USDC to BUSD conversion

- Coinbase also paused USDC to USD conversion

- Circle disclosed they have $3.3 billion worth reserve stuck in the Silicon Valley Bank (out of $40 billion), is Circle solvent? Does USDC have enough money to cover this potential loss while keeping the USD peg?

Meanwhile, insiders have cashed out SIVB weeks prior

- When the ship is sinking, the rats pull out fast

- CEO of Silicon Valley Bank cashed out million prior to this collapse while urging depositors to "stay calm" #lol

- There are other executives who also cashed out weeks prior

This is a domino that may trigger the financial reset if not managed quickly

History is in the making, again, yet it rhymes. Feels like we are repeating as if we haven't learned enough from the previous crashes. This time is usually not so different, we are taking it to a new height, and not in a good way.

A responsible Fed will intervene, bail out, and stop raising interest rates, as this event could lead to systematic failures. Unless that's the intent.

Silicon Valley Bank holds significant deposits from the crypto industry, more may come forward in the coming weeks and disclose their exposures.

Posted Using LeoFinance Beta

USDC recovered mostly. Circle will cover the loss from corporate fund.

Bailout incoming maybe.

How the mighty fall…