Week 12: Options and Dividend Summary

For week #12, I made a small profit this week as I was prepared for more pressure due to the banking crisis. This week's big news was all eyes on the FED and what the FED says.

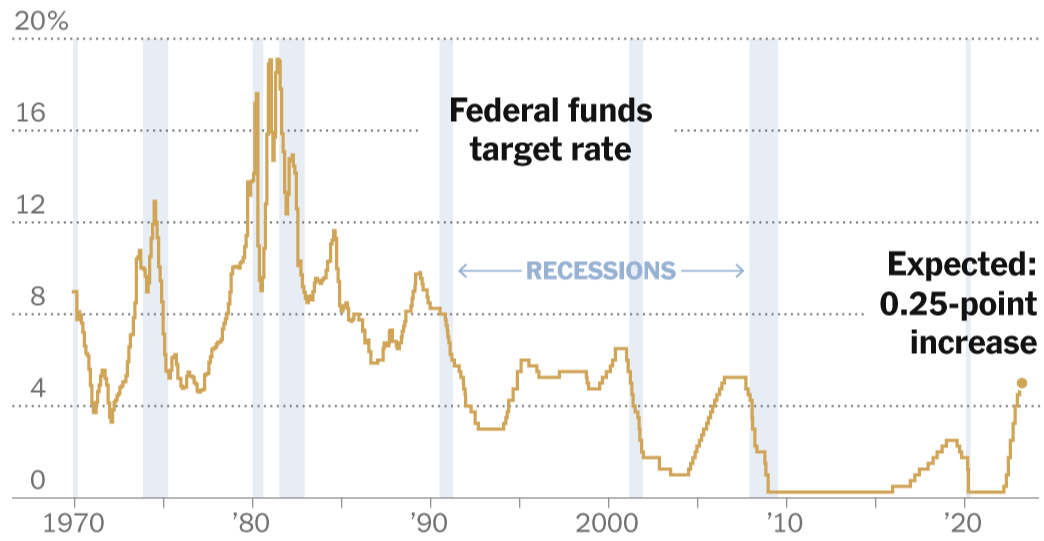

On Wednesday, the FED increased the rate by .25 basis points, suggesting that the HIKES are nearing an end. Inflation remains high, and there is still pressure to "slow" down the economy. The hardest part of this is the balance between the two extremes. To slow the economy, things like LAYOFFS and BANK CRISIS can help you do that. The problem is those are not SOFT LANDING events and have a bigger negative effect.

How did I play the markets this week?

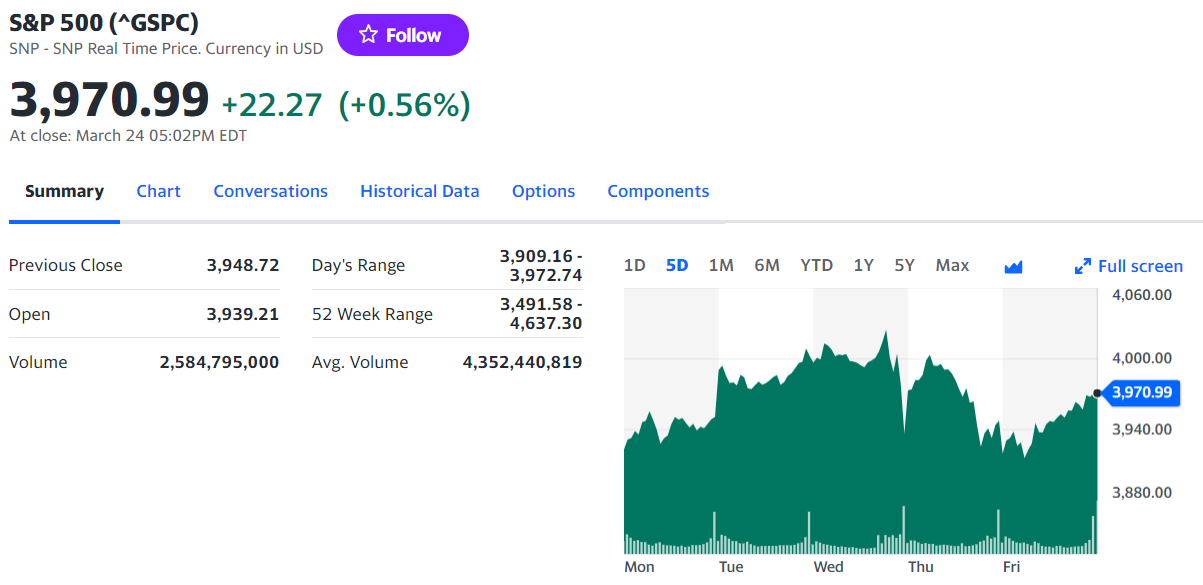

The S&P 500 was positive for the week! Some increases in volatility can be a problem for the options trader, especially if you are on the wrong side of the market move.

Dividend

For week #12, I got $88.90 in passive dividends. That is much lower than the previous week. What matters is the amount I'm collecting per year, not the specific week I receive the payment.

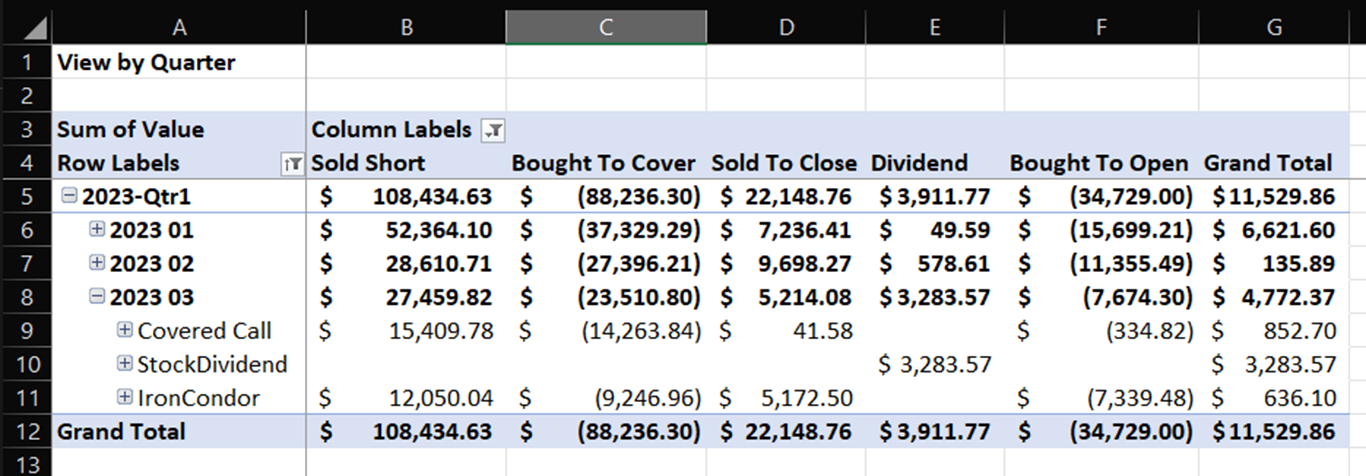

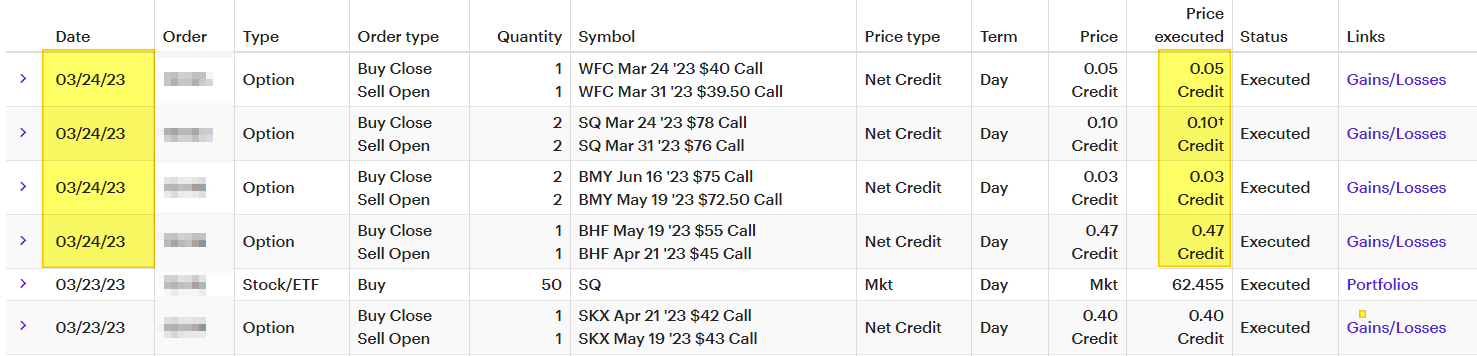

Options Trades Summary:

- Dividend $88.90

- Options $224.37 (profit).

- Added 50 Shares of Block (not on this Pivot table).

- 26 Options Trades this week (not on this pivot table).

Looking at the data, I can see I made a small profit. I needed to roll UP and OUT my covered calls because the market was rebound. For my Iron Condors, I did nothing but wait. I let THETA DECAY do its magic, and I will wait some more before adjusting or closing those positions. Many of them are JUN 16 or JUN 30, which gives me plenty of time to sit and do nothing right now.

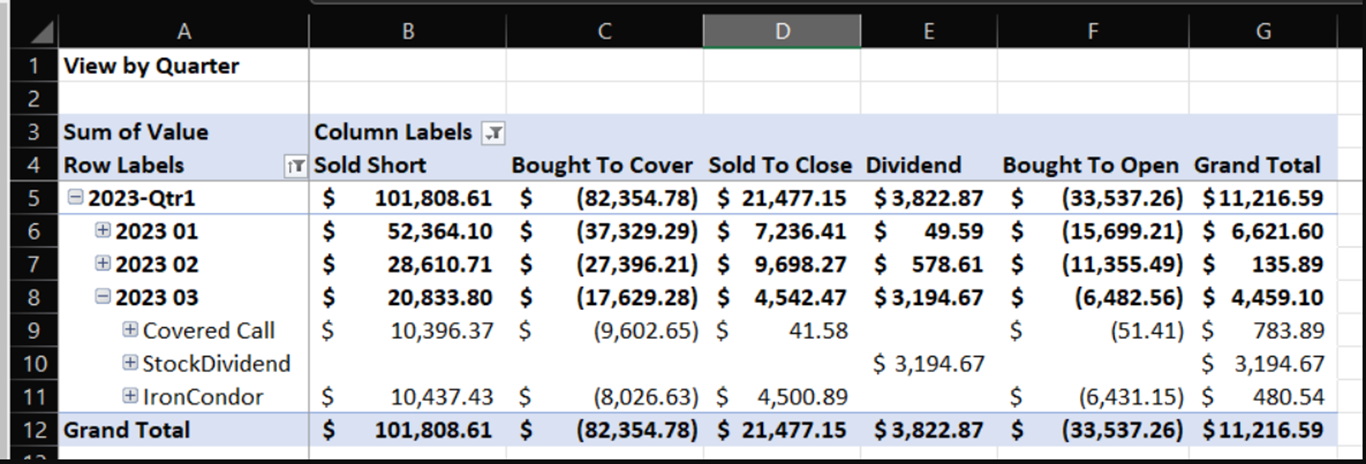

Week #11 Data

Week #12 Data

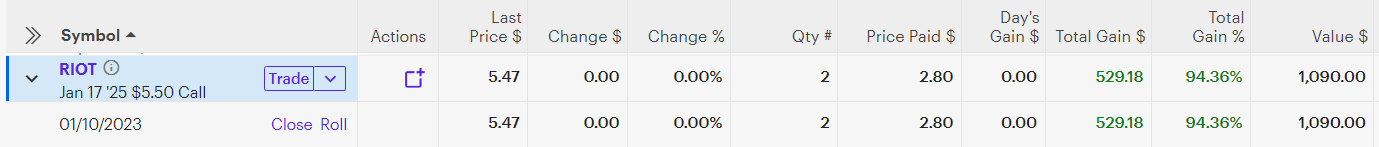

Early this week, I posted this on social media. You can see I added 50 shares of BLOCK to my holding. I still bet that BTC will continue to rise into 2025.

I also have a LONG CALL OPTION on RIOT for Jan 2025. If RIOT can trade at $15, $20, or $25+, I will make a decent return on Bitcoin moves. Many think BITCOIN will pass 50K or even hit a new ATH and go to 100K for the FIRST TIME. If that should happen, I have positioned my portfolio to take advantage of any BULL run on BITCOIN.

Remember, this is not financial advice.

There is just some of the moves I'm making for my portfolio.

You should never copy or risk money you can't afford to lose.

This is for educational purposes only.

Solving-Chaos!

Posted Using LeoFinance Beta

Posted Using LeoFinance Beta

The rewards earned on this comment will go directly to the people( @solving-chaos ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Which broker do you use for options solving-chaos ? I may try some

Posted Using LeoFinance Beta

My Options Trading Screens are from ETRADE.

TD, Fidelity and others have good platforms for options trading.

Congratulations @solving-chaos! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 50 comments.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out our last posts:

Support the HiveBuzz project. Vote for our proposal!