Week 27: July 2 Investment moves

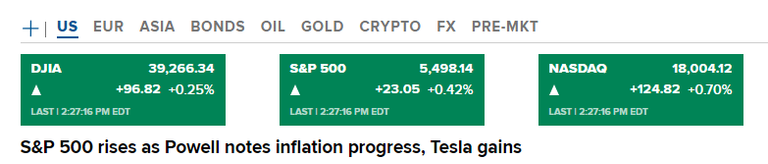

- July 2 US market conditions @ 2:30 pm EST

- July 2 Option trades

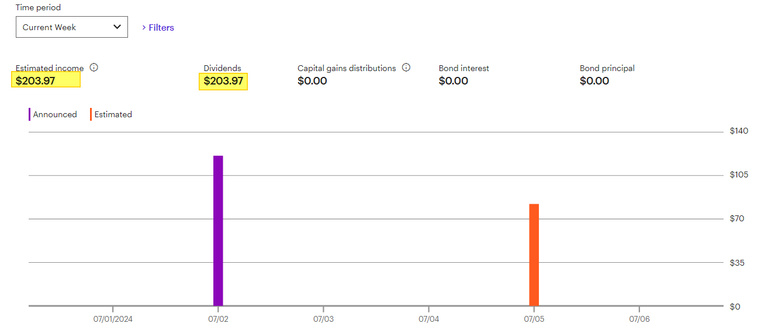

- Week 27 Passive Dividends

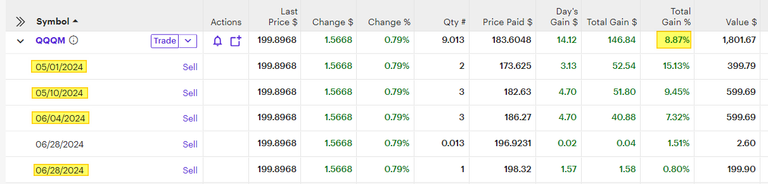

- Selling Dividends --> Buying QQQM update.

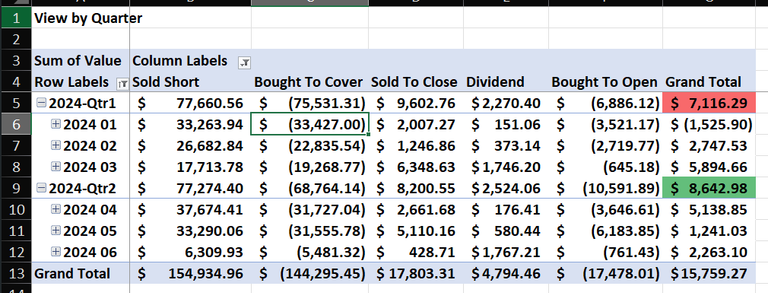

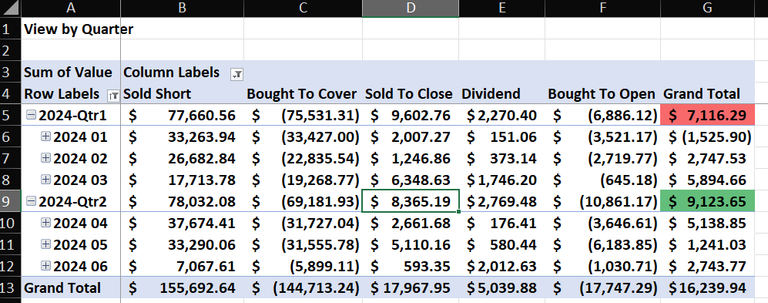

- Option Summary as of Q2 2024

July 2 US market conditions @ 2:30 pm EST

The US markets are green and the trends continue to be "strong" when you look at the last month, last 3 months, and the last 6 months. This is good for all 401K/403B investors out there.

July 2 Option trades

Here are my options trades for July 2 (in yellow highlight). Since I did not post on July 1, I included the trades from yesterday.

Summary:

- Rolled RIOT Covered call down for more premium ($3)

- Rolled F Covered call up and out for $6 each.

Bitcoin dropped to $62k-$63 recently and RIOT shares have been downtrending since April. I have been using this to adjust my options position to ensure I still collect premium on the covered calls (CC) and the cash secured put (CSP).

Week 27 Passive Dividends

This week's dividend follows another week around the same payout. Getting between $200-$300 a week is a good target to aim for. There are still some weeks where it is less than $20. Timing of dividends payout can vary and you should not pick STOCKS based on what week/or month it pays out the dividends.

Most people care about the monthly payout (if you are using this for retirement) but I most care about the yearly payout amount.

Selling Dividends --> Buying QQQM update.

For those that have been reading my previous posts, you will notice I have been selling some DIVIDEND stocks after the dividend reinvestment occurred. I explained that I'm doing this as a "portfolio rebalancing". I wanted to reduce some boring dividend stock holdings as those continue to grow since I have reinvested the dividends for over 10 years.

Using the proceeds, I started a new position in QQQ on May 1, 2024, and currently up 8% in two months. I'm using the concept of Dollar Cost average (or a different flavor) based on the dividend payout.

What makes this feel like a "random" event, is I only apply this rule to a few dividends that I get:

- 1- If I don't want any more shares of a boring dividend stock (ie: Ford, BMY, GILD, etc).

- 2- If I believe my individual holding is too large. Then I will decide if I only sell what I get or if looking to reduce the size of that holding.

- 3- If I believe having QQQ will be better than having the safety of the dividend stock.

Option Summary as of Q2 2024

The end of Q2 2024 is here and I wanted to share it with you. All my trade data is copied from ETRADE and pasted into an EXCEL table. Then I use a PIVOT chart to display my TRADES in a way that helps me track the results.

Here is what it looks like from week #25

Here is what the final Q2 (week #26) looks like:

What you should notice:

- I made a profit last week (week #26).

- I made a profit in June 2024 with $700 from options.

- I made a profit in Q2 2024 of 9K, which is more than Q1.

- The last time I had a losing month was Jan 2024 (with a -$1525 loss).