Week 47 - Nov 23 Summary

- Week 47 Summary

- #Bitcoin Price/Moves

- PEAK 2025 Bitcoin Cycle? Should you sell?

- Selling Method 1 - Time-based (1%)

- Selling Method 2 - Return-based (10%/20%)

- What are the differences after 2025 PEAK?

Week 47 Summary

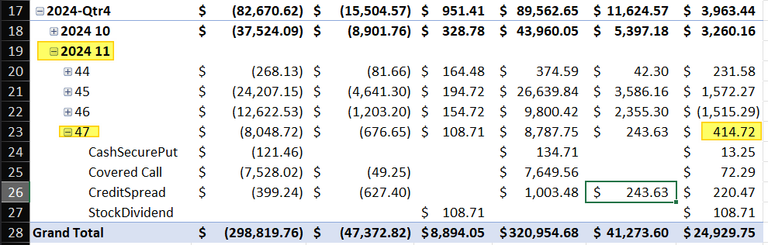

This is my options/dividend tracker for 2024 showing data by weeks.

This week SP500 moved up 1.6%, which is within the "expected move". So as an option trader who mostly used "selling" of options, this was a decent week.

Week 47 option/dividend profit was $414 (with ~$300 from option trading).

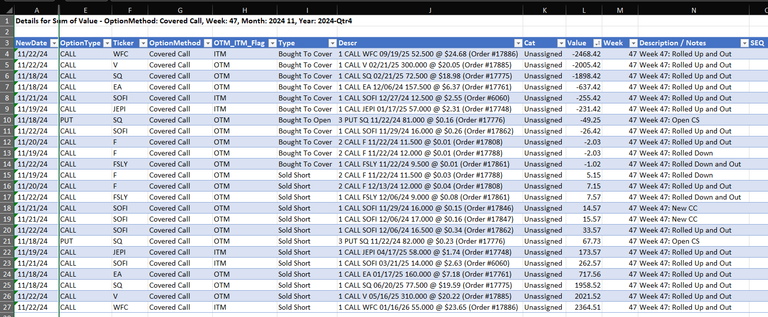

#Coveredcalls were a mixed bag. I had 2 covered calls that I rolled UP and OUT because they were ITM (in the money). I plan on keeping JEPI and WFC is deep in the market due to the recent move. I need to continue to roll the STRIKE price up on Wells Fargo before I decide if I want to exit that position.

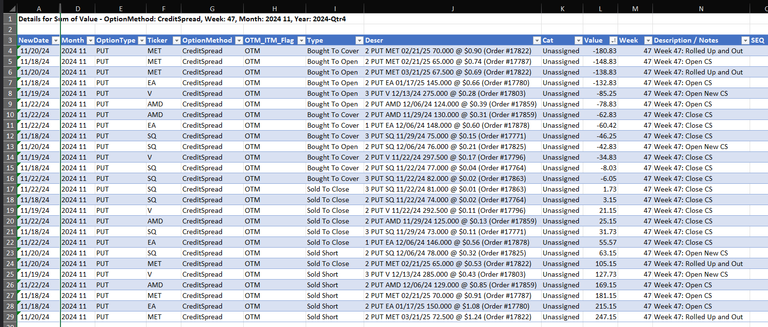

#Put Credit spreads were all OTM since the markets were mostly GREEN this week. I use credit/profits from PUT credit spread to help offset or pay for any adjustment on the CALL side (like the covered call or IRON condor). This week was a decent week on the "shorter term" PUT credit spread that I had open.

The things I need to pay attention to:

- #SQ is moving up faster and higher than I expected so far.

- #AMD is moving down, and close to my Put credit spreads.

- #SOFI has come alive lately. I added two covered calls recently.

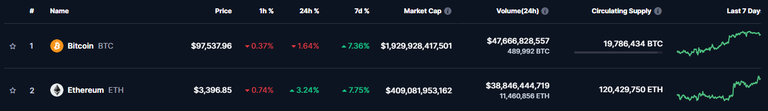

Bitcoin Price/Moves

The big news this week is Bitcoin moves to 98K.

Four years ago, on Nov 23, 2020 -> I created a #Facebook post about #CNBC Free Zoom Message on Live TV. If you see the segment, it was on Bitcoin (trading at 18K).

Since that time, Bitcoin has run up to 69K (Bitcoin hit a record $68,999.99 in November 2021) before entering its bear market cycle. During that time, there was plenty of time to get back in before the START of 2024.

Bitcoin 2024 Highlights:

- BTC Spot ETF starts on Jan 11, 2024, with 10 different FUNDS.

- 5% of all Bitcoin is now controlled by these 12 or so ETFs.

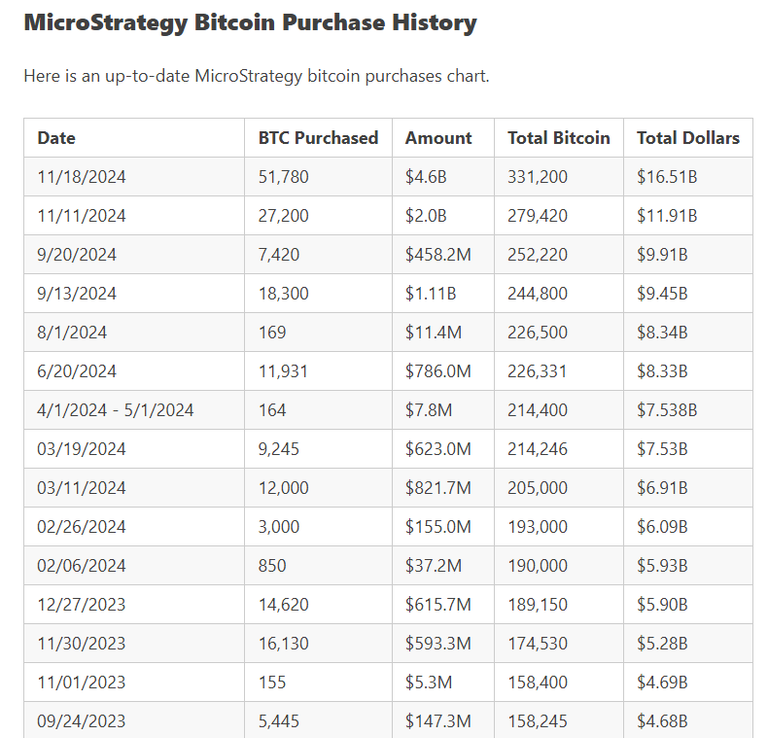

- #MicroStrategy controls over 331,000 bitcoins.

PEAK 2025 Bitcoin Cycle? Should you sell?

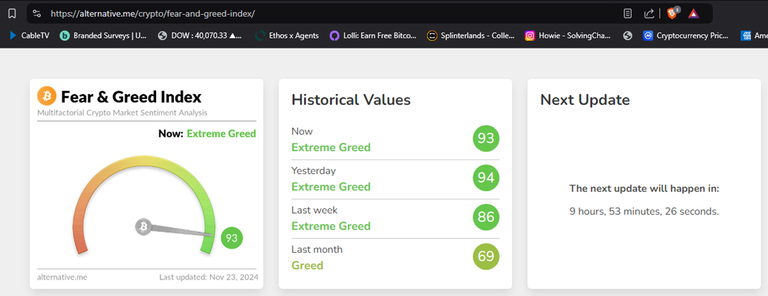

FEAR vs GREED Index:

The markets are near their PEAK/TOP with the GREED at over 90 the last few days. How long will this last?

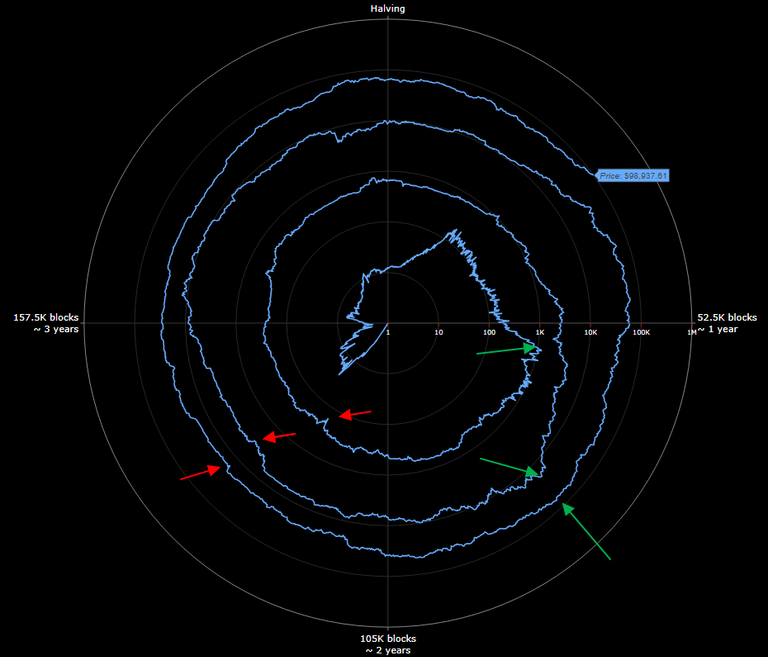

A well-known pattern of Bitcoin is the 4-year cycle. Some folks like the circle chart because so far it has never crossed paths in this pattern (the lines are 4 years apart).

This version of the chart uses the HALVING on the top. The last BTC Halving is on April 2024. History has shown that the "PEAK ALL TIME HIGH" is between 12-18 months the last halving.

Today, we are only 7 months after the last halving and we have moved from 80K to 98K recently. With the PEAK scheduled to happen between April 2025-Dec 2025, many are starting to wonder if this will happen sooner in this cycle.

Why do we care? History has painted a picture of selling near the PEAK ATH during that year, giving you plenty of time to re-enter the POSITION. The green across is the PEAK in 2013, 2017, 2021. We would expect the PEAK on the CURRENT cycle to happen in 2025 (based on the prior cycle GREEN arrows).

The red arrows were the previous cycle LOWS, which generally happens with a year of the PEAK ATH of that cycle. This is interesting to know because you have about two years before the next peak, and there is plenty of time to get back in.

Selling Method 1 - Time based (1%)

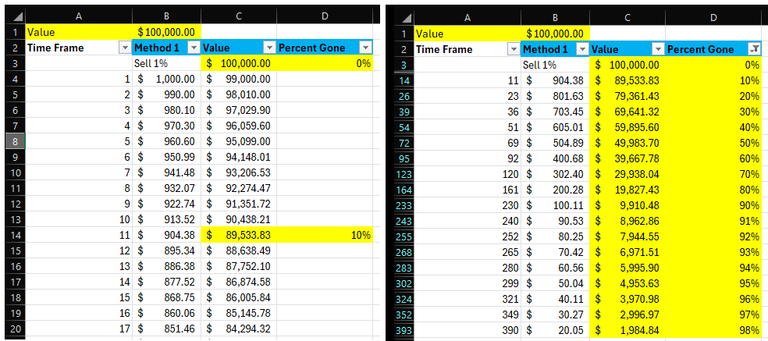

On the other side of things, let's look at some of the methods you can use to SELL your position. We will use a sale of 1% each time (per day, per week, per month).

In this example, the price is not a factor. If you use this method, it only takes 36 days to get rid of 30% of your bag and 69 days to reach 50%. The problem with this method is we assume the peak is going to happen within the first 30 days. After that, we already got rid of a big piece of our holdings.

One way to modify this is to replace the "TIME" event with a new ALL TIME HIGH event. You can look at no more than one ATH event per day. That can solve getting rid of the holdings too early. The issue with that logic is what do you do with PEAK ATH (or knowing if you missed it).

Selling Method 2 - Return-based (10%/20%)

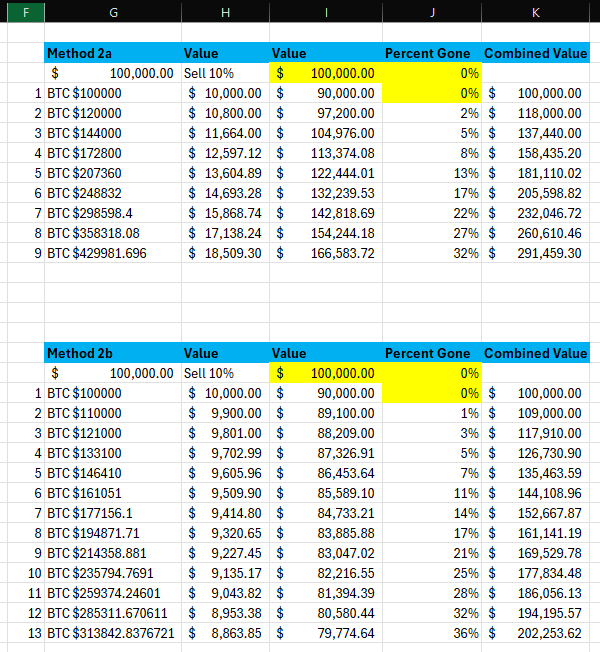

In this SALE method, we start off selling 10% each time.

In example 2A, the next time we sell is when the asset gains another 20%! The goal is to get rid of BTC each time it reaches certain milestones. The value of the remaining asset will continue to be worth more until BITCOIN reaches its PEAK ATH. Once we enter the BEAR market, you need to use this data

In example 2B, the next time we sell is when the asset gains another 10%!

The difference is there are more events on the UPSIDE, meaning that it should have a higher percentage gone, so it is a bit better at "peak" sales (before knowing) when the peak is.

Remember that the issue is you don't know when something has peaked or if another ATH is coming next week. No matter what sale method you use, most people can't time the peak.

Buying the DIP is just as complex as SELLING into the PEAK. If you track the data, you need to make sure each tranch you are buying is below the selling price at the time of the trade. The problem here is in the PAST with 60-80% correction, this was much easier to do. Going forward, it might be very hard to time the reentry as prices are lower. If the trading ranges narrow, it might be hard (or impossible) for some to get back in at a cheaper price.

What are the differences after 2025 PEAK?

In the past, it was only RETAIL investors that jumped ship after each PEAK. Since 2020, there have been more and more CORPORATE entities holding Bitcoin on their balance sheet. This is also one of the main BENEFITS of SPOT BTC ETF trading on Jan 11, 2024. Blackrock, Fidelity, and others now control about 5% of all BITCOIN, and that number will continue to grow as long as INFLOW continues to the SPOT ETF.

Things to consider in 2025-2026:

- The trading range will be narrower than in the previous cycle.

Don't expect an 85-90% drop from PEAK ATH. - Will institutional investors also have the HODL view? Or will they drive the volatility?

- More 401K/403B plan investors? This depends on the plan administrator. What about changes to the Target Retirement FUNDS? What if they all have 1% or 2% exposure to Bitcoin?

- The Gary Gensler SEC is gone, but is it enough?

Have a profitable day!