Here are my Investment moves for today:

What is covered in today's post:

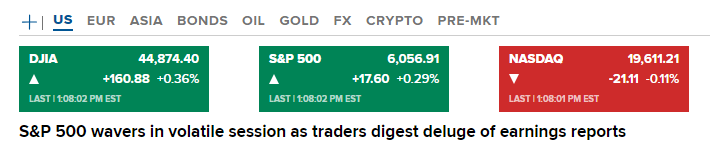

- Today's Market Current condition

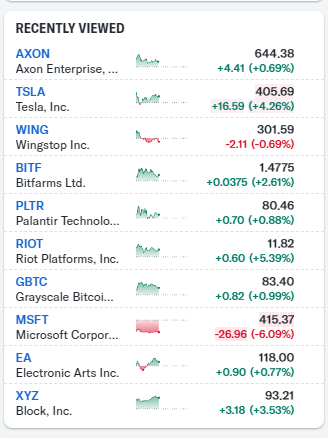

- Today's Jan 30 Investment moves (1:15 pm EST)

- This week's #5 dividend

Today's Market Current condition

A lot of stocks I follow (or own) is GREEN for today.

Today'sJan 30 Investment moves

Summary of my trades as of 1:15 pm (EST)

Here are the trades again:

The #options trades are as follows:

- Rolled V #CoveredCall up and out for $42 credit. I gain $1000 if my Visa stock stays above $320 in Sept 2025.

- Added Call #CreditSpread to an existing Put Credit Spread on Visa. I collected $15 for each contract.

- Added Call Credit Spread to an existing Put Credit Spread on MRVL. I collected $12 for each contract.

- Added Call Credit Spread to an existing Put Credit Spread on RTX. I collected $23 for each contract.

- Rolled MARA put credit spread down and out one week for $7 each.

- I closed the BMY for $17 each.

- Open new Iron Condor on BMY for $25 each. (Which has a lower Put Strike price).

- Added Call Credit Spread to an existing Put Credit Spread on GILD. I collected $34.

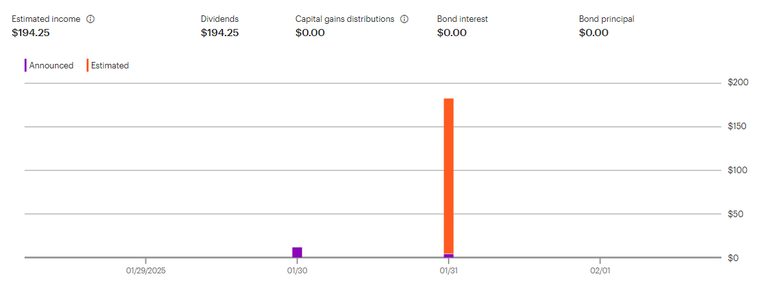

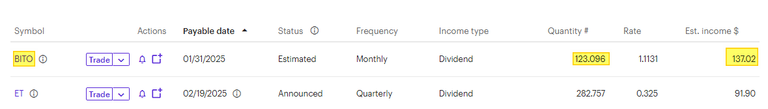

This week #5 dividend

This week's dividend payment is shown as:

That dividend is from BITO, a dividend #Bitcoin ETF. Since I have it on reinvest #dividend, it will purchase more BITO on its own. This holding can have a negative (or declining) NAV price movement because the yield is north of 40% per year. In a year like 2024, where BITCOIN was up nearly 120%, you might not see the erosion of the NAV.

From a portfolio point of view, I don't think I need to do any selling or transferring of assets around this week. I will wait for other dividends that I will receive in the coming weeks to do that.

Have a profitable day!

Posted Using INLEO

Here are my Jan 31 Investment moves:

Enjoy and have a profitable weekend!

Here are my Jan 31 Investment moves:

Enjoy and have a profitable weekend!

I'm surprised that rolling an in the money covered call (visa) by $10 still pay you $42 credit. Sound like you can win in both ways!