Week 6 (2025) - Feb 6 - Investment moves

- Current Market Conditions as of 1:00 pm (EST)

- Feb 6 - Trades

- Dividends to Bitcoin asset rotation

- 401K Update - Feb 5

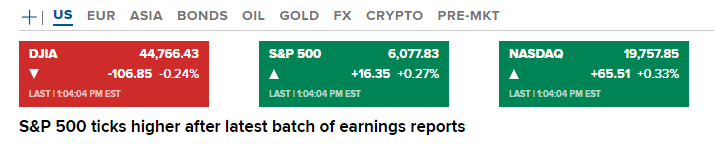

Current Market Conditions as of 1:00 pm (EST)

This is how the market is moving as of 1 pm. If the markets stay flat, I will make money on the TIME DECAY from my options.

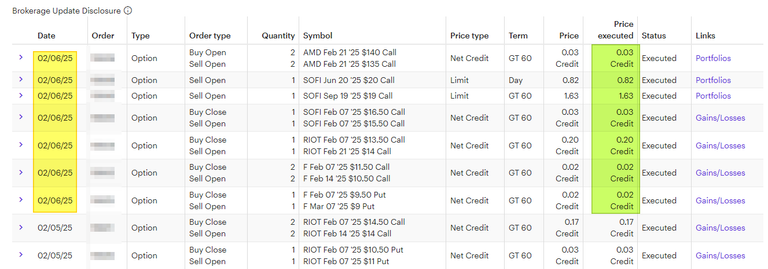

Feb 6 - Trades

Mostly Option trades for today:

- Added Call Credit Spread on AMD for only $3 each.

- New Covered call for $82.

- New Covered call for $163.

- Rolled RIOT covered call for $20.

- Rolled F covered call down and out for $2 each.

- Rolled F cash secured put down and out for $2.

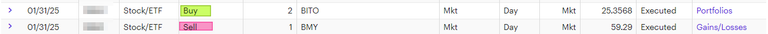

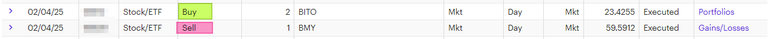

Dividends to Bitcoin asset rotation

I was getting a dividend payment so I ended up selling before the dividend hit my account. The reason is as long as I owned the STOCK on EX-Dividend Date, you can sell the stock prior to PAYABLE date and the dividend will still come to me.

And:

Since I knew how much was coming in, I sold only the amount of Stock that was less than or equal to my dividend value.

Then I use that CASH to buy BITO -> a future contract that follows the Bitcoin Price movement.

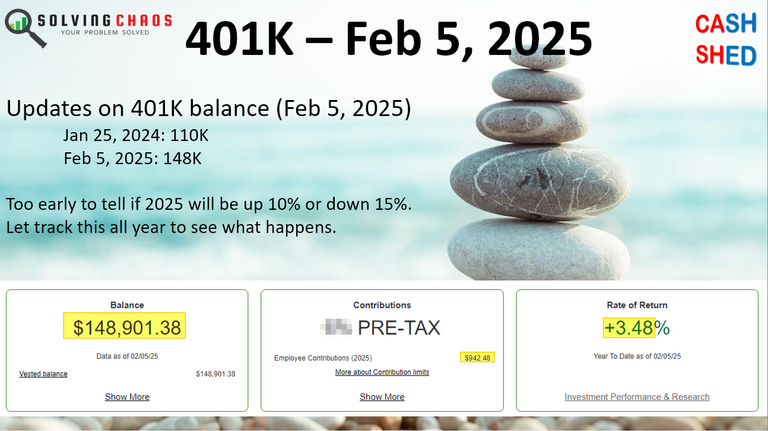

401K Update - Feb 5

Here is my 401K update. The value has not moved since the last time I posted this data, even with a few hundred dollars more in contribution for 2025. The reason is the market has dropped a bit.

Have a profitable day!