Week 7 Feb 12 - Investment moves

- Current Markets

- Feb 12 investment moves

- Hot Stock: PLTR (Buy, sell, or HOLD)?

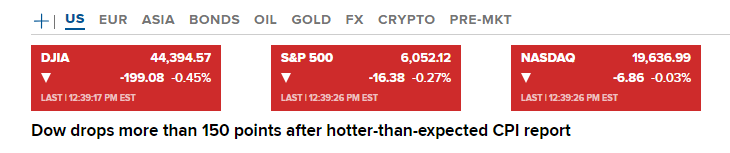

Current Markets as of 12:40 pm (EST)

Red markets today:

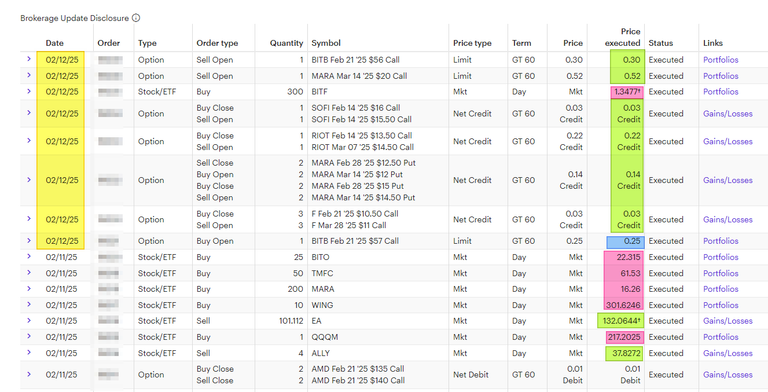

Feb 12 investment moves @ 11:30 am (EST)

Here are my trades so far today at 11:30 am. The market was mostly down and I needed to adjust some of my positions.

Summary:

- New Covered call BITB for $30 (using 56 strike price)

- New #MARA Covered calls for $52 (using 20 strike price)

- Buy 300 more shares of #BITFARMS. I think Bitfarms can trade between $4-8 in a few years if they can move with the price of #BITCOIN.

- Adding risk to my #SOFI covered call for $3.

- Rolled my #RIOT covered call up and out 3 weeks for $22.

- Rolled the MARA put credit spread down and out for $14 each.

- Rolled the #F covered call up and out a month for $3 each.

- BITB was a mistake. This is a long call, but I was trying to do a covered call. I will close this position tomorrow.

- Yesterday I sold EA and ALLY stock and I purchased BITO, TMFC, MARA, WING, and QQQM. This is part of my rotation that I have been talking about for the last year.

Hot Stock: PLTR (Buy, sell, or HOLD)?

I own #PLTR and I want to consider trading out of this position. Why? Look at the 1-month return of over 70%. In the last 6 months, there was over 290% return. My return is at 216%!!

This is not my only investment in PLTR. I own more shares at even lower COST BASIS in a different portfolio.I purchased some shares right between the #SP500 index inclusions. Has this run up too far and too FAST? How often do you toss in 50 x $37 (or $1850) and now is valued at over $5700?

This is the reason why I wanted to ask: Buy, Sell, or Hold?

- Buy: If you don't have exposure to AI or want PLTR shares.

- Sell: If you want to lock in Profits and reduce risk in the holding.

- Hold: If you believe there more room to run up.

Have a profitable day!

Posted Using INLEO