Polygon's MATIC has shown huge development over the course of the last week. At first having a hard time, the altcoin has since gotten a move on, effectively unbelievable key opposition focuses. The new increase in MATIC's worth caught negative brokers by pushing past the fundamental obstruction sign of $0.9. In any case, with the expansion in financial backers hoping to exit on benefits, there is rising worry about a potential withdrawal. This present circumstance puts the focus on bullish dealers to check whether they can keep up with the ongoing vertical pattern.

60K Addresses Get ready For A Selloff

In the beyond 24 hours, the cost of MATIC encountered a hearty meeting, crossing the significant $0.9 mark. However, the flood was brief because of financial backers trading out, which prompted a slight plunge in MATIC's cost. Harmonizing with this occasion, information from Coinglass uncovered that short positions adding up to more than $1.4 million were exchanged when the cost flood countered the negative wagers.

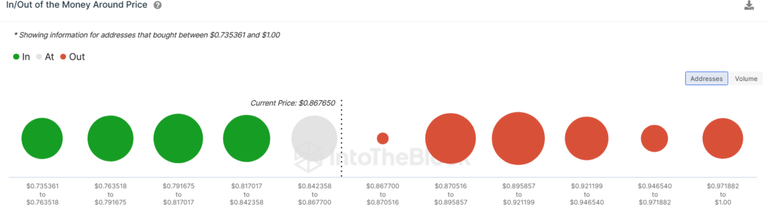

Yet again in any case, on the off chance that MATIC's cost endeavors a move above $0.9, it might experience expanded negative energy. As per IntoTheBlock, roughly 63,500 addresses are right now unbeneficial in the $0.87 to $0.95 cost section. Strangely, since MATIC last exchanged this reach in May, it recommends that these holders might have procured their MATIC during this span, flagging a possible auction zone where they could look to make back the initial investment assuming MATIC arrives at that zone once more. This could flag the finish of their understanding as MATIC's unpredictability has moderately been bring down this year.

Moreover, whales are showing benefit driven conduct by purchasing in during value plunges and selling at top qualities. Following the expansion in MATIC's cost to $0.85 on November 9, there was an observable reduction in the volume of enormous exchanges from a high of $357 million.

Presently, as whale exchange action spikes over again, coming to $252 million, it recommends that one more fruitless endeavor by MATIC to break over the $0.9 limit could prompt huge liquidations among these enormous financial backers. This can affect bulls in keeping a vertical force.

What's Next For MATIC Cost?

MATIC's flood picked up speed in the wake of taking off past the $0.85 mark, despite the fact that it is presently experiencing obstruction close $0.93. This recommends that dealers are dynamic close $0.9. As of composing, MATIC's cost exchanges at $0.89, flooding more than 5.6% as of now.

Bulls will get tried close the $0.82 level. Should the cost hold energy close to that level and trigger a bounce back, it could flag the strength for one more flood past the $0.93 opposition. A fruitful break over this level could affirm a twofold base example for the MATIC cost, setting a bullish objective of $0.976.

On the negative side, a downfall underneath $0.8 could prompt a backup to the $0.68 level. A critical pullback to these levels would show that MATIC might stay inside the merged scope of $0.6 for quite a while.