No longer a news that the crypto market is indeed running bearish run bitcoin still struggles to rise above the 30grand in June. This move led traders to buy the dip hoping the sharp decline would be followed by a bullish movement. Although there has been a quick retrace, with the coin trading close to $40k, bitcoin is still failing to meet most traders’ and investors’ expectations (experts and noobs) altogether.

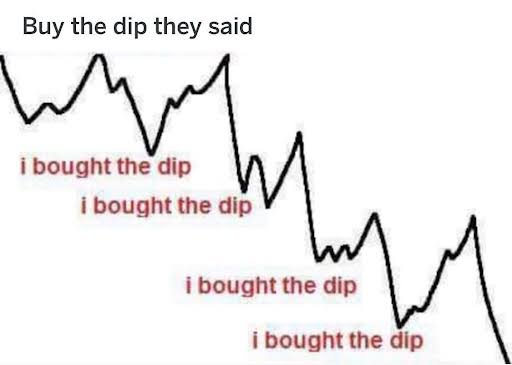

Many who bought bitcoin when the price dropped in May would have made a slight seeming profit on their investment as at the time when the price traded at a threshold of $40k. However, a sizable amount of these traders would have decided to hold on to the coin with strong hopes that it is embarking on a journey to its glory days. Seeing that the dip is continued, many crypto investors and traders are in a panic mood as bitcoin is still witnessing setbacks at this point. The big question in the hearts of many is; do we buy the dip? Or just cut the losses?

Buy The Dip, What Does This Mean?

Buy the dip, a term used when a trader decides to accumulate more of an asset when it is experiencing a price fall. Take an example, buying bitcoin now because the value has dropped almost by half of its all time high (ATH) value, this is “buying the dip”. It is quite believed that this term is only unique to a bearish market, it is not.

The highs and lows in a bullish market also presents its dip. Some traders even believe it is better to buy the dip in a bullish market when the trend is experiencing an ‘upward’ movement. Bear in mind the profit from buying the dip in a bullish market is not always as huge as when you buy the dip in a bearish market.

Buying the dip has its risks such as not being able to predict if the price decline or bearish trend is about to end in the current price or not. Entering the market at the wrong time might just lead to a loss.

Buying the dip seems to be a strategy to introduce newbies into the market because now that the price of the asset has dropped massively from its all-time high price. The bear market is the best time to also learn how to buy bitcoin.

Cut Your Losses

Cutting losses is a term that means selling an asset at time when its prospect are no longer feasible or futuristic to protect your portfolio and avoid losses. A decision to sell some bitcoin holdings because of the drop in price is referred to as cutting your losses. To most investors whose minds are pegged on long-term, cutting losses isn’t the best thing to do in a bearish market, they believe holding (Hodling) is the best way to accumulate more assets hence they are prone to buying the dip.

However, selling might just be the move to save you from skinning your portfolio or even losing all your investments on a coin on its way to being extinct.

Diversification

Diversification is a term used when exploring other options in the cryptosystem. The bear market offers you the option to explore other options by diversifying your crypto investment portfolio and buying altcoins known for solid used case with great growth potential. Now instead of putting all eggs in one basket, you can decide to increase your chances by buying these altcoins.

Instead of selling your bitcoin due to the price fall, you can sell part of your hodlings to acquire other assets. By doing this, you are reducing potential losses bound to happen when the price of bitcoin dips even further.

Prior to the bear run, a lot of businesses were beginning to adopt as well as people learning how to buy bitcoin. This meant the interests in the assets increased sporadically. However, the dip has in some ways discouraged newbies who found them loosing in their new found interest and just newbies but frustrated traders had to sell their assets and cut losses.

To some of these folks who experienced losses, buying bitcoin at the now might be a dumb decision but those long-term Hodlers know better due to their firsthand positive experience of buying the dip. The value of Bitcoin could still dip further down, but a good history of price recovery makes buying the dip a venture that could pay off.

Once upon a time people bought the dip in 2018 now, they have a good story to tell about the asset. Not a financial advice but now is the best time to buy the dip as well as regard other options of altcoins.

Posted Using LeoFinance Beta

Buying the dip has always been one of the most successful strategies when it comes to investing in any asset and so with the crypto.

Personally, I use the method of increasing investment as we go down, like invest 10% at the dip of 5% and increase it further as we go down more.

Posted Using LeoFinance Beta

Would you advice this for all altcoins besides the bitcoin and Ethereum...?

Posted Using LeoFinance Beta

If you are looking to invest, DCA should be the factor to consider, and never invest all at once.

I apply DCA and profit booking strategy for all of my investment either it is BTC, ETH, or any other altcoins and also in stocks.And it has always helped me to build better portfolio. Also it reduces the stress:

I have made separate article about it, You can check it out here:

CLICK TO READ IN DEATILED

Posted Using LeoFinance Beta

Congratulations @spirall! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 30 posts.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Look who’s back! Oshey!

Posted Using LeoFinance Beta

Hahaha... Good to be back.

Posted Using LeoFinance Beta

this has really helped me to see things in a different way, as I thought that if the price fell and I bought I would lose my money, but I see that it is not so bad after all, I bought a lot of cub when it was at 0.50 cents and now I have earned 50% of what I invested, as well as other altcoins that I hope in a few months will give me good results, but I am still thinking ahead.

Posted Using LeoFinance Beta

Accurate for all investors stepping into the waters of any investment. Think ahead, sacrifice what we have at hand now to grab what's ahead.

Kudos sire

Posted Using LeoFinance Beta

I completely agree, right now there are some interesting altcoins at a very attractive price.

Posted Using LeoFinance Beta

Someone said against Forex which is about 40years of age, the Crypto market is still young, his words "in its formative age".

If this is true, I wonder what 30-40years from now would be looking like, already there are constant profits here and there all that's required is due diligence in personal research.

Posted Using LeoFinance Beta