Here’s how you can invest $10000 in 2020 into well diversified portfolio yet not so over diversified!

Everyone has been aspiring to be a millionaire, some get there some find it difficult and some are on their way to a million dollars. Further down in the next 5 to 10 years, we’ll have more millionaire than ever! You can too be one of them!

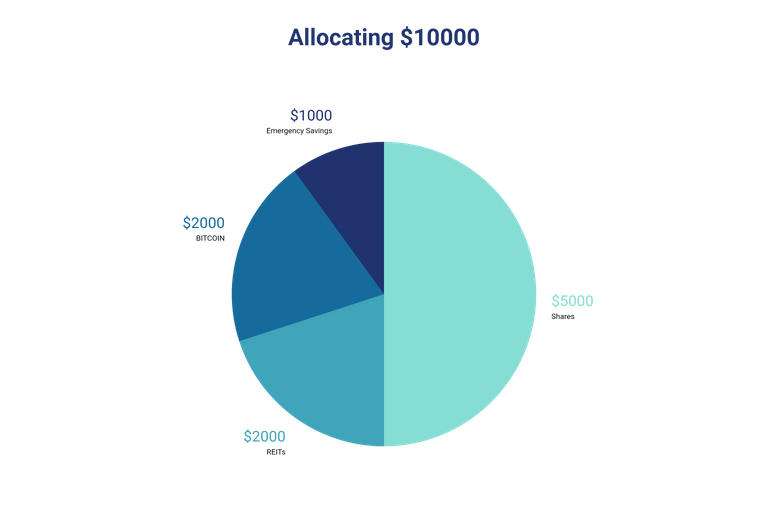

Allocating $10000:

This is probably worth 6–12 months of savings. And if you managed to save it or have it invested somewhere, excellent!!

Here’s how we will allocate your $10000.

Shares — $5000 (50%)

The only reason Bezos is the richest is due to Share Market. One has to understand that share market has more money than the GDP of USA.. Stock market is a place where people find opportunities to buy one of their favourite companies.

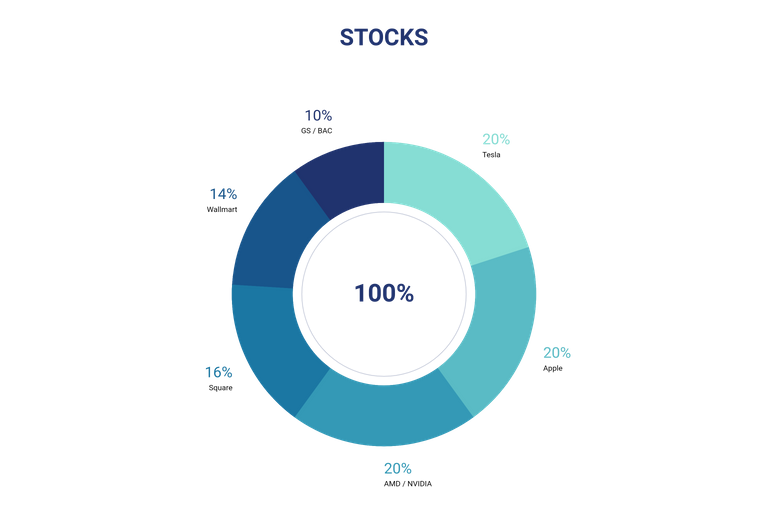

I will show you a rough idea as to how you can allocate your $5000 in shares. (Request you to do your research and invest in stock of your choice)

Tesla — 20%

Many of us have understood Tesla the wrong way! We have associated that Tesla is only a car company. The growth of Tesla is not only because they sell cars but because it’s a Power Utility / Distributor, Tech & Software and a solar energy company and has the lead in the battery technology..

Why Tesla: Tesla will soon fully master the autonomy of self driving cars. They also have a huge lead over their competitors. They also are the best EV car out there. This gives them the advantage of being able to compete with not just the car companies, but also Uber! Tesla once attains the fully autonomous driving, they can use their fleet to offer taxi services for way cheaper rates as there is no driver and the cost of electricity is cheaper than fossil fuels.

The company also has Tesla Energy under its roof which has also been growing every quarter. They also will be one of the top solar roof company offering stylish room tiles and ability to generate electricity. Users of solar roof and Tesla PowerWall electricity storage have also been earning by giving back the excess power to the community. The company has been expanding their energy business gradually.

They are also rapidly increasing their factories….!

Apple — 20%

Apple reached $2 Trillion as on 20th August 2020 and became the 2nd company after Saudi Aramco to reach $2 Trillion.

Apple is not only makes devices, but owns a whole ecosystem that keeps the users within it. Switching from the ecosystem is not easy once you have been used to to. And Apple has done it.

Apple is a brand of luxury, style and fashion. The company has been innovating and lead the way to new technologies. People who can afford an iPhone will go for the iPhone. Although the competition has started to increase, the company has positioned themselves as still the choice of brand of the celebrities and important people. Apple has been known for their security which other phone companies using Android lack.

Apple as a company will always be amongst us. The company’s growth is driven by the higher spending of today’s generation and they will drive the revenue of Apple even higher.

AMD / NVIDIA — 20%

These two companies are and will be a part of your computer.

NVIDIA is well known for their Graphic Card (GPU) amongst the gamers and is being actively used is almost all Windows based laptops. NVIDIA also started data centers which as of Q2 has proven to be more profitable than the GPU business.

If a gamer needs GPU, it’s either NVIDIA or AMD. They are the biggest players in the industry and will continue to be due to their innovation leads.

AMD on the other hand has been rising up from the scratch. It’s success story would require a whole new write up.

Under Lisa Sue, AMD has taken lead of the CPU business from it’s biggest competitor “Intel". The company also has been catching up with NVIDIA in the GPU market with many of the recent laptops featuring AMD GPUs and CPUs.

Square INC — 16%

We all have heard of Cash App. It’s owned by Square INC.

Square INC is payment gateway and a technology company. The company has grown 10 folds from the time they started. They not only are helping people to make safer transactions, but also helping the business owners by making their collections easier.

With the help of Cash app, the company has created a whole ecosystem. If you have the Cash app, and Starbucks has the Square POS, you can use your Cash app to make seamless transition.

The company also offers loans to the business owners who use their POS and has added stocks to their Cash app in order to empower the users to make investment.

Walmart — 14%

There is no need for me to tell you what Walmart is and what it does.

The reason Walmart is here is due to the fact that it is one of the biggest retail chain in the USA. The company also is one of the biggest revenue generator.

Recently the company started it’s e-commerce platform that is in head to head with Amazon! Although Amazon is the biggest e-commerce platform, Walmart has no major threat from them. With the help of Walmart’s e-commerce, they can deliver within a few hours due to their large number of retail outlets and they are present in every corner of USA. But Amazon has to source it from other sellers and ship it to you and it takes time.

Banks — 10%

There may be a bank you like which you would want to invest in, than you can do so. I only put an example of banks.

The reason why I said banks is because entire monetary system is handled by the big banks. They are the biggest custodian of USA’s $Trillion of dollars. And they will continue to be.

The banking sector will continue to grow in volume. They are also the biggest lenders. So if you want a piece of their money, you should invest in the banking stocks. (Chose the bank which is too big to fail)

REITS — REAL ESTATE INVESTMENT TRUST — $2000 (20%)

REITs: They offer you an excellent opportunity to invest in real-estate without having to actually buy one.

REITs own large portion of their investment in Real-estate and are liable to pay you from their rental income / earnings.

While stocks do not need to pay you dividends, REITs need to distribute 90% of their profits to the REITs share holders. This is an excellent way for you to earn additional income without and have an exposure to real-estate.

Your risk is not as much as it is with shares. And also the shares of REITs do not appreciate the way other shares of the companies like Apple do. Hence REITs are a safe mode of investment.

Bitcoin — $2000 (20%)

Bitcoin, well known amongst the investors for it’s exponential price growth over the decade. $1 invested could have mad you more than $100k if you had invested at the beginning.

This is not a share, nor a company. This is a decentralized currency that is not owned by anyone and neither controlled by anyone in the world.

There can only be as much as 21 million Bitcoins into circulation. And as of today, 1 Bitcoin is wort close to $12k.

Bitcoin will replace and disrupt the financial services in the future and it has the potential to.! Even Cash app has added Bitcoin. One day, you’ll be paying almost everything with Bitcoin.

You do not need to buy a whole bitcoin with $12k. You can also invest a fraction of your money into buying parts of a whole Bitcoin called Satoshi. Buy bitcoin and hold it for another 10 years and you’ll see the world adopt Bitcoin.

Save — $1000 (10%)

Just save it!

Thank you for reading!

All the images used are royalty free and free for commercial use. (Graph owned by the author)

The same has been posted on Medium and Blogger

Posted Using LeoFinance

Source

Copying and pasting previous posts or significant parts of it of could be seen as spam when:

Spam is discouraged by the community and may result in the account being Blacklisted.

Please refrain from copying and pasting previous posts going forward. If you believe this comment is in error, please contact us in #appeals in Discord.