Recently, I started trying my luck on IPO in the Indian stock market. The demands for some of the newly listed share pretty high. A high demand means higher listing profits. When the demand is huge, an investor would be like to try their luck to get some initial benefits. I tried on multiple of them, but alwsys ran out of luck. And when i tried to get first hand on some of them they locked at the upper circuit. A very awkard stance where an investor unable to buy the company share.

Today it was one of such day day for a newly listed company share. Mamta machinary got listed in the stock market with a huge margin. When I tried to buy few as soon as upon the listing happened, the shares were not available to trade.

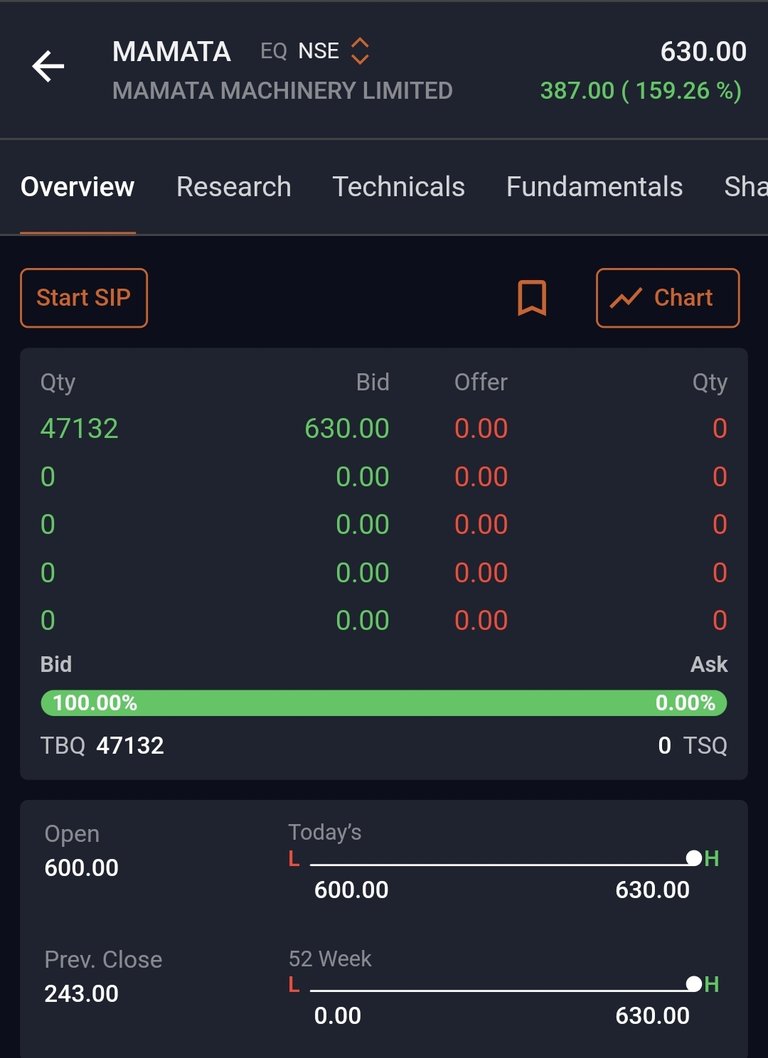

(screen grab of trading platform)

As you can, it was initially offered for INR 243, however it listed on INR 600 and within minutes it locked at INR 630. A huge gain of more than 159 % on the first day.

This may happen to any new share listing or even to an existing listed share.In the stock market, an "upper circuit" refers to the maximum price a stock can reach during a single trading day, while a "lower circuit" is the minimum price it can fall to on that day. Thhey are actually the price bands set by stock exchanges to prevent extreme price fluctuations and protect investors from sudden large losses or gains.

These circuits are designed to control volatility in the market by setting limits on how much a stock price can move in a single trading session. When a stock reaches its upper circuit, further buying orders cannot be executed, and similarly, when it hits the lower circuit, selling orders are restricted. The upper and lower circuit limits are usually expressed as a percentage of the previous closing price. If a stock hits its upper or lower circuit, trading may temporarily halt until the price moves back within the allowed range.

Initial Public Offer

IPOs often offer shares at a discount to their market value, which can lead to higher returns if the company does well. IPOs allow companies to raise money from new shareholders, even during economic downturns. However, IPOs can also be high risk investments. Market volatility can cause a drop in the market price of an IPO share, leading to capital losses for investors. IPOs also tend to deliver poor long-term returns for investors, and they generally underperform the broader market.

There are instances, when even after listing gives a good return. This is why I tried to buy some quantity after listing. But not all trade are fruitful. We must analyse the company fundamentals before investing. There is always risks and we must avoid them.

Peace!!

Namaste @steemflow

Posted Using InLeo Alpha

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating to @indiaunited. We share more than 100 % of the curation rewards with the delegators in the form of IUC tokens. HP delegators and IUC token holders also get upto 20% additional vote weight.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited..

This post received an extra 20.00% vote for delegating HP / holding IUC tokens.

IPO's can be really rough sometimes. Mostly because companies can be way over valued compared to what they are actually worth. Coinbase is a perfect example. The stock was hyped so much and the valuation of the company was so high that it really didn't have anywhere to go but down. The pandemic and bear market didn't help either, but it's always a risky proposition.

Very interesting article. Peace be upon us together.