Last time, I went to foreclose my loan account, I had to pay certain penalty on account of foreclosure charges. I was not aware of it, at the time of taking loan. This foreclosure charges are an extra burden for the loan borrower. However, today Reserve Bank of India provides some relief to the loan borrower by removing the foreclosure charges on amount borrowed on floating rate of interest.

Foreclosure charges are fees that lenders impose when a borrower repays a loan before the agreed-upon end date. They are also known as prepayment penalties. Foreclosure charges are applied when a borrower repays the entire loan balance in advance or partially. Foreclosure charges are usually a percentage of the outstanding loan amount. In short, the borrower has to pay a penalty to pay off their debt ahead of schedule. The exact amount depends on the lender's policies and the type of loan. Many lenders have a lock-in period of one to two years, during which borrowers can't foreclose the loan without paying a higher penalty.

It happens many a times that we get some source of fund in between the loan tenure and wanted to repay the loan in advance. This result in additional charges for the prepayment. Foreclosure charges negatively affect borrowers by adding an extra cost to the early repayment of a loan. When considering foreclosure, borrowers need to carefully calculate the charges against the potential savings to determine if early repayment is truly beneficial. The primary impact is that foreclosure charges eat into the interest savings that borrowers would normally achieve by prepaying their loan, potentially making the option less attractive.

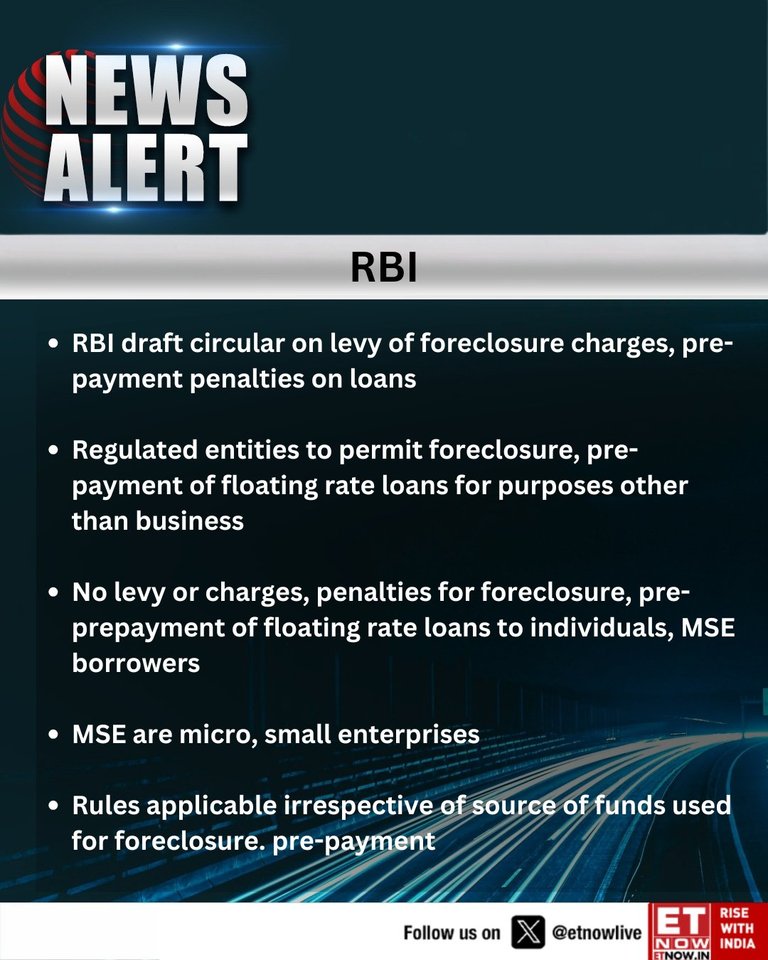

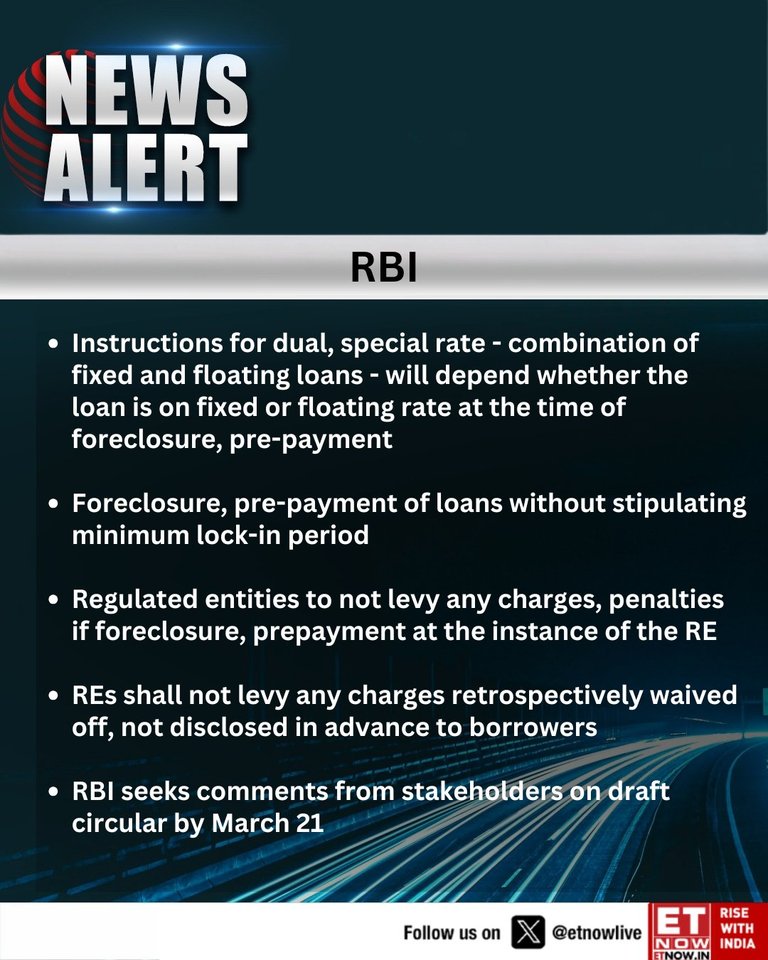

Providing much needed relief to the borrower, from the foreclosure charges RBI today has proposed to do away with these charges on all the floating loans. Here are the latest update on the issue as availavle over X / Twitter

|  |

|---|

Floating rate loans are also known as variable rate loans which fluctuates based on market conditions. This means that the loan's Equated Monthly Installments (EMIs) can also change. The Reserve Bank of India (RBI) has proposed removing foreclosure charges on floating-rate loans for individual borrowers and Micro, Small, and Medium Enterprises (MSMEs). The borrower would be benefitted with this step. Removing foreclosure charges can help borrowers by reducing their debt, improving their credit, and increasing their financial flexibility. Borrowers can reinvest funds that would have gone toward penalty payments into their business. They have some additional fund in hand which they can put in best use.

The circular is still in deaft mode and hope to see some better day for all the loan borrower. This step would bring smile on many borrower faces.

In good faith - Peace!!

Posted Using INLEO

At present there is no foreclosure penalty for home loan only and this extension is good initiative by the government to give some relief to borrowers