Earnings Season Kicks Off Strong

So, the earnings season has recently started, and it came in hot. The banks delivered great news, but with so much "noise" around us these past few days, we might not have given them the attention they deserve.

Bank stocks had a blast! Citigroup , Wells Fargo , Goldman Sachs , and, of course, JPMorgan exceeded all expectations. Even regional banks saw significant gains, showing that the positive sentiment isn't limited to the big players. This is further supported by the KBW Bank Index, which rose 3.3%, while the Regional Banking Index gained 1.3%.

A Boost for Banks

Let’s start with the strong positive vibe in the sector. With Trump potentially returning to the White House, markets are already trying to predict his moves. Based on his previous term, it’s clear that the financial sector has plenty of reasons to look forward to his return.

What would Trump even do? Early signs suggest he’s likely to continue implementing business-friendly policies, which would naturally benefit banks. Let me break it down.

Trump has hinted that he plans to further reduce regulations for businesses, especially in the banking sector. Fewer regulations mean lower compliance costs for banks and greater freedom to invest in areas like investment banking, capital markets, and lending.

Additionally, if he introduces another round of tax cuts, banks will be among the first to benefit—just like with the Tax Cuts and Jobs Act of 2017.

Generally, Trump tends to focus on policies that boost consumption and entrepreneurship, like infrastructure investments and offering tax incentives to companies. And where does all this lead? Naturally, to increased economic activity, which is great for banks because it drives demand for loans and other financial services.

And why is this such a big deal for banks? The answer is simple. Banks are the backbone of economic activity. When businesses grow and consumers spend more, banks issue more loans, manage more transactions, and profit from interest rates.

Add to all this the potential for increased flexibility due to reduced regulations, and the future looks bright for banks.

JPMorgan’s Stellar Earnings

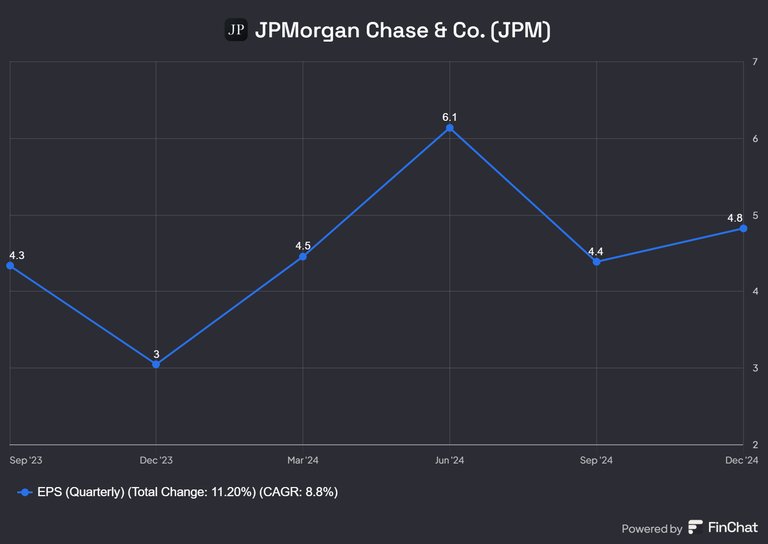

Of course, we can’t talk about banks without mentioning JPMorgan ), which, by the way, performed exceptionally well last quarter. Specifically, its earnings per share hit $4.81, far surpassing analysts’ expectations of $4.10.

And that’s not all, as JPMorgan is crushing it across the board. To be specific:

- Investment banking revenues were up by 49%.

- Revenues from trading rose by 21%.

- Assets under management exceeded $4 trillion. YES, $4,000,000,000,000!

What about 2025? you ask. The bank expects net interest income to reach $94 billion while continuing to expand in critical areas.

The future’s looking bright for banks, isn’t it?

Posted Using INLEO