Exxon Mobil

Increased Demand for Oil, and a Unique Investment Opportunity in Exxon Mobil

How are these connected, and why might this be the best time to act?

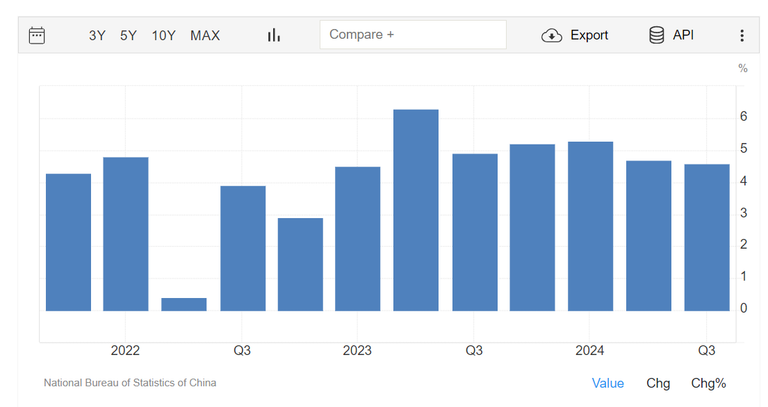

China

Let’s start with China. According to the latest World Bank forecasts, China’s economic growth is expected to hit 4.9% in 2024, and 4.5% in 2025. These numbers even exceed previous estimates, thanks to the government’s fiscal stimulus aimed at boosting demand and stabilizing the economy.

“Great, but why should we care about China’s economy?

Well, China’s economic resurgence isn’t just a local affair—it has massive implications for the global market.

Oil

China is the world’s largest importer of crude oil. See where this is heading?

As its economy bounces back, oil demand is expected to surge significantly. And as always, the markets have already reacted. Oil prices have been climbing, with Brent crude hitting $74.12 per barrel, and WTI reaching $71.31 .

Clearly, investors anticipate more support measures from China that will likely push demand even higher. Add to this the recent drop in U.S. oil inventories, and the stage is set for even further price increases.

The Investment

Now for the critical part: when oil prices rise, energy companies are the first to benefit. And my favorite player in the sector? Exxon Mobil

Why Exxon? Because it has exceptional management, is perfectly positioned in the market, and—importantly—is undervalued right now.

What does that mean for me? It means that Exxon Mobil is, in my opinion, a fantastic investment opportunity at the moment.

Based on all these factors—the Chinese economic recovery, rising oil demand, and Exxon Mobil’s strong fundamentals it's almost a certain win.

IBM

So, what’s the second bet? Well, it’s IBM

Of course, we start with the DCF (Discounted Free Cash Flow)! In simple terms, this model helps us estimate the fair value of a stock by predicting the company’s future cash flows.

According to the DCF, IBM’s fair stock price comes out to $310. That’s about 30% higher than its current trading price of $219.

Fantastic, especially since it clears the 10% margin of safety I always include. Based on the DCF model, the stock seems to be quite undervalued.

Something to consider in 2025

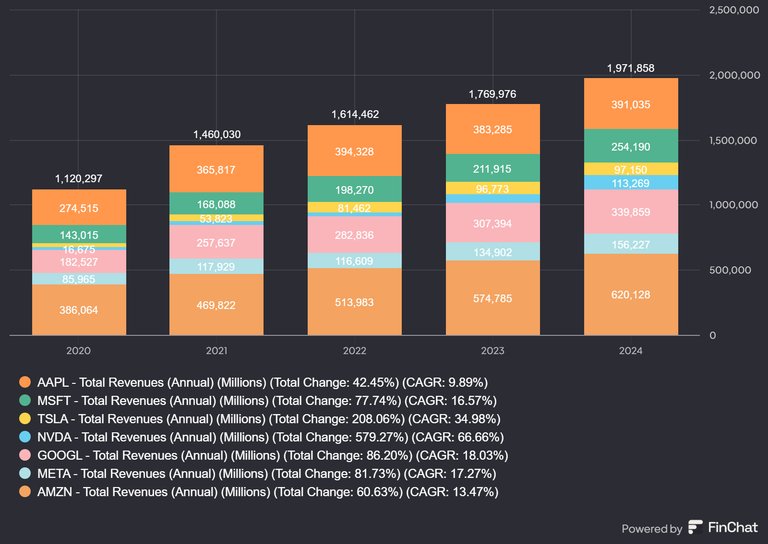

The US market strength is in the 7 Biggest companies.

The Magnificent 7 are truly… magnificent

Over the past year, their total revenue reached nearly $2 trillion .

In other words, that’s almost 2x what they earned in 2020.

Of course, this isn’t the first time the index has been so concentrated in the top 10 .

It changes over the years. And as impossible as it may seem, we likely won’t have the same top 10 a decade from now. Or maybe we will. No one can know for sure .

Posted Using InLeo Alpha

This is a very educative post to read, I love the fundamental and the breakdown. It is very much understandable.

Thanks for sharing

Thanks mate I hope it helped you after reading it.