Hey guys

I hope you all have a great December this is the happiest month of the year and it is also one with the greatest returns in stock markets and crypto.

But What about November?

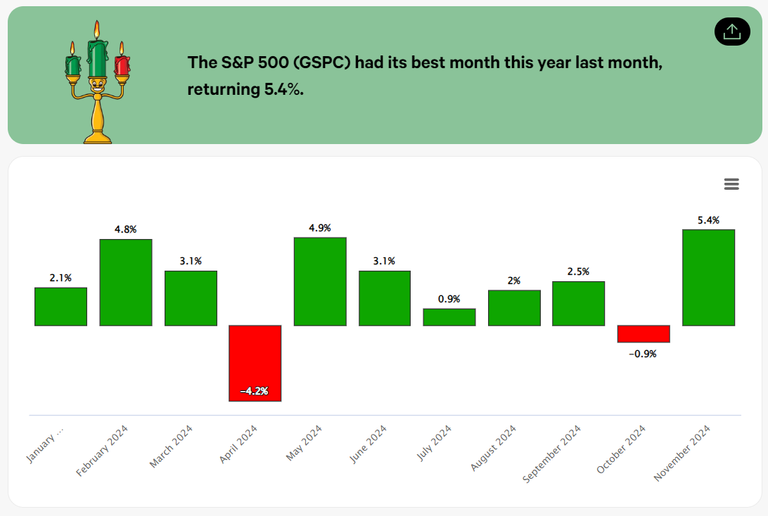

Black Friday, aside from all the buzz of offers , marked the end of the best month of the year. And why do I say that? Because the S&P 500 closed the month up 5.4%, achieving its best monthly performance for 2024. Truth be told, many didn’t anticipate such a strong surge, but it seems Donald Trump’s election victory has filled the markets with confidence. On one hand, expectations of less stringent regulation, and on the other, a more business-friendly approach, have helped markets recover robustly.

So, the S&P 500 has been doing great so far, right? Correct! The S&P 500 has gained +27.19% since the start of 2024! And not only is this an OUTSTANDING return, but it also gives us another positive signal. What positive signal, you ask? Well, according to research, historically, when the S&P 500 has posted an annual gain of over 20% by November (like this year), December ends up positive 76% of the time, with an average return of 2.1%.

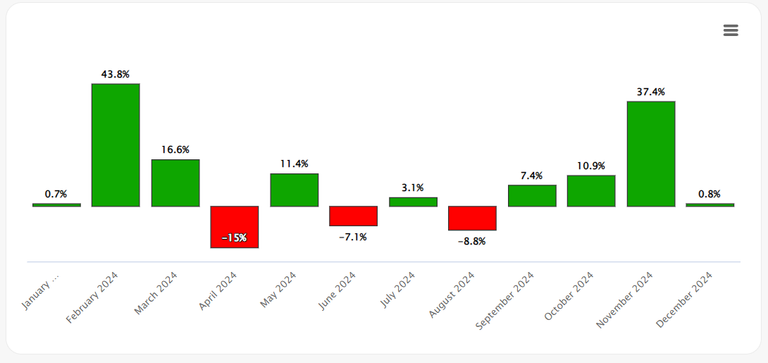

Bitcoin also gave us the second strongest month of the year with a 37.4% and despite less historical data the last three month of the year are the best for crypto. And I am sure this month we will brake 100K

Of course, December is generally considered one of the strongest months of the year, which adds another optimistic note for market performance through year-end.

Let's see some of the news and data that can affect the markets this month.

USA

The employment report (Friday) is crucial for the Fed's decision on December 18. Strong data will boost the dollar and bond yields. Additionally, ISM data and factory orders will be closely monitored.

Canada

Employment data (Friday) and trade figures (Thursday) are key after weak GDP numbers. Negative developments increase the likelihood of rate cuts.

Eurozone

Weak PMI figures (Monday/Wednesday) and German industrial production data (Thursday/Friday) are expected. Christine Lagarde's speech (Wednesday) might hint at further rate cuts.

United Kingdom

Final PMI figures (Monday, Wednesday) and German industrial production data (Thursday, Friday) point to continued weakness. Lagarde’s comments (Wednesday) might also suggest further ECB rate cuts.

Australia

Retail sales data (Monday) and GDP figures (Wednesday) are in focus. Banks are now forecasting rate cuts in May, which affects bond markets.

Japan

Toyoaki Nakamura's speech (Thursday) and household spending data (Friday) could influence policy decisions. Bond auctions will determine yields.

China

The Caixin indices for manufacturing and services are expected to provide signals of recovery following Beijing’s stimulus efforts.

Posted Using InLeo Alpha