On Friday the 13Fs of the super investors dropped—aka, their investment moves from the previous quarter

And who better to start with than Warren Buffett himself

A) Opened a new position in Domino's Pizza ($DPZ)

B) Another new position in Pool Corporation ($POOL)—yep, a company that builds and maintains pools

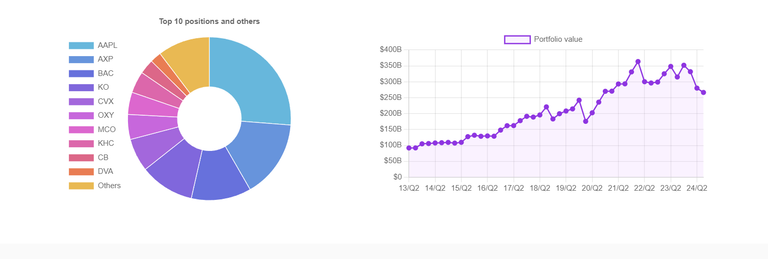

C) Trimmed 25% of his stake in Apple ($AAPL) and 22.7% of his position in Bank of America ($BAC)

Now, he's managing a $266 billion portfolio, with American Express ($AXP) climbing to the #2 spot

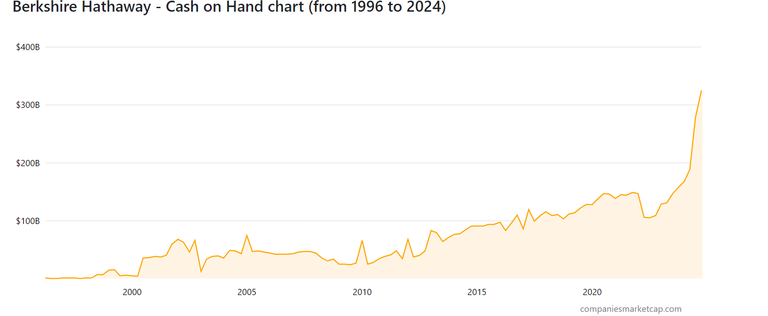

Oh, and let's not forget he's sitting on a mountain of cash—$325 billion, to be exact 🤯

What do you think of the strategy from the world’s best investor? Where would he deploy all of this cash???

Continuing our spotlight on the super investors

Next up is the well-known fund manager and occasional activist investor, Bill Ackman

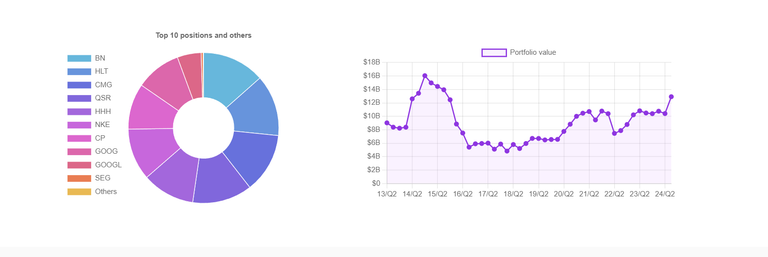

Ackman runs a highly concentrated portfolio worth $13 billion in total

Here’s what he did last quarter:

A) Nearly quintupled his position in Brookfield Corporation ($BN)—essentially the Canadian Berkshire—making it the largest holding in his portfolio

B) Also quintupled his stake in Nike ($NKE)

C) Made a big bet on Seaport Entertainment ($SE), a company with a total market cap of just $350 million

Seaport operates in the real estate sector, managing properties for various events

What do you think of Bill Ackman’s latest investment moves? Investing in a small cap company is quite interesting.

Here you can find more about the super investors and their portfolios

Earnings

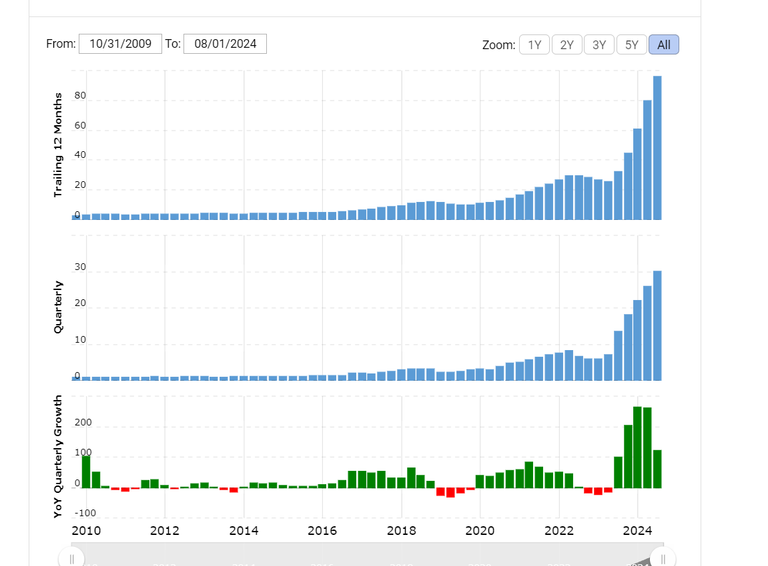

On Wednesday, after the market closes, Nvidia will not only need to defend its position as the world’s most valuable company (market cap: $3.6 trillion) but also justify the recent stock market rally

Analysts have set the bar high, expecting $33.03 billion in revenue and earnings per share of $0.74

With its current valuation, Nvidia needs to:

A) Deliver another double beat

B) Provide positive guidance on GPU demand for the upcoming months 💻

Here’s hoping Jensen Huang (CEO) can impress the investing community once again!

Posted Using InLeo Alpha

These are some strong moves and portfolio is expanding fast. I am also into stocks after some serious investments this year, but most of my assets didn't perform as expected. My biggest disappointment is AMD which I saw it as a contender to NVIDIA. Let's see if the incoming AI chip will really challenge that.

At this point Nvidia is years ahead and the sentiment is on their side but in technology one leap can flip everything

Congratulations @steemychicken1! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

Buffet is waiting on cheaper prices, means he is expecting a crash!

Then he will buy!