The financial markets are in turmoil as new data shows that inflation remains persistent, while the FED is in a tough spot regarding its next moves.

And right in the middle of all this, we see a classic showdown between Powell and Trump, with interest rates at the center of the battle and investments feeling the impact!

Fed Policy, Inflation & Market Reaction

- The Fed’s Dilemma: Rate Cuts or Holding Steady?

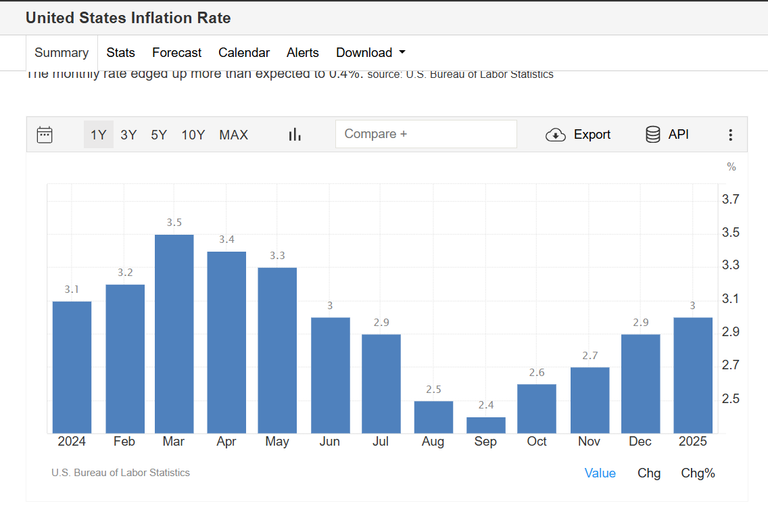

Inflation has ticked up again, causing initial market declines, followed by a rebound. What does this mean for rate cuts in 2025?

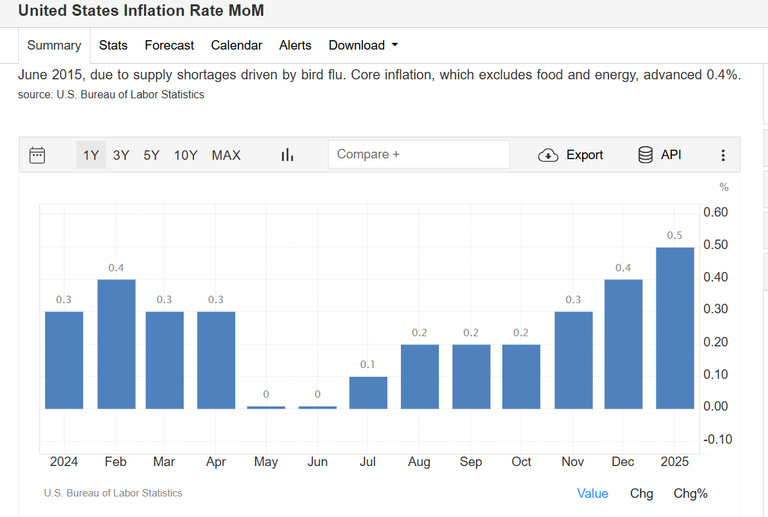

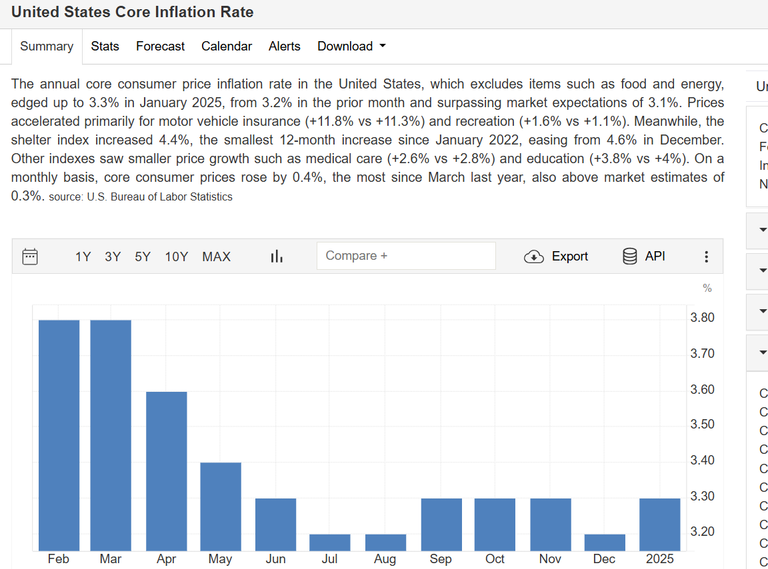

- January Inflation: A Nasty Surprise

Prices rose 0.5% month-over-month, pushing annual inflation to 3%—above expectations. The Fed had hoped for lower numbers, but inflation seems stubborn.

- The Fed’s Stance: "We’re Not Rushing"

Powell stated: “We’ve made progress, but we’re not there yet.” This means the Fed won’t rush to cut rates unless the economy shows signs of slowing.

The Trump Factor & Tariffs

Trump is pushing for rate cuts while also imposing new tariffs (10% on Chinese imports). Economists warn that higher tariffs could reignite inflation, making the Fed’s job even harder.Markets Initially Dropped...

Stocks and bonds reacted negatively to the data. Investors fear the Fed may keep rates higher for longer than expected.

...But Then Rebounded!

Despite the bad news, markets turned positive. Why? Investors still expect rate cuts in 2025—but is that realistic?How Many Cuts Are Coming?

The Fed initially hinted at two rate cuts, but given the latest data, one cut—if any—now seems more likely.Conclusion

The Fed won’t rush to cut rates if inflation stays high. The next 2-3 months will be crucial. If inflation drops below 2.5%, we might see a cut by late 2025. If not, we may not see any cuts at all.

Trump VS The Fed

As inflation data continues to show stubborn persistence, Donald Trump stepped in, declaring that interest rates must be cut—and not just that, but that the cut should come alongside new tariffs!

His statement was crystal clear:

“Rates need to be lowered, which should go hand in hand with the upcoming tariffs!!!”

( I am hearing him in my mind saying it ) (hahahahah)

In other words, Trump is pushing for cheaper money while simultaneously advocating for more tariffs.

Powell, on the other hand, is trying to maintain balance. In his recent testimony before Congress, he didn’t comment on tariffs at all.

Posted Using INLEO

If trump didnt born down the US before he leaves only God knows whats his next agenda and move