Good day to my fellow Hiveans ✨

I hope you're updated with all the improvements we're having in leofinance currently INLEO.

Today I'll be talking about the relevance of physical structure in the financial market in this stage of our social evolution.

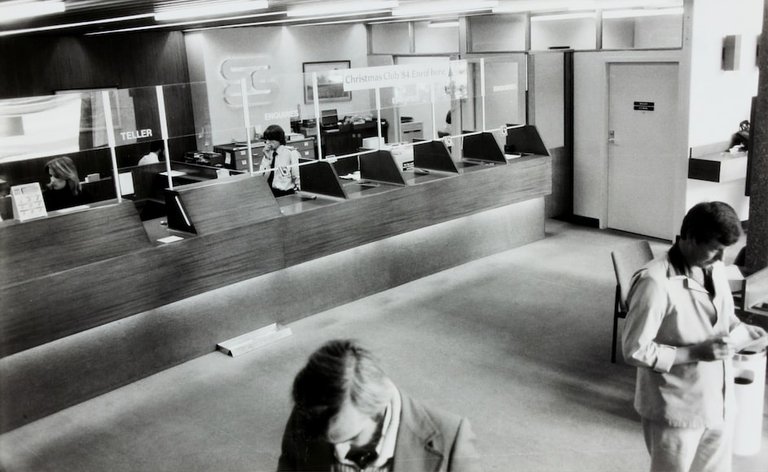

The physical structure of financial institutions, such as banks and credit unions, has evolved significantly over the years. While there are several advantages to having a tangible presence, there are also notable disadvantages. In this post, I will love to discuss the pros and cons of physical structures in financial institutions, with a particular focus on the drawbacks.

First let's look at the advantages of physical structure in financial institutions

Accessibility: One of the primary advantages of physical branches is accessibility. Customers can visit these locations to conduct various financial transactions, seek advice, or resolve issues. This accessibility is particularly important for individuals who prefer face-to-face interactions or who lack access to digital banking services.

Credibility: Physical structures can enhance the credibility and trustworthiness of a financial institution. A well-designed and secure branch creates a tangible image of stability and reliability, which can attract customers looking for a trustworthy place to manage their finances.

Community Engagement: Physical branches often engage with the local community through sponsorships, events, and outreach programs. This community involvement can foster a sense of trust and goodwill, strengthening the institution's bond with its customer base.

Assistance for Complex Transactions: While many routine banking tasks can be handled online, complex financial transactions or major life events often require in-person assistance. Having physical branches allows customers to access expertise and guidance when needed.

Easy deposit Services: Physical branches facilitate cash deposits and withdrawals, making them essential for businesses and individuals who deal with physical currency regularly.

What about the disadvantages

Operating Costs: Running physical branches comes with substantial overhead costs, including rent, utilities, staffing, security, and maintenance. These expenses significantly impact the financial institution's profitability, and the burden is often passed on to customers through fees and lower interest rates on savings accounts.

Limited Hours of Operation: Physical branches have set operating hours, which can be inconvenient for customers with busy schedules. In contrast, online banking services are available 24/7, offering greater flexibility.

Geographical Constraints: Physical branches are confined to specific locations, limiting their accessibility for individuals in remote or underserved areas. This geographical constraint can lead to financial exclusion for those who cannot easily access a branch.

Security Concerns: Physical structures are susceptible to security risks such as robberies, vandalism, and fraud attempts. These threats require substantial investments in security measures, which further add to operating costs. These doesn't mean that other virtual or online institutions are not without their own risk when it comes to security concerns, but the individual has some measure of control on the safety of their funds.

Environmental Impact: The construction and maintenance of physical branches have environmental consequences, including energy consumption and emissions. In an era when sustainability and environmental responsibility are paramount, physical structures may be viewed as contributing to ecological issues.

Limited Innovation: The focus on maintaining physical branches can sometimes impede innovation in the financial industry. As institutions allocate resources to maintain their physical structures, they may lag behind in developing cutting-edge digital services.

Changing Customer Preferences: With the rise of digital banking, many customers prefer the convenience of online and mobile banking, rendering physical branches less relevant for everyday transactions. This shift in customer preferences can make it challenging for institutions to justify the costs of maintaining physical locations. And hence the need for a significant shift.

In conclusion, the pros and cons of physical structures in financial institutions reflect the evolving landscape of banking services. While physical branches offer accessibility, credibility, and community engagement, they also come with high operating costs, limited hours of operation, and environmental concerns. As the financial industry continues to adapt to changing customer preferences and technological advancements, institutions must carefully assess the role of physical branches in their business models to remain competitive and sustainable in the modern era.

Be in charge of your transactions

I think that considering the age of social evolution we live in the several advancement in the method of operations in the has been made and we should rather focus more on the technologies available to us like crypto currencies, decentralized exchanges and other benefits offered by communities like leofinance(INLEO) to improve the management of the financial market rather than focusing on a system that is almost fading away, the physical structures of financial institutions.

Your time reading this blog is much appreciated.

Posted Using InLeo Alpha

Congratulations @stevewealth! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 30 posts.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out our last posts:

Thank you so much @hivebuzz