Before we start, it's been quite a while since I've been active on the Hive eco-system. The last year has been extremely crazy between Covid restrictions, hurricanes, increased work responsibilities, and family illness.

Early in 2020, I was kicking along just like many, feeding my 401k with employer match of up to 3%. As the pandemic hit, we received news that my employer was changing our pay structure. There were two main changes, both designed to save the corporate office money. The first was that I switched from hourly pay to per-visit pay. After looking at my average case-load and time spent with a patient and driving, this actually turned into about a $15 per-hour raise for me. The second was that they were stopping the 401k match.

That 401k stoppage is what made me look into taking control of my retirement.

I opened two brokerage accounts, one in Robinhood and the other in M1 finance. Robinhood is now DOA for me. I only held one position through them and just cashed it out with the GME manipulation.

I'm keeping M1. I'm a big fan of their pie UI, and I find them easy to work with. So this report only focuses on my M1 account and not any of my Crypto holdings.

My strategy

My investing strategy is a pretty simple one: Find high-quality companies that pay a dividend. Reinvest those dividends back into the holdings and keep an eye on if any changes need to be made.

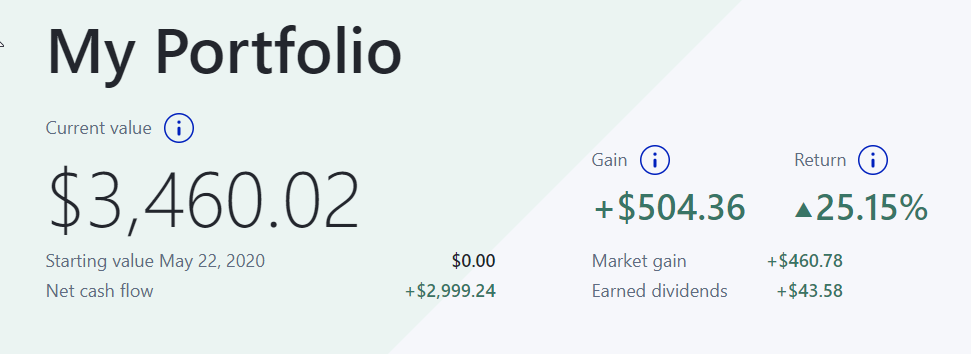

I started with $400 and added $100 every pay period. I have since increased that to $150 every pay period and will be increasing it to $200 in a few months once the new administration settles in.

As of 1/30/2021

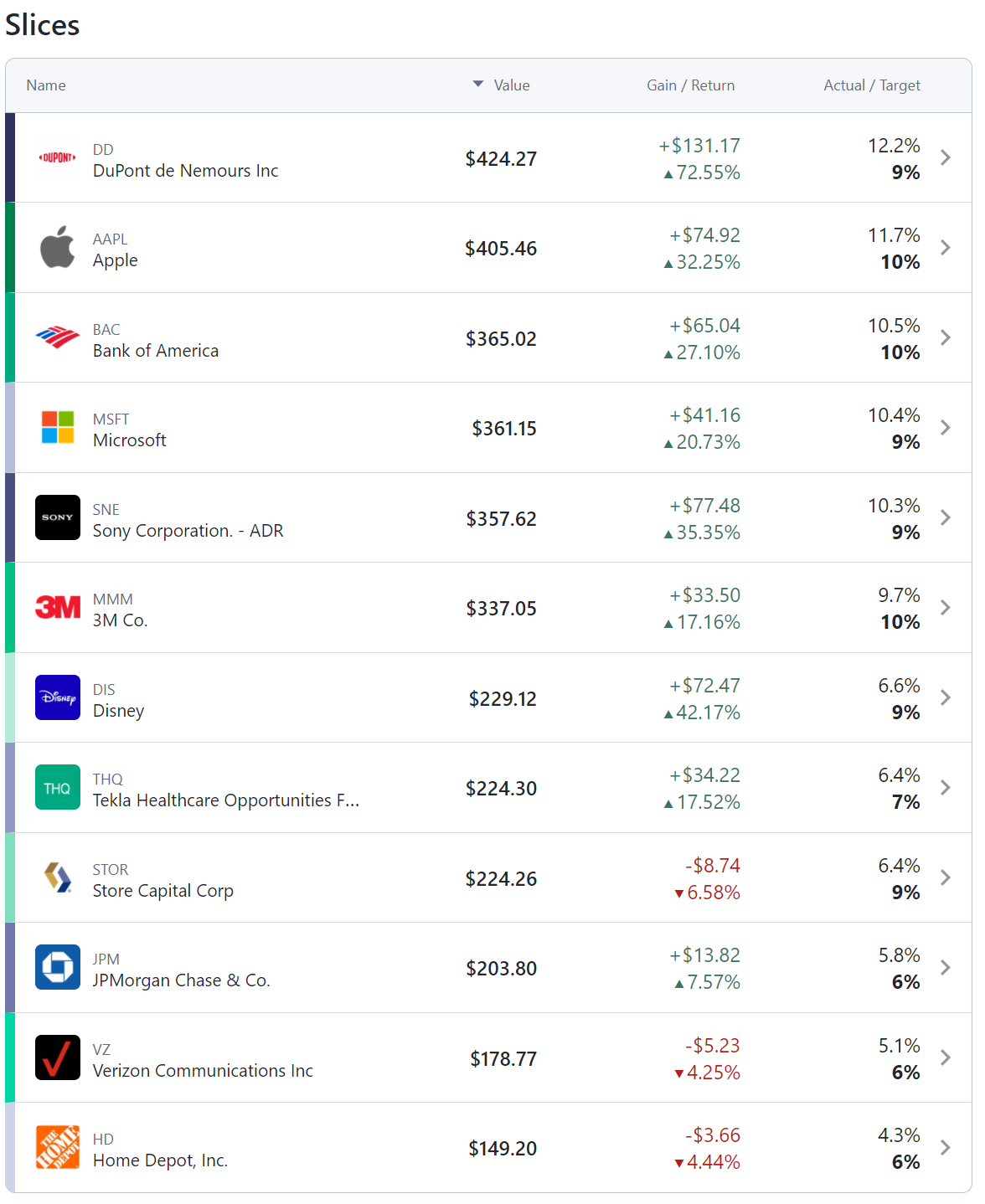

The following are my current positions. They are all dividend producing stocks (Disney currently has their dividend on hold) I won't get into why I picked each of these, but in future reports, I will explain my thoughts on any additions or exits I may have.

Posted Using LeoFinance Beta

I think I will take a cue from this. I love the part of increasing the investment purse every payday. Thanks for sharing.

Posted Using LeoFinance Beta

Some nice solid picks in there.

Sadly 401ks which was honestly one of the last things working folks could count on is gone as well now. In just my age rage alone I've seen pensions vaporized, 401ks vaporized and who the heck know's what's next besides maybe paying the government more money from the less money we all earn. Pretty jacked up lol

However taking hold and being smart about your own investments is key and something I believe more will start doing. Instead of paying someone else to manage you stocks and honestly they seriously don't have a clue and still take 1% or so of your money for doing so you now get to keep that and invest it yourself.

It's going to be a rough road for the next few years but it's a transition that needs to happen and I think we will all be in a much better spot.

Posted Using LeoFinance Beta

Thanks. I was looking things over, and I think I'm going to cut Verizon out. I get the feeling that there's not really a lot of room for growth with them.

But yeah, I agree, on the rough road. I do have a concern that the WSB fun is going to have some negative affect to us mortals.

Posted Using LeoFinance Beta