For the last couple weeks I have been trying to push my wife to have a look at the energy contracts before the winter comes. She has been "busy" and has kept saying "I will do it", like she is promising to take the bin out. A couple days ago, a gas pipeline into Finland was potentially sabotaged, and the available contracts I had suggested were taken down, as they awaited news. Even though there is supposedly minimal damage and there should be no disruptions, the contracts are now 20% more expensive.

Should have just made the decision myself.

And I knew it.

The problem is, if I had just done it, I wouldn't have been inclusive and it would be like her parents, where if her father dies, her mother can't pay any bills, as she doesn't know how. And if her mother dies, her dad will just be eating steak and barbecued food for the rest of his life.

But, this is the thing - if someone doesn't have interest in learning about the things that affect their lives, should they be included in the discussions? And when it comes to money matters, generally, men are more interested, active and engaged in improving their position. This doesn't exclude women from being so, but if we think of economics as a game played against others, where the ones with the highest amount of money wins, it is natural that the ones who take the most interest, are likely to be the ones who perform the best.

Women tend to have more savings than men.

But, men tend to have more investments than women. There are many reasons for this perhaps and pay inequality is often cited, but it is good to understand what happens over time, all things remaining equal.

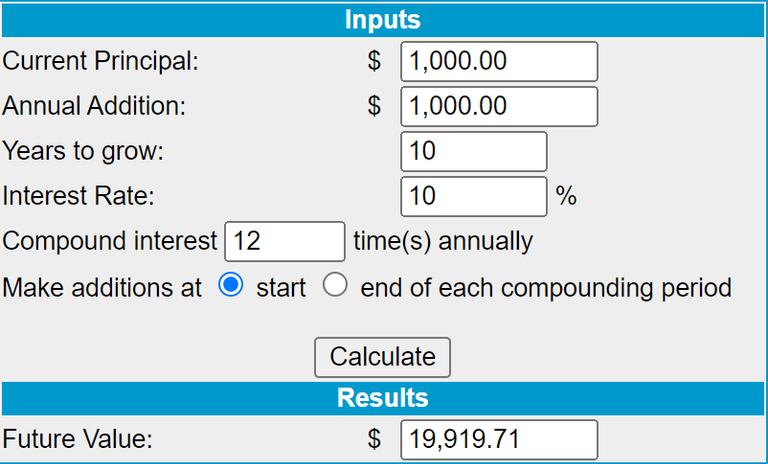

The man starting with $1000 invested and adding $1000 each year for 10 years, at 10% ROI.

19,919

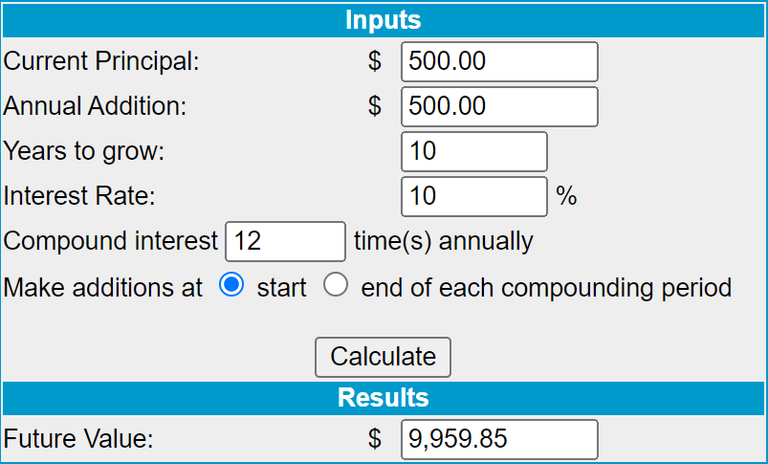

The woman starting with $1000, investing 500, saving 500, adding 500 a year for 10, at 10%.

9,959 + 5000 = 14,959

That is over a 33% difference in the space of ten years.

71,136.

35,568 + 10,000 = 45,568

That is a 56% difference in the space of twenty years.

If the man wants to play it safer and go 750 start, add 750 for 20y at 10%, the result is

53,352 + 5000 = 58,352, which is a 28% difference on the upside.

Men tend to be more risk-seeking than women on average, which probably accounts for why they don't live as long, as many die stupidly. But there are benefits to being risk-seeking financially, without having to swing for the fences. The other thing to factor in here is bleed, because whether the money is tied up in an investment portfolio, or loose in a bank account, is going to change the hurdles to spend it. Once invested, most people don't want to divest it - however, when it is liquid, it seems more like free money, available to spend on something that might only be a cost, not financially generative.

Money matters.

One of the lessons I have learned over the years is that while money can't buy happiness, life without money in the world in which we live is shit. Pretending that we can be happy without enough money, is like pretending that eating only junk food isn't going to have a negative affect on your body. The experience of pretty much everyone I have ever met in real life is the same,

Being poor sucks ass.

But, it is also this fear of being poor that holds many of us back from actually investing, because we fear losing the little we have. We struggled to get it, so we want to make it count, and for most of us, that means spending it on something that makes us feel good. Making investments doesn't feel good.

The return on investment does.

Making the investment feels bad because we are opening ourselves up to risk and loss, meaning that in order to invest, we have to fight the urge to go in the other direction, to run away. Investing is making the choice to face the fear of the uncertain future, rather than deciding to feed the desire of feeling secure right now - with "security" being something to show for the money.

It takes time for an investment portfolio to be significant enough to "feel it" and even longer for it to be enough that it feels more secure. Then, there is the constant fluctuations in evaluations and at times, the downward shifts can be quite severe. For some, it feels more secure to have the money in savings, where it is always the same amount - even though it isn't generating anything and is actually decreasing in value through inflationary pressures.

Over the last few decades, there has been a lot of media pressure driving for the "independent women" earning her own money - which is fantastic. However, I wish that there was as much discussion around the investment of those earnings being the real catalyst of wealth, not the saving of it.

This is a lesson for all of us.

We should all be learning firstly how to be more financially independent, and secondly, about what it takes to be so. Multiple revenue streams, passive incomes, investment strategies, and about finance and economics as a whole. If we were all more financially literate, we wouldn't have the wool pulled over our eyes nearly as often, and we would be far more demanding on governments and the businesses they enable and protect. But, because we aren't literate, we are slaves with our hands out, begging to be treated nicely.

Well, tomorrow I will have to make a contract with an electricity company at a price 20% higher than it would have been, but about 50% higher than it should be.

What will the difference cost me in ten or twenty years?

Taraz

[ Gen1: Hive ]

Posted Using InLeo Alpha

I will have to admit that we have departments at home. I do most of the fixing and outdoor work, while she does most of the shopping and pet related stuff. Not that either of us couldn’t do the other stuff if necessary. Still, the “oh I could never” needs to go away and there are so many learning resources available today that were never there in the past. There is no excuse to avoid learning these things, even just for context and appreciation for the specialization that it takes to do some things properly.

I treat some family organizational things like business and some business relationships as if they are parenting. Not because it is the right way to do it but there are common similarities. In the context of things we don’t enjoy doing, you have 3 choices as a business leader. Delegate it, automate it or eliminate it. Looks like you delegated the electricity bill (because it is near impossible to eliminate it) and that didn’t go well. The timing is just bad on the supply/demand side of things which is an exception to the norm, which should also be accounted for when considering risk.

Either way, lessons could be learned from this misstep and carried over into the next time you have to decide between eliminate, automate or delegate! ;)

Absolutely and, when one inevitably can't do it, like through illness or other. When it comes to finance, it allows for both people in the relationship to be part of the decision making process.

delegation rarely works for me. If it is something worth doing, do it well. Delegating to someone who isn't interested enough to do it well, means I have to do it anyway - just at a greater cost.

That is a good way to look at it though! At work, I am trying to automate some processes in the organization to save time and effort for people whose time can be better spent doing their real job. It is fun, but I also get pushback on it, because in order to automate, there has to be common processes in place and many don't want to have to be confined. It is always a tradeoff.

Process is a special kind of business discipline and worth every moment spent defining and refining. Culture either kills it or proves it can handle a scaling up if not.

Also, running a family like business doesn't work very well either. ;)

We pay the one hour spot price for power.

The power company called me the other day and offered a fixed-price fixed-term electricity contract for two years at about 8 cents for the power. My prompt answer was "No, thank you." and they didn't even try to convince me otherwise because they knew what a bad deal it was for an ordinary consumer such as our household whose power bills are around €50 per month with the current spot price based contract that we have.

Even if the price went up by 20%, which I doubt it will, the spot price contract would still be the overwhelmingly cheapest option. The Olkiluoto 3 NPP has been running without a hitch since last spring with some ability to vary its output and the newly installed wind power capacity is massive. Any cold and calm snap during the winter will probably be short enough not to warrant paying for the huge markup for every single hour that the power company would pocket for the vast majority of two-year period.

The latest 28-day average price of power (not including transmission, the peak power fee and the constants in the bill) was about 2 cents.

Yes, but - I can also imagine that come the dead of winter, this is going to change. There will be more issues. The reactor has had some issues already. In winter (start of year as contract ended in Dec), we were paying around 450 a month.

I was thinking about taking a 12m contract and seeing how it goes, even though the rest of the year it will be a bit more expensive. If the spot price is at say, 4c we will be paying twice as much, but if it is at 15 cents, it will be cheaper.

In my opinion, we shouldn't be having these issues at all with OL3 online, and considering the cost of it and how late it is, we should be given free electricity from it for the next ten years.

I think the added wind power capacity and the fact the new reactor is online and has been working without major issues for 6-7 months makes it likely that there won't be a crisis like last winter.

Of course, if you have electric heating you are in a completely different position. Anyone in that position is going to have to think about the price risk more carefully. I hope you can find a product that meets suits your needs.

I feel the same way about failing to pull the trigger on my DEC bulk buy a few weeks ago. I knew I should have done more to free up capital when DEC was sitting at .70c / 1K. I bought as much as I could afford to at the time with my excess hive-based tokens, without making any exchange/wallet DeFi swaps. Well, that decision backfired. DEC is now nearly 40% more expensive than it was 2 weeks ago and my other tokens haven't appreciated nearly as much over that same period. Like you, I should have seen the writing on the wall and done more to buy the DEC I needed when the price was the most depressed. Oh well :-/

I bought some DEC late. Enough to cover, but I could have done the same - bought far cheaper. I also feel that I should have bought more SPS at the recent ATL.

SPS will continue to drop lower over time through its scheduled printing (inflation) as I believe we will see people siphon their earned SPS into more DEC to buy Rebellion, whose cards will have a strong ROI in the rental market and as well as ranked/tournament play.

That seems like a mis-statement, considering the rest of your post. Men take fewer risks than women?

I'm a woman, and if I hadn't risked it all a couple of times in my life, I'd be broke. Perhaps some, not all, of my "investments" were lucky ones, but the only time I didn't invest in myself (such as any money I put into financial planners' control), I lost money. It's very complicated. I now think that, if I have any reservations at all, I don't make the move.

damn it! I changed the sentence structure and then didn't read it back properly. Mistakes, mistakes, mistakes....

Yes it is. And I guess there are always reservations, but with experience, they become more calculated, not as emotional.

Will have to edit again... Thanks for picking it up!

Posts like this are so much work. Details!!! I appreciate people who put the work into these things.

Fortunately, on Hive you can both eat your stake and have it by delegating it. 😅

(Sorry, couldn't resist.)

:)

I will have to correct it.

It doesn't come up as an error, so I miss them. You will notice at times I get their and there mixed up too. It is a "gift" from the stroke. I also speak wrong words that sound similar to what I am meant to say :D

Don't worry about it. It happens to most people all the time.

Not much actually, the world is about to collapse soon

Well, this is a good point. Any major worries around your way?

Nah, plenty I guess but why worry about the inevitable? ^_^

We are all going to zero.

Oh yes, I love taking risks, investing and playing on the cryptocurrency exchange. My wife is already accustomed to my risky play on the cryptocurrency exchange :)

Does she get scared?

No. My wife sometimes scolds me when I miss a good deal. And she is silent when I make a good profitable trade.

Sounds like you cant win!

It is impossible to win and convince your wife :) And this despite the fact that she has not worked for 7 years and we live only from cryptocurrency trading.

I think this is open to question. I can say that the women of the previous generation still tend to as they have seen many challenges in their life. However, for this generation I am not sure to say. One should take her to shopping and see :)

This is so true. When we sold the house in the UK I kept the insurance/endowment policy going which would pay the mortgage at the end of the contract. She said no but I still did it as what was literally 100 GBP per month. That paid our recently and was told we made a great decision lol. I wish they did get involved in the money matters and paid attention. Shopping I have virtually taken over due to knowing all the prices and it is rather significant these days. I hope you come right with the electricity as I was reading about the sabotaged pipeline today. Definitely sucks knowing you could have had 20% more left over which could help cover any increases.

My wife was pretty clear when we got together that she didn't want to have anything to do with the bills so it has always fell to me. Some of her relatives questioned that I was controlling the money at first, but she explained to them that she had no desire to have anything to do with it. I try to keep her involved, but I also know she might struggle if something were to happen to me. I need to come up with a better plan for her.

Electricity rates in Minnesota are set by a Public Utilities Commission. The only real “option” we have is whether or not to pay extra for the privilege of having our electricity supposedly come from renewable (solar/wind) sources. But since electricity is fungible, there’d be no way to know what the actual source was. It’s not as if they have two sets of transmission lines.

It's tough but I do agree that men do take risk more. I don't have a wife and I do find myself just doing a few risky choices every now and then. The prices going up sucks but I have a feeling that prices are more likely to go up in the current economy. Things are more likely to become worst than it is to become better right now.

That sucks dude, I know that I am more on the investment side than my wife and she wants to save as much money as she can in the bank instead of spending it on things. Where we both struggle equally is procrastinating buying things when we know we should lol. We do eventually buy something or spend money on something but it can sometimes be a bit later. Sometimes it's at a price increase but others it's at a savings which is nice.

The unfortunate part is that it happened when it did! We know that we would love to do things when we think of it but that can also have it's downfalls. At least it can be something she learns from, hopefully!

It is scary that something could happen far away and people could be left without gas/ internet/ electricity. Or that their prices for these essential things can have crazy increase overnight...

I wonder what kind of problems rich people have. It would be interesting to switch places with them at least for a while.

I think that used to be true in the past.But now a days a lot more women are into investment, trading, crypto. I happen to know few around. And they are more into investment than me. Though their risk taking capacity brings more problems too. But overall there are more men who happen to be more conservative on investment atleast since pandemic.

I agree in being more informed with finances and investments. I know of a lot of people that still just hold their money in banks, and earning less than 0.5 percent interest per year. Some invest in bonds which give higher, but still low interests. I think if you have some money that you don't need immediately, putting them in mutual funds or dividend yielding stocks are better options.

You are very right. There are times when we may ask men for money and they say they don't have does not mean that they do not have any investment at that moment.

Truly, women invest but not like men. A lot of women prefer to save money than invest, lol and I don't know why

And on that note, I'll just go dig for 7k USD or whatever it is to invest in the next set of Splinterlands cards - if I can push through that not so good feeling.

Yeah... That was my yesterday....